(Updated April 5, 1 p.m. ET with news about CargoAi)

Eight cargo jets are only the beginning for Air Canada.

The first carrier in North America to return to a combination passenger-and-freighter fleet intends to invest in more all-cargo aircraft as logistics contributes more to long-term profitability, the company’s cargo chief says.

Air Canada began flying its first Boeing 767-300 converted freighter in late December and the arrival of a second aircraft is imminent. Israel Aircraft Industries is remodeling older Air Canada passenger jets to carry heavy freight. Six more will be produced between now and the end of 2023, according to airline executives.

The stand-alone freighter operations will help feed the globally connected passenger network to get goods to more destinations.

During an Investor’s Day presentation last Wednesday, Jason Berry, vice president of cargo, said the airline is already pursuing additional freighters. A spokesperson declined to elaborate.

Owning or leasing freighters carries risk in market downturns and adds operational complexity for pure passenger carriers, but also increases flexibility and cargo capacity. Shippers don’t have to rely only on passenger flights where routes and schedules are usually dictated by travel demand. Air Canada (OTCUS: ACDVF) officials say they are precisely injecting the freighters in lanes that can benefit the most from cargo-only operations and complement the passenger network.

“As the first to market [with a freighter fleet], we not only believe this provides us with a running start, but a new base of revenue and a moat that will help us defend market share while simultaneously unlocking opportunities for incremental revenue,” Berry said.

Deploying freighters in key cargo trade lanes diversifies revenue and minimizes seasonal effects when airlines adjust the size of passenger aircraft based on traffic patterns.

“Most importantly, eliminating seasonality from our cargo capacity gives Air Canada the ability to attract a broader customer base, contributing to revenue for both passenger and freighter operations year-round,” he added.

COVID silver lining

The carrier decided to establish a freighter unit after successfully pivoting to cargo-only passenger flights during the pandemic and assessing the long-term growth prospects for e-commerce shipping.

Air Canada has operated more than 14,000 all-cargo flights since March 2020. The airline is using its widebody passenger aircraft for dedicated cargo service, including several Boeing 777 and Airbus A330 aircraft with seats temporarily removed to carry light boxes in the cabin. It will reinstall the seats and return the planes to full-time passenger service as travel bounces back this year.

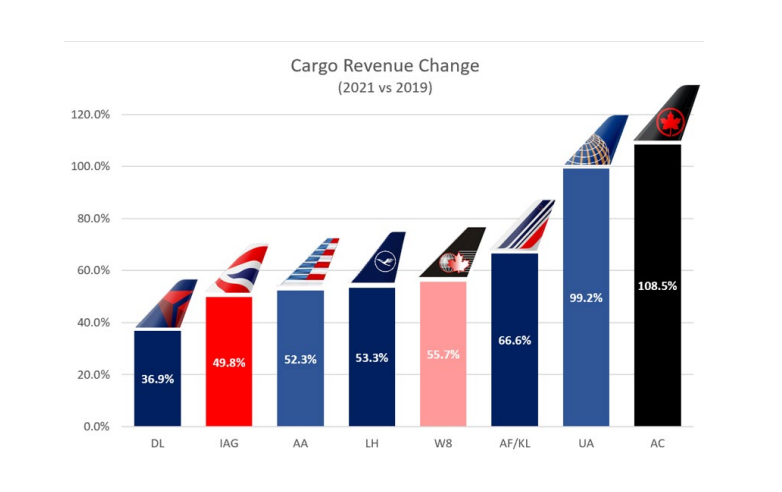

Cargo revenue increased 109% to $1.2 billion in 2021 compared to 2019, thanks to strong yields in a tight market. Volumes came close to 2019 levels despite 300,000 fewer passenger flights with belly space for cargo. Air Canada outperformed U.S. and European rivals such as United Airlines (NASDAQ: UAL), British Airways and Air France, and even Canadian all-cargo carrier Cargojet in terms of revenue growth.

Air Canada led its peers in revenue growth during the COVID crisis

The company brought in new customers, but much of the growth was with the existing client base, Berry said.

On Thursday, the airline unveiled an expanded schedule for its fledgling freighter network. Delivery of a second Boeing 767-300 will allow the airline in May to begin flying from Toronto to St. Johns, Canada, six times per week; Frankfurt, Germany, and Madrid two and three times per week, respectively; with weekly stops in Cologne, Germany, and Istanbul.

Routes for the first 767 cargo jet cover Miami; Quito, Ecuador; Lima, Peru; and Guadalajara, Mexico. On April 19, Air Canada will increase its workload with five flights per week to Halifax, Nova Scotia.

The Boeing 767-300 extended range freighters will allow Air Canada Cargo to offer five different main deck configurations, increasing the overall cargo capacity of each aircraft to nearly 64 tons or 15,000 cubic feet. Three-quarters of the capacity is on the main deck, where passengers used to sit.

Air Canada is among several mid-size carriers that have added dedicated cargo jets since the start of the pandemic to capitalize on growing air cargo demand. But it’s the only one in North America with a global passenger and freighter footprint.

WestJet plans to launch freighter service this summer, but will utilize smaller Boeing 737-800 jets initially deployed on domestic routes. Delta Air Lines, the last North American airline with a freighter division, scrapped the 747 jumbo jet freighters it inherited from Northwest Airlines shortly after acquiring the company in 2008.

Enhancing cargo capabilities

Air Canada last month completed the first phase of an expanded cold chain facility in its Toronto hub, the only one of its kind for a Canadian airline. It will feature more than 30,000 square feet of temperature-controlled storage, plus a larger freezer, for medicines and biologics, fresh food and other perishable goods. The cargo division will add permanent and temporary racking this year and install X-ray machines so that outbound temperature-controlled containers can be screened for security before going into the facility, the company said.

The enhancements are part of a multiyear investment plan to enhance infrastructure at major gateways in Toronto, Vancouver, Montreal, Frankfurt, London and Chicago. In January, Air Canada acquired additional warehouse space in Frankfurt to prepare for the freighter service.

Last week, Air Canada joined WebCargo, the digital platform from Freightos that enables carriers to market capacity to freight forwarders with transparent, real-time pricing and booking. Forwarders can now compare more than 30 airlines on WebCargo, which launched in 2019. The company also announced on April 5 that will also sell cargo space on CargoAi, another platform for users to manage the entire air cargo booking process, including electronc quote requests.

Participating in multiparty electronic booking systems is the latest step in Air Canada Cargo’s digitalization journey. In late October, it rolled out a new application programming interface enabling customers to more easily connect to its portal for instant quotes and booking. Air Canada says further enhancements scheduled for this year include instant access to flight and trucking schedules, a service that pushes notification of shipment milestones so customers don’t have to manually check status and a service that allows users to make real-time changes to airway bills up until goods are accepted.

The company is also modernizing its call centers for cargo customers.

Berry said the introduction of the freighters, a domestic program that offers door-to-door e-commerce delivery using first-and-last mile ground partners, and selling cargo transport for drone operators positions Air Canada Cargo as a high-growth business able to support the airline’s quick recovery from the pandemic.

More FreightWaves/American Shipper stories by Eric Kulisch.

WHAT ELSE TO READ:

Will exuberance for air cargo conversions create freighter glut?

Air Canada sings ‘O Cargo’ with all-time best revenue in 2021

Air Canada expanding refrigeration capability at Toronto cargo hub