Good news for America’s beleaguered agriculture exporters: China is buying again. A lot. Bulk-vessel loadings are finally returning to pre-trade-war levels just as President Donald Trump is leaving office.

Bad news for exporters: Ag shipments via containers now face a double whammy. First, exporters still don’t have enough containers to get their goods to Asia in a timely fashion. And second, China is once again clamping down on inspections on fears that frozen food carries COVID.

More ‘reefer madness’ in China

When China intensifies food inspections, inland moves of reefer boxes slow. When that happens, terminal reefer plugs — the power sources — max out. Ships cannot unload inbound reefers at a terminal without available plugs.

This issue first arose in June and July after an outbreak in a Beijing food market. As of October, delays were resolved. Now, the situation is going downhill once again.

Mediterranean Shipping Co. (MSC) is telling customers that it can no longer unload reefers in Xingang, China. All reefer plugs are full there due to “COVID test procedures.”

MSC said it may unload reefers at alternate terminals. But it warned that the situation in Xingang could “rapidly replicate” in other Chinese ports. It further warned that “all the main ports in Asia are subject to heavy pressure and working almost at full utilization, thus alternative places for unloading reefers are minimal.”

CNC, an intra-Asia subsidiary of French carrier CMA CGM, told customers that all carriers in the CMA CGM group have stopped taking bookings to Huangpu, China. It blamed “stricter inspection and disinfection requirements of reefer imports” and reported that most reefer plugs in Huangpu are now full.

Peter Friedmann, executive director of the Agriculture Transportation Coalition, said in an interview with FreightWaves on Tuesday, “Whether it’s legitimate or not, the Chinese believe these inspections are necessary. It’s also true that reefer plugs are filled and carriers don’t know where to put these reefers.”

Carrier surcharges criticized

“The question is whether carriers will ever have a response to disruption other than imposing penalties on their own customers. It’s always the same. Anytime they wake up with a hangnail, they impose a surcharge.

“If you impose a surcharge because the Chinese government is slow-walking the imports and the reefer plugs are full, the objective is to incentivize customers who haven’t shipped yet to ship to some other customer or some other port,” said Friedmann. “But if the cargo is already on the ship, what is the U.S. exporter supposed to do?

“The carriers say, ‘It’s very expensive for us to be holding these containers on the ship. But how expensive is it for exporters who are not able to get the cargo to their customers in China and lose the sale because they missed their delivery date?”

Empties versus exports

It’s not just reefers. Dry containers used to ship food and soybeans are another big problem. In this case, on the U.S. side of the equation.

Carriers desperately need forty-foot high-cube containers in China in order to load eastbound exports back to the U.S. Loading food exports on the westbound U.S.-China run takes more time — both on the load side and the destination side — than sending boxes back empty.

Carriers may earn more overall if they bring back boxes empty and use them for Chinese exports. The gap between eastbound and westbound trans-Pacific spot rates has never been higher.

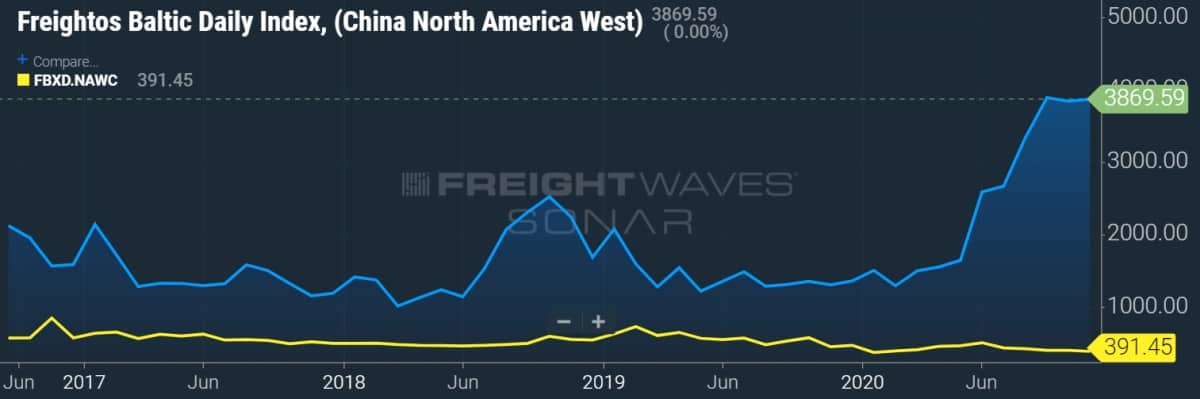

According to the Freightos Baltic Daily Index, the spot rate on the China-West Coast route (SONAR: FBXD.CNAW) was $3,870 per forty-foot equivalent unit (FEU) on Monday, nearly 10 times as high as the $391-per-FEU rate on the West Coast-China route (SONAR: FBXD.NAWC). The spread between the two routes more than tripled year-on-year.

Progress on equipment front

According to Friedmann, “There were some carriers that engaged in a knee-jerk reaction of declining all export bookings through year-end and canceling as many existing export bookings as they could. And I’m specifically not talking about Hapag-Lloyd or any of the European carriers. These were carriers with headquarters in Asia.

“I think the European carriers have now taken a look at this and seen what they can do to balance [exports and imports]. They are trying to understand how they can get that lucrative import revenue but continue to carry exports.

“They have now announced GRIs [general rate increases] for export cargo that will generate sufficient additional revenue to justify carrying export cargo rather than carrying empties back. We approve.”

Asked whether ag exporters are still short of containers, he confirmed that shortages are causing shippers to miss their windows. “Cargo is flowing, but the stress on the system is so great that it is rendering many of our exporters undependable to their foreign customers,” he said. “Exports continue to be extremely disrupted.”

Bulk back to pre-trade-war levels

It’s a tale of two cities for U.S. food and agriculture exporters. For containers, it’s a story about a lack of readily available equipment at the origin and diversions at the destination. For dry bulk, it’s about resurgent demand, accessible transport and freight costs that are still within the five-year range.

According to Nick Ristic, lead dry cargo analyst at Braemar ACM Shipbroking, “The last couple of months have seen a sharp rise in grain volumes from the U.S.” October grain liftings from the Pacific Northwest were up 92% year-on-year in October, with U.S. Gulf volumes up 57%.

The main driver was “a surge in shipments of American soy,” he continued. Soybeans are used as feed by the Chinese pig industry, which has recovered from the swine flu epidemic.

“With Brazil’s crop now virtually depleted, U.S. shipments have picked up to pre-trade-war levels. Preliminary indications from the USDA show a 75% year-on-year jump in October, primarily to China.”

China is also now unusually active in the U.S. corn market. “China tends to import relatively small amounts of corn, but in the past few weeks we have seen a significant uptick in cargo arrivals,” said Ristic.

He attributed the change to flooding in China’s corn-producing regions earlier in 2020 as well as to more use of corn for animal feed in light of higher soybean prices.

“Chinese corn receipts on bulk carriers totaled 1.2 million tons in October, the highest monthly volume since 2016. What is unusual about October’s imports [to China] is that they were sourced almost exclusively from the U.S.,” said Ristic.

This represents “the first time this bilateral trade has amounted to more than just a handful of shipments per year,” he said, adding, “We expect U.S. corn shipments over Q4 to grow 70% year-on-year.”

Positive for Panamaxes

Due to draft (water depth) restrictions at both U.S. and Chinese terminals, shippers transport bulk ag commodities on bulkers in the Panamax class (65,000-90,000 deadweight tons or DWT) or smaller. Higher demand for U.S. export cargoes should help boost Panamax spot rates.

According to Clarksons Platou Securities, spot rates for larger Capesize bulkers (of around 180,000 DWT) that carry iron ore and coal currently averaged $12,000 per day on Tuesday, down 46% year-on-year. In contrast, rates for Panamaxes with agribulk exposure were higher than Capesize rates, at $12,500 per day, up 28% year-on-year. Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON AG EXPORT ISSUES: Containers are the ‘new gold’ amid ‘black swan’ box squeeze: see story here. Ag exporters grapple with COVID, trade war, political unknows: see story here. Fresh threat to food exports: China COVID inspections: see story here. Refrigerated cargo diverted from Chinese ports: see story here.

Brian Watt

I was expecting this. As soon as it was certain Trump was done, the PRC starts showing up again. I have my dray friends in Chicago monitoring for corn & soy shipments by bulk container. Nothing to mention, yet. Figure by mid-February. Chinese New Year should help open up available container space here in North American. Chinese New Year 2021 begins February 15.