Air cargo business is slowing amid global macroeconomic pressures but 2022 is still shaping up as one of the industry’s strongest years ever with cargo revenues nearly double those before the pandemic, the International Air Transport Association said Monday. The cargo forecast was part of an upgraded outlook showing that the industry is inching closer to profitability in 2023 as passenger demand finally kicks into full gear.

The largest airline trade association said it expects cargo to continue supporting the industry’s performance. Volumes are projected to rise this year even as cargo yield moderates with the additional belly capacity from passenger aircraft returning to service.

“Airlines are resilient. People are flying in ever greater numbers. And cargo is performing well against a backdrop of growing economic uncertainty. … It is a time for optimism, even if there are still challenges on costs, particularly fuel, and some lingering restrictions in a few key markets,” said IATA Director General Willie Walsh in opening remarks to the group’s annual general meeting in Doha, Qatar.

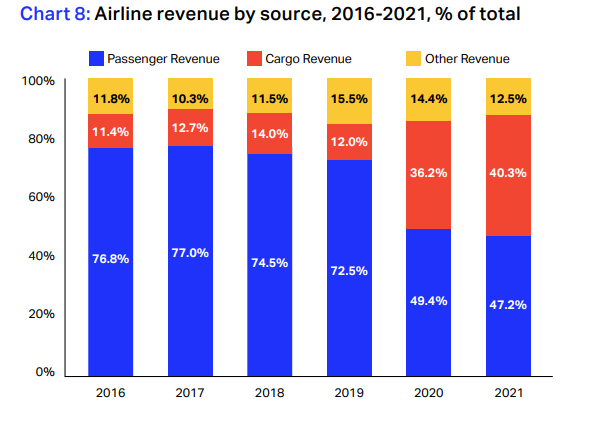

Cargo revenues are expected to tally $191 billion, a 6.4% reduction from 2021’s peak of $204 billion and nearly twice the $100 billion achieved in 2019. Airfreight will account for 24.4% of total passenger and cargo airline sales, IATA estimated. With passenger traffic decimated by the pandemic, cargo represented 36.2% and 40.3% of airline revenues in 2020 and 2021, respectively, compared to about 12% in the preceding four years.

Airlines are projected to carry more than 75 million tons this year, which would represent a record high. But growth has flattened on a seasonally adjusted basis — albeit at near-record high volumes. Nonetheless, IATA projects air cargo volumes to be 11.7% above the pre-pandemic level following red-hot 2021 growth of 6.9% versus 2019.

The figures could actually be higher because IATA only surveys its 292 members and many all-cargo carriers do not belong to the group.

IATA recently reported shipment volumes contracted 11.2% in April as cross-border trade weakened and were down 1% versus 2019 — a weak year for the cargo sector. Airfreight volumes tumbled 7% in May from 2021, according to Clive Data Services, a market intelligence firm with more current data.

Global merchandise trade growth is expected to moderate to 3% this year, after increasing by double digits last year, according to the World Trade Organization, due to unprecedented economic swings caused by the pandemic. Over the past 20 years, global trade has grown, on average, 6% annually. IATA forecasts the value of international trade shipped by air this year to be about $8.2 trillion, up from $7.5 trillion in 2021, as inflation increases the cost of goods.

Several factors are acting as a drag on international goods movement by air: delayed factory production due to heavy-handed COVID lockdowns in China; the Ukraine war; a drop in new export orders; a shift in consumer spending toward services in a relaxed pandemic environment; high inflation; and congestion at airport cargo terminals.

IATA estimates global GDP is now poised to grow about 3.4% this year, down from 4% to 4.5% prior to Russia’s invasion of Ukraine. The U.S. and European Union economies contracted by a fraction of a point in the first quarter and China’s second quarter output will be heavily impacted by the extensive lockdowns imposed in April and May.

Prior to the invasion of Ukraine, about 19% of international cargo shipments transited Russian airspace. Russia’s ban on overflights in response to 40 nations closing their airspace to Russian aircraft means higher fuel costs for carriers that now must detour around Russia on Asia-Europe and Asia-North America routes. The extra transit time and need to carry extra fuel has reduced aircraft utilization for cargo by about 20%, according to aviation experts.

Marie Owens Thomsen, IATA’s chief economist, last month estimated a 20% chance for a recession next year, but said economic activity and air cargo would still be relatively solid in 2022.

Softer market conditions are expected to knock down cargo yields by 10.4% from last year, IATA predicted. That is a small retreat for per-unit profits but doesn’t undo the increases of 52.5% in 2020 and 24.2% in 2021. Yields are being propped up by strong shipping demand combined with 5% to 10% less cargo capacity, and airline surcharges for recovering extra fuel expenses.

The guidance suggests the air cargo market is poised for a very strong third quarter that makes up for the slow start to the year.

IATA’s projections dovetail with feedback from air logistics providers that say they expect an early peak season this year as companies rush to expedite delivery of shipments that were backlogged in China because of quarantine edicts that limited factory, port and airport operations in major cities.

Upbeat forecast

IATA highlighted the potential for a return to global industry profitability next year as passenger business recovers from a two-year tailspin.

Overall, IATA said airlines are expected to reduce their losses to $9.7 billion, $2 billion better than what it was predicting in October, from $42.1 billion last year and $137.7 billion in 2020 as the pace of recovery from the COVID crisis picks up. Airlines suffered a net loss of 8.3% and 36% respectively during the previous two years, but margin loss will shrink to 1.2% in 2022.

Strong pent-up demand, the lifting of travel restrictions in most markets, low unemployment and increased personal savings are driving strong bookings through the summer, with IATA anticipating passenger throughput will reach 83% of the pre-crisis level in 2022. International travel is finally gathering momentum after being hindered by COVID controls.

Industry revenues are expected to grow 54.5% from last year to $782 billion, only 6.7% less than in 2019. Airlines will operate 33.8 million flights, 13% less than three years ago, IATA said. Passenger revenue is expected to account for $498 billion of industry revenues. As planes get more crowded, yields are expected to rise to 5.6% from 3.8% a year ago.

Cost savings and improving yields are helping airlines to reduce losses even with skyrocketing fuel and labor costs. Jet fuel prices have jumped 40% this year, but airlines say the high travel demand and limited ability to add extra flights because of labor shortages are enabling airlines to pass on nearly all of the higher fuel expenses.

IATA forecast the industry could achieve profitability in 2023. North America is expected to continue to be the strongest performing region and the only region to return to profitability — $8.8 billion — in 2022.

The expected net delivery of more than 1,200 aircraft in 2022 is evidence of industry optimism, the trade association said.

Turbulent conditions

But there are warning flags that the airline industry’s recovery could be derailed if inflation-weary travelers and companies tighten their budgets and pull back from trips after the busy summer season while jet fuel prices remain extraordinarily high. Also, airlines aren’t earning as much as they have in the past because they don’t have enough seats to sell since there is a shortage of pilots and other personnel needed to operate more flights, analysts say. A big question mark is whether a projected shift to business and international travel will offset a flattening out of leisure demand, said Cowen aviation equity analyst Helane Becker in a recent research note.

Other risks to IATA’s forecast include a strong U.S. dollar, which is increasing the price of U.S.-dollar-denominated debt for those doing business in a local currency and adds to the burden of paying for fuel imports, and the return to restrictive anti-COVID border policies. Airlines are still carrying $650 billion in debt, much of it accumulated to survive the COVID crisis.

“The improvement in the financial outlook comes from holding costs to a 44% increase while revenues increased 55%,” Walsh said. “As the industry returns to more normal levels of production and with high fuel costs likely to stay for a while, profitability will depend on continued cost control. And that encompasses the value chain. Our suppliers, including airports and air navigation service providers, need to be as focused on controlling costs as their customers to support the industry’s recovery.”

Walsh, as he has before, was extremely critical of “monopolistic or oligopolistic” airports and governments that are raising infrastructure charges as the aviation industry emerges from pandemic wreckage. London Heathrow and Amsterdam’s Schiphol airports have implemented, or plan to, fee increases of 50% and 37%, respectively, and Dublin authorities are seeking an 80% hike for the next three years. More than half of the top 100 airports have announced increases for 2022 and 2023 to make up for revenues not collected during the pandemic.

“Try that in a competitive business. ‘Dear valued customer, we are charging you double for your coffee today because you could not buy one yesterday.’ Who would accept that?” said the director general.

He singled out the government of the Bahamas for doubling the rate of overflight fees after regaining control of its airspace in 2021 and contracting with the U.S. Federal Aviation Administration to provide overflight services free-of-charge.

Fuel is once again the largest cost item for airlines at $192 billion, with fuel representing 24% of total costs, up from 19% in 2019, based on an estimated average of $125.5 per barrel for jet kerosene. Although the war in Ukraine is a major driver of high prices for Brent crude oil, the spread between crude and jet fuel prices is well above normal due to capacity constraints at refineries.

IATA estimated that direct employment will increase 4.3% as the industry rebuilds its workforce following the COVID downsizing. The workforce will still be more than 200,000 below the 2019 level of 2.93 million jobs and is expected to remain below that level for some time. The industry’s tab for wages is expected to grow 7.9% to $173 billion — notably more than the increase in total jobs.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

RECOMMENDED READING:

Geopolitics contributes to 11% decline in air cargo demand

Air cargo market fades 7% in May, faces summer of uncertainty

Airport congestion masks softening in trans-Atlantic air cargo