This story is part of a series concerning California’s impending regulations on zero-emissions vehicles, which have the potential to upend the American trucking industry. You can follow along with the stories here.

As Sean Cocca said at the start of a recent webinar, the ACF rule is here.

And then he followed up with an obvious question: What comes next?

Cocca is the director of compliance at the advisory firm of Gladstein, Neandross & Associates, and it was his voice on a recent webinar hosted by ACT News that tried to bring clarity to the complex regulations under California’s Advanced Clean Fleets (ACF) rule.

With the full California Air Resources Board (CARB) adopting the Advanced Clean Fleets rule in late April, it sets the stage for what will amount to an almost 20-year process that is likely to end one of two ways.

The first is that the sheer economic heft of California, as well as the states that say they will follow its lead, will bring about such massive technological change that the fleets of most of America by 2042 will be powered by hydrogen, batteries, renewable diesel or … well, we don’t know yet what might be lurking out there as part of a technological revolution.

Or we will find that the sweeping range of complaints that California is too far ahead of the technology and infrastructure curve to deliver on such ambition was correct all along, and the result is vehicle market chaos.

But while there might be significant public hand-wringing, in management suites the focus should be on compliance with the rule. As Cocca said, if such work hasn’t begun already, it needs to start.

The drayage portion of the ACF rule has been a clear presence in that industry, as fleets lurch toward the rule’s ban on registering new internal combustion engine (ICE) drayage vehicles in California after the start of 2024. Vehicles to be added to the state registry after Jan. 1 must be zero-emission vehicles (ZEVs). If there is an ACF-created crisis, it’s likely to become evident first in drayage, possibly as early as next year.

Beyond the Jan. 1 deadline, there are no rules about when a drayage fleet needs to become 100% ZEV. But there are rules that govern how long a vehicle can stay in the drayage registry; anything before a 2010 model year is already barred. What the state has set as the “minimum useful life” of a truck is the earlier of 18 years or 800,000 miles or a minimum of 13 years if the truck has over 800,000 miles. After that, it needs to be retired. There also are new requirements governing reporting of mileage totals to the state.

The plan is that the “no new ICE” rule, combined with the limitations on how many miles and years a truck can stay on the road, will gradually force ICE engines out of the drayage fleet to be replaced by ZEVs.

But unlike drayage, the targets in Class 8 trucking may seem more distant and are far more specific.

For the larger “high-priority” fleets as defined in the ACF rule, the big decision they face is whether to stop buying ICE vehicles completely next year or begin the transition through use of the “Milestones” that have been established for the transition.

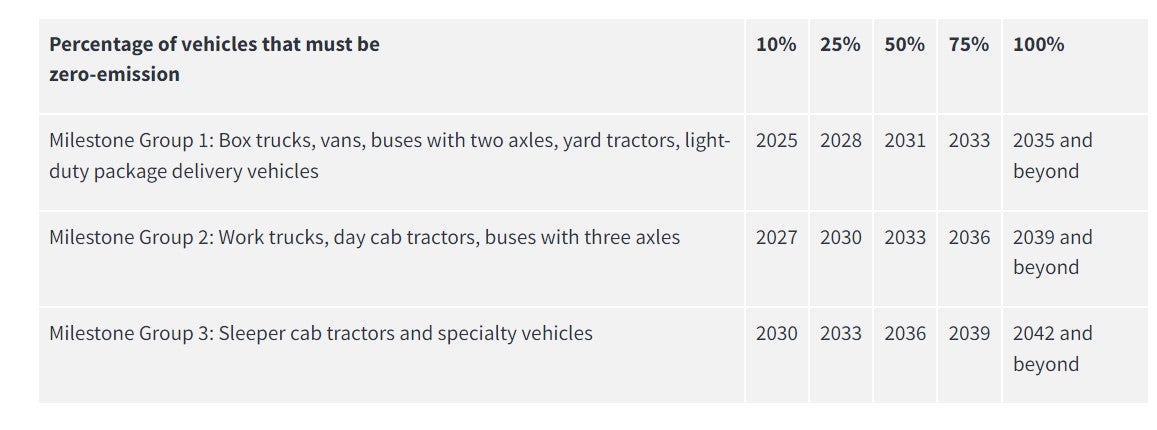

The “no new ICE” provision for high-priority fleets is similar to the rule governing drayage. It takes effect Jan. 1. The Milestones are the alternatives for high-priority fleets and it takes a table to understand how they work.

This is the table provided by CARB for the milestones.

“You’ve got to be a mathematician to figure out where you fall with the percentages and the different groups of trucks,” Glen Kedzie, a principal at E&E Strategies, told FreightWaves. Kedzie is a former official with the American Trucking Associations who has his own consulting company and clean fleet rules along with government relations are an area of specialty.

Despite that, “I would guess that fleets would go with the Milestone schedule,” Kedzie said. “I think there’s more flexibility involved. You gain a little more time.”

Paul Arneja, CARB’s lead staff on the ACF, said in an interview that he also believes the Milestones pathway is most likely to be chosen by high-priority fleets to comply.

“There are two options available for high-priority fleets, but both of them will eventually reach the same place,” Arneja said. “But the path to get there will be different.” Echoing Kedzie, Arneja said the Milestones pathway “has more flexibility and a staggered timeline for the longer range and more specialized vehicles. So we do think that will be the preferred option for most fleets.”

The flexibility comes in the fact that if a fleet chooses to go the Milestones route, it can continue to add ICE vehicles, as long as the overall percentage of ZEVs in the fleet hits the Milestones targets.

Arneja added that the ACF has a reporting requirement that will kick in next February. At that time, he said, fleets will need to report to the state whether they are going to choose the Milestones route or simply stop buying ZEVs and ride out the 18-year/800,000-mile requirement.

On the recent webinar, Cocca made several points about the Milestones and the high-priority fleet rules.

- The standard for whether a company falls under the ACF rule is if it had $50 million or more in revenue in the prior year or operates 50 vehicles or more, with at least one in California. It is one or the other, Cocca said; a fleet with 75 vehicles and $20 million in gross revenue still falls under ACF.

- What Cocca called “common ownership and control” means that all trucks under that common ownership are counted in determining whether a fleet falls under the rule, even if it’s doing business under different names.

- One drawback to the Milestones route, as explained by Cocca, is that there are restrictions in place under California law that limit the state’s ability to force retirement of an older vehicle that hasn’t hit the standard 18 years or 800,000 miles defined as useful life. The Milestones pathway eliminates that protection. “By waiving that right, you’re allowing CARB to tell you that you have to retire one of your vehicles before its useful life,” he said. That is unlikely to have any short-term impact on the road to full ZEVs, but as the end of the transition nears, “you might be forced to retire a vehicle that has not yet reached its minimum useful life.”

- The requirements under Milestones are across all the subcategories within each group. For example, under Milestone group 1, which has a 10% ZEV requirement by 2025, the components include five types of commercial vehicles: box trucks, vans, buses with two axles, yard tractors and light-duty package delivery vehicles. Cocca said the 10% would be applied to the entire fleet. The requirement is not that a fleet has 10% ZEVs in all those categories.

The Advanced Clean Fleet rule follows the state’s Advanced Clean Trucks rule, which was approved in 2020. It deals specifically with the types of vehicles that can be sold into the state. As Kedzie said, the Advanced Clean Trucks rule without the ACF could spell failure.

“This gives a guaranteed audience to sell to,” he said. The Advanced Clean Trucks rule standing alone would have meant, according to Kedzie, that “there was no other hook to require anybody to purchase. The ACT rule provides an audience.”

The final ACF rule appears to stray into territory staked out by the Advanced Clean Trucks Rule.

The initial ACF proposal had a rule that said all manufacturers that fall under the rule, which is defined as an OEM that “certifies on-road vehicles over 8,500 pounds,” is required to deliver only ZEVs to California by 2036. That rule originally had been 2040.

That has led to some confusion in the media, which has declared that the state has a goal of all ZEVs by 2036. For sleeper cab tractors, the Milestone that would bring an end to ICE vehicles is that 100% of all fleets are required to be ZEV by 2042. By contrast, Milestone Group 1, which includes box trucks and vans, is looking at a 100% ZEV requirement by 2035.

That is a requirement that could be seen as a mandate on manufacturers, which is supposed to be the job of the ACT, not the ACF, but Arneja did not see it that way: “We’re trying to just make sure that we’re aligning what the manufacturers need to be selling and what the fleets need to be purchasing.”

Where this is particularly significant is for those fleets under 50 vehicles and $50 million in revenue. A small fleet with just a handful of vehicles may be exempt from the ACF now, but by 2036, if there are no new ICE vehicles being delivered into the state, these fleets will still be facing the fact that their ICE vehicles will reach the useful life threshold and there will no longer be new ICE vehicles to replace the ones that need to be retired. Eventually, there is a sort of “extinction” of ICE vehicles even if the smaller fleets aren’t under any specific mandate.

But that’s more than a decade away. In the shorter term, Kedzie said, “If you’re a small trucking company, you want to do your due diligence on what happens if you go to 50 trucks, if you have 30 now.” Because if that 50-truck number is breached, “you’re sucked into the rule,” he said. Getting bigger to deal with mandates is a well-trod business strategy but it may work the opposite in California trucking.

Arneja also noted that California will begin work soon on what he called the “zero-emission truck measure.” “That’s looking at ways to electrify the rest of the fleet,” Arneja said. That plan, which Arneja said does not exist at present, would be sent to CARB in 2028 with implementation in 2030. It would bring in all fleets, not just ones that are defined as high priority under ACF.

The ACF also has a rule governing public fleets. It is less complex because it doesn’t have the percentage breakdowns found in the Milestones rule. Instead, it requires an aggressive standard of purchasing a percentage of ZEVs beginning in 2024, becoming 100% only in 2027. But there are no requirements on getting rid of existing vehicles. The assumption is that the passage of time will retire those fleets and what will be left are ZEVs.

There are exemptions in the ACF, and in the road toward the final rule, they were liberalized. Order a ZEV but the manufacturer can’t deliver it in time? There’s an exemption for that. Planning on running part of your fleet on battery vehicle technology but the utility can’t hook up the charging infrastructure in time? You can get some relief, in some cases up to a year. ZEVs available but not of the type to suit your needs? That falls under the “daily usage exemption.”

But as Cocca said on the webinar, every exemption has a unique set of requirements that must be met. Documentation requirements are steep: “The information required is very detailed and some of it is quite extensive,” he said.

Among Cocca’s other admonitions to the listeners on his webinar were that if a fleet is seeking an exemption, it needs to be speaking now to its OEM partners about vehicle availability.

“You need to know what the availability is,” Cocca said. “If you’re going to apply for some of the exemptions, there are several of them that require you to have communications with your OEMs to show that you’ve done your due diligence and you made a good faith effort to comply with the rule.”

Even if a fleet isn’t going for an exemption, the basic act of acquiring the vehicles while staying in line with the ACF is complex, Cocca said.

“There is a lot of coordination that’s going to be required between groups like operations, finance and vehicle procurement,” he said, adding that the need for coordination extends all the way up into the C-suite, and “that coordination needs to start happening now.”

More articles by John Kingston

CARB clear on lack of changes in California Clean Fleets rule

California gets EPA waiver to move ahead with Advanced Clean Trucks rule

2022 may be pivotal year for California’s green rules for trucks

GAREY GRANNAN

California needs to be sued! They are causing undue hardships and extreme financial cost to Owner Operators.

Everyone needs to stand against California by joining a class action law suit filed against California from every truck driver! California’s continue to lie about the needs for emission standards in the Trucking industry.

This is nothing short of assault on the Trucking industry. California stated that the diesel exhaust fluid system would be the answer to everything having to do with emissions along with bio diesel. Which nobody seems to talk about. Bio diesel is only type of fuel you could buy at any truck stop in California. Now what they said was good enough yesterday with emissions,, today they say isn’t good enough! California has already cost the Trucking industry billions in new truck purchases to meet the current standards. Anything additional would be financially catastrophic to many of us that already have truck loans to meet CARB standards. What will California come up with next once they get everyone on board. Point is. This will never stop. Must do something else this cannot continue. California continues to accuse the trucking industry Being responsible for sending people to the ER and causing cancer. That in its self is a misrepresentation of Trucking and we do out here for america. I guess the air doesn’t filter diesel exhaust it only filters everything else in the air. If this is so bad. How are we all still alive! Where are the list of people us truckers send to the error and kill with cancer every year. The same story CARB said about the need for DEF, is the same story CARB is saying about the need for EV trucks. They just changed the wording!

Joshua Rash, Rash Trucking Inc

Now we sit on the sidelines (state lines) and watch California emplode

No one talks about

Ag equipment

Pumps irrigation

Stand by generators

Fire and safety equipment

Craines

Snow removal

Construction equipment

Livestock equipment

This will be fun to watch

TCS53

Simple answer, stop going to California. Freeze them out. BTW what are they going to do about the trains that haul all those containers out of the ports?? California is a joke, a beautiful state that needs to secede from the rest of the country.

Jeff allen

Easy fix. Boycott california. If they cant move freight in their state they will have no choice but reconsider

Mark Hansen

Everyone stop going to California let them starve let that crap go bad on docks they want to kill the trucks well give the same respect back …