The air cargo market continues to lose altitude in the face of an overall economic slowdown and supply chain dislocations. Whether swiftly changing conditions enable airlines’ cargo business to swing it back to positive territory this summer is an open question.

Air freight volumes tumbled 7% in May versus 2021, replicating April’s slide, as the Ukraine war, large-scale COVID lockdowns in China, soaring inflation and high interest rates slowed global output and consumption, according to figures released Wednesday by Clive Data Services.

Demand for air cargo service was also 8% lower than in May 2019, before the pandemic, the air intelligence arm of freight rate benchmarking and analytics firm Xeneta reported. Meanwhile, available capacity increased 4% from the year prior but still remains at a 12% deficit compared to 2019. The change in supply and demand resulted in substantially lower aircraft utilization, as the average load factor dropped 9 points to 60%.

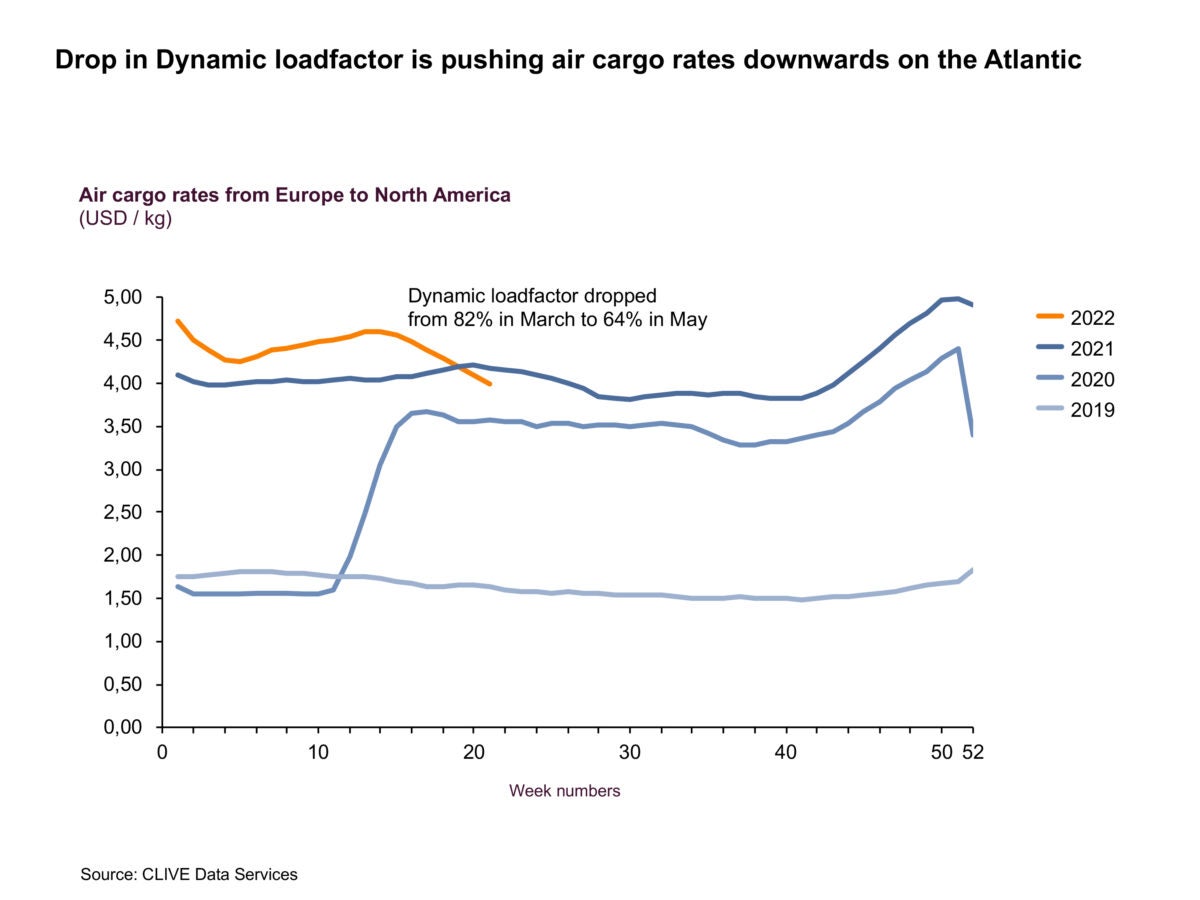

The reduced competition for shipping space led to lower rates, although they still remain quite elevated relative to historical norms. Rates in May were still 16% greater than in 2021 and 134% above 2019, but about 10 points less than in April.

Some of the biggest changes were in the North Atlantic market, where passenger airlines have rapidly reintroduced passenger services for the summer season in response to fewer travel restrictions and strong bookings. The large number of widebody aircraft that can carry people and cargo has added a large amount of capacity in a short period of time. May capacity was 82% higher than in 2021, up from 44% in March.

In the past eight weeks, load factors in the Europe-North America trade lane plunged to 64% from 82% in March. May’s dynamic load factor — the amount of cubic capacity filled by cargo — was also 22 points lower than a year ago, compared to March when the decline was only 7 points. In the last week of May, rates from Europe to North America actually had negative year-over-year growth for the first time in two years, Clive Data Services said.

High fuel costs passed through to customers are one reason analysts say rates haven’t fallen more.

“The Atlantic market is interesting to follow to see how rates shift in the coming months, as it might be a bellwether on how other markets will develop when the capacity of passenger flights returns to its former level and beyond,” said Niall van de Wouw, Clive’s founder and now chief airfreight officer at Xeneta.

The pullback in consumer spending, the shift in spending to services and lower export orders could translate into a weaker peak shipping season, and less air cargo demand, this fall than many previously expected. Another possibility, according to logistics experts, is a major demand bounce in the traditionally slower summer period from delayed factory production being unleashed into the market as China reopens from the strict lockdown period. Many airlines are anticipating a surge in cargo demand as companies rush to make up for lost time getting goods to market.

And more business could come their way if West Coast dockworkers conduct work slowdowns to influence negotiations with maritime employers on a new contract. The existing International Longshore and Warehouse Union contract expires July 1 and little progress has been reported so far. Shippers have already rerouted some cargo to other ports to avoid potential delays and could convert more freight to air as the deadline approaches.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

RELATED NEWS:

Airline industry economist sees recession risk in 2023

Air cargo market risks downturn as export orders contract

Airport congestion masks softening in trans-Atlantic air cargo