(UPDATED: 7:15 p.m. ET with FedEx earnings news)

The only way to characterize the air cargo market in March is it’s a little less worse than the past few months.

Slight recovery of factory output in China after the Lunar New Year holiday, a rise in manufacturing exports elsewhere and incremental improvement in inflation are helping global demand and rates achieve some sense of seasonal stability after a yearlong slump.

But the outlook remains murky, with green shoots pointing to a second-half recovery against a backdrop of difficult economic conditions. If import/export activity grows, the likely beneficiary will be container shipping lines — not airlines. Plus, an influx of capacity from restarted international passenger services, combined with weak demand, is weighing on rates.

The normal peak season failed to materialize last fall, but air cargo executives said demand really went off a cliff in December. Volumes have slowly increased on a sequential basis in recent weeks after a slow start to the year, according to analysts and data services. Market intelligence firm Xeneta reports week over week volumes ticked up 2%. Several air corridors from Asia to North America and Europe are more active.

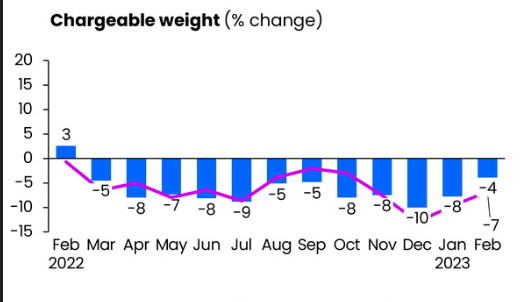

Last week’s monthly research from Xeneta showed demand declined 4% year over year in February while the International Air Transport Association (IATA), which captures lagging data with a different methodology, said traffic fell 14.9% in January. Shipment levels had been tracking at negative 8%, or more, versus the prior year for several months, per Xeneta, so February’s figure showed improvement.

It should be noted that February comparisons could be skewed by the Chinese New Year falling earlier this year than in 2022.

Meanwhile, total cargo capacity increased 11% for the second consecutive month in February, reaching pre-pandemic levels for the first time after a year of steady growth. Airlines are responding to the strong recovery in passenger travel by deploying more aircraft, which have extra space in the lower hold for cargo. Xeneta’s analysis shows passenger belly capacity spiked nearly 20 points since last summer, while freighter capacity fell more than 10 points.

Aviation experts say all-cargo airlines are starting to park some older, fuel-guzzling aircraft that were profitable to operate during the peak of the COVID-19 crisis when freight rates skyrocketed.

More passenger aircraft are scheduled to pour into the market for the busy summer season starting in April. And the rapid removal of all COVID travel restrictions in China and Hong Kong has unleashed pent-up travel demand in Asia and led airlines to quickly bring back grounded aircraft, which will increase transport supply on major trade lanes.

Teleport, the air logistics arm of Malaysian carrier AirAsia said it is resuming 18 cargo routes into China this month with a combination of passenger airlift and freighters chartered from third parties. It intends to increase to 40 routes from Malaysia, Thailand and the Philippines by July.

Soft demand has reduced load factors by eight points compared to the end of 2022, meaning planes on average are only 57% full, Xeneta said. But the average can be misleading because passenger aircraft often fly routes with minimal cargo potential while freighters typically get more space filled.

Another way to measure capacity — besides weight and cubic space occupied, or weight times distance carried — is aircraft utilization. Freighter flight hours fell an estimated 4.7% in February — an improvement from the 8.1% decline in January and a 9% drop in December, according to a recent report by investment bank BMO. The three-month moving average of flight hours declined 7.4%, the steepest drop in three years.

FedEx (NYSE: FDX) on Thursday reported an 81% drop in operating income for its Express segment for the third quarter. The carrier cut flight hours by 8% and parked an additional nine aircraft to mitigate heavy revenue losses. CEO Raj Subramaniam said the company will further reduce flight hours in the current quarter because of continued low demand and that a more pronounced readjustment of the air network is being planned.

Atlas Air, Air Transport Services Group, Cargojet and Sun Country — all of which provide outsourced transport for Amazon Air and other large customers — have recently reported lower aircraft utilization or said they expect activity to drop this year. That’s significant because it shows the downturn in air cargo is extending beyond general cargo to express consignments, which were bolstered longer by the surge in e-commerce. A Maersk Air Cargo spokesman said demand on its new Asia-U.S. route was extremely soft at the start of the year.

In fact, Xeneta data shows the air cargo market would have contracted over the past four years were it not for express shipping, spurred by rapid growth in online shopping, and special cargo, such as pharmaceuticals.

IATA has said air shipment traffic tilted down 8% during 2022 from the prior-year record and was 1.6% less than before the COVID crisis. It predicts air cargo volumes will fall further this year to 5.6% below 2019 levels.

Semiconductors and consumer electronics are major gauges of air cargo demand. A recent World Semiconductor Trade Statistics Organization forecast projects annual global chip sales will decrease 4.1% in 2023.

International Data Corp. recently lowered its forecast for PC and tablets, saying 11.3% fewer units will be shipped this year than in 2022 because consumers are no longer stuck at home due to COVID restrictions and commercial backorders for PCs are largely completed. Worldwide smartphone shipments will decline 1.1% this year on the heels of an 11% drop last year due to inflation and weak consumer demand. Smartphone shipments declined 18.3% in the fourth quarter, the largest-ever decline in a single quarter.

Intra-Asia air cargo demand is higher than from Asia to North America and Europe. Analysts attribute this to many companies having recently diversified their supply chains beyond China due to the China Plus One strategy and the Regional Comprehensive Economic Partnership trade agreement that went into effect a year ago.

Lower shipping prices are welcomed by businesses moving goods but have resulted in lower revenues and yields for carriers and logistics providers.

Spot rates, which are volatile and vary by regional market, are down about a third from a year ago but still 55% better than the pre-pandemic level. Air logistics experts expect the new baseline to permanently settle a bit lower but above the 2019 level.

The negotiating power of carriers is waning as legacy contracts with higher rates expire. As commitments for allocated space expire at the end of March for trans-Pacific eastbound and eastern Asia-to-Europe traffic, new rates under negotiation will generally be lower by about 15% to 20% compared to the previous year but still higher than the current market rate, Taiwan-based logistics specialist Dimerco said in a recent customer update.

But with so much uncertainty, freight forwarders could be hesitant to sign long-term contracts with airlines.

Glass half full and half empty

Air cargo faces ongoing challenges from the global economic slowdown, high inflation, the Ukraine war and high jet fuel costs.

In addition to being a drag on consumer spending in Europe, the Ukraine war has effectively eliminated air cargo capacity by forcing airlines to detour for several hours around restricted Russian airspace. Lufthansa Cargo executives recently said the longer routes between Europe and Asia have cut the utilization of 1.5 aircraft, or about 11% of its fleet. More passenger airlift may not make much of a difference this year because the extra fuel carried will prevent more cargo uptake, said CEO Dorothea von Boxberg.

Oil prices have recently softened, but greater refining costs still mean jet fuel is 50% more expensive than four years ago. Those costs are being passed on through surcharges that have significantly propped up airfreight rates. Airlines and airport cargo terminals are also dealing with labor shortages, extreme weather events and union actions that have increased costs.

There are also positive signs for trade that could translate into more air shipments. Factories in China have resumed production after a longer-than-normal holiday hiatus, with some shippers turning to air transport as a way to make up for downtime. And importers and exporters no longer have to worry about factory shutdowns for COVID after the Chinese government ended its hard-line policy to eradicate the virus at almost any cost.

Air volumes and rates firmed considerably on outbound lanes from South China during the past couple of weeks, especially to North America, according to the latest data from price reporting agencies and logistics companies. Still, rates are about 45% below a year ago — but 80% to 90% better than before the pandemic.

New export orders, a leading indicator of cargo demand, are growing in several major economies and stabilizing in the U.S. and China, according to the Purchasing Managers’ Index. And inflation is easing for G-7 countries.

In the U.S. manufacturing PMI improved four-tenths to 47.3 in February, with 50 being the threshold for growth. Inflation has fallen year over year from a peak of 9.1% in June to 6% in February. The producer price index is at its lowest point since March 2021. And consumer spending has remained quite resilient despite the pocketbook pressures. Many Americans will have more disposable income thanks to the 8.7% cost-of-living increase this year for Social Security.

Many logistics providers are anticipating a second-half bounce in international orders and shipping activity as retailers finish clearing out bloated inventories and begin ordering new goods again.

But airfreight may not benefit much from any extra trade because improved ocean freight reliability and much lower rates — down nearly 90% in a matter of months — make the air transport mode less attractive.

The National Retail Federation predicts March import volumes at U.S. seaports will be 12% higher than in February and 8% higher than four years ago, with volumes climbing steadily at least through July and exceeding 2019 levels.

“Many shippers will look firstly to use cheaper modes of transport and, from where we are now, even if there is a boost, we might still be seeing zero overall growth for general air cargo by later in the year,” said Niall van de Wouw, chief airfreight officer at Xeneta, in the latest analysis.

Under a more pessimistic scenario, air cargo demand doesn’t substantially rebound until 2024.

Click here for more FreightWaves and American Shipper articles by Eric Kulisch.

RECOMMENDED READING:

Freighters flying fewer hours underscores market weakness in air cargo