Digital marketplaces for air cargo have added new features making it possible for logistics companies managing imports to instantly book export shipments from agents in another country without the hassle and time-zone delays of shopping quotes by phone and email.

It’s another level of connectivity for online booking portals that enable freight forwarders to search, compare and book cargo space across multiple airlines in real time. The simplified booking process is valued by logistics professionals, but some worry they could lose business if multilateral distribution channels open their systems to nonaccredited intermediaries or directly to cargo owners themselves.

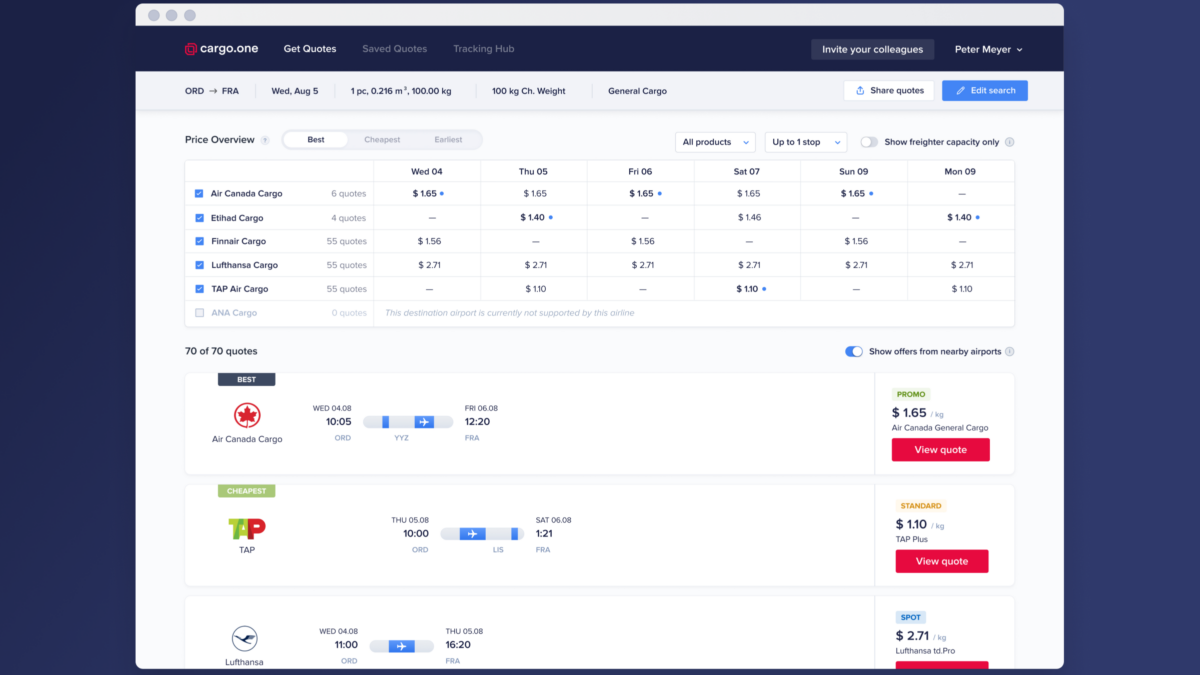

Cargo.one on Wednesday announced an upgrade designed to streamline freight forwarders’ overseas bookings that require a partner to execute. WebCargo, a Freightos company, last week said that airfreight wholesalers in China for the first time can now sell space to freight agents just like airline partners.

The third-party platforms, along with rival CargoAi, allow airlines to market their capacity in one place. Forwarders can quickly compare live rates and availability and then electronically book shipments — much like travelers shop for airline seats, hotels and rental cars on Kayak or Priceline. The advantage of automatically connecting forwarders’ transportation management systems with airline reservation systems is more predictable, transparent pricing and capacity information that can be confirmed instantly compared to shopping static rates.

But the process only works for export traffic. A logistics company operating in Baltimore, for example, can’t reserve a pallet of auto parts on an aircraft departing Amsterdam because of customs regulations and how global settlement systems are wired.

For import moves, a freight forwarder has to use an agent in the country of origin to make the booking, organize delivery to the airport and ensure export clearance is obtained. Procuring rates has mostly been manual, involving many messages back and forth that can take hours or days, especially when different time zones are involved. Logistics offices, depending on the size of the company, can write dozens to hundreds of quotes per day. The lag in finalizing transactions can result in losing reservation slots to competitors or prices going up.

Andy Frommenwiler, a vice president for Krieger Worldwide based in Los Angeles, said it is difficult getting quotes from agents in other countries.

“Just let me know who flies something from Shanghai to Boston and then I can discuss with my customer. Otherwise I have to wait the whole day, send the information overnight and if something’s missing I won’t see it until I get up. By then they’re going to bed and I have to wait again for 24 hours,” he said in an interview.

With Cargo.one’s “pro” version, forwarders can quickly get quotes for customers and instantly book approved transportation in another country. Agent quotes include the airlines’ price, plus their own fees for trucking, customs filing and security processing, as well as any markup. In reality, the inbound forwarder is essentially delegating the booking to its partner because of all the in-country execution challenges.

Who benefits?

Cargo.one pro isn’t just for small, independent forwarders but also big companies that need an overseas office to process digital bookings and forwarder networks with vetted members who pool their sales and resources, said founder and co-CEO Moritz Claussen in an interview.

“The technology that we’ve built enables both the small freight forwarder to find work abroad and work with it, but also the big ones to do that internally and to make that process much more efficient,” Claussen said.

Prior to its official launch, more than 50 export agents have tendered over 6,000 import quote requests from 121 countries without the burden of manually replying.

WebCargo for a year has quietly enabled import agents in forwarder networks to compare export agents’ contract, tariff and dynamic rates, and place a booking through a dedicated portal. Freightos hasn’t widely promoted the capability so far, according to users. CEO Zvi Schreiber said via email that forwarders can delegate air cargo booking privileges to each other whenever they choose.

Frommenwiler said it took inquiring with WebCargo to learn that he can give rate access to approved overseas agents. He hopes more companies join the platform so it becomes easier to enable those connections.

“I’m kind of blind. I get weekly rate sheets, but there is some risk. I cannot just go in and see the flights out of China and Europe unless I go to WebCargo, give my credentials and an overseas partner goes in with my credentials and then we see each other,” he added. “I really like WebCargo. It helped us get a lot of pieces. I just wish WebCargo would be used more, and then I could approach more agents overseas to share our export figures.”

Conflicts of interest

The ability to share capacity and rates exclusively among forwarder partners has simplified the job, but rate platforms have the potential to undermine forwarder business if they offer direct access to customs brokers, shippers or other noncertified participants, said Christos Spryou, founder and CEO of Neutral Air Partner, a membership cooperative for purchasing transport. The fear is that cargo owners could bypass agents and book freight on their own, especially if the portals provide financing or digital wallets to facilitate transactions. Or, he explained, export agents might have an incentive to go directly to the client and cut out the import agent.

“It is important that the appointed origin agent by the booking platforms is 100% neutral and operates as a wholesaler to the trade and doesn’t deal directly with [cargo owners],” Spryou said. Since 2021 his members have used a dedicated portal within WebCargo for real-time rate sharing and e-booking.

The International Air Transport Association (IATA) licenses air logistics providers to verify their financial and professional soundness and enable single invoicing for activity generated by global offices.

Professional forwarders won’t be severely impacted, he predicted, because they have long-term contracts for guaranteed allocations of space with preferential pricing over standard rates.

“I’m not worrying they will break the market. But they need to stay neutral or they’re attacking the same clients and allowing access without needing the relationships and investments,” Spyrou said. “That’s a bit of a game changer. Then why should I put my rates into the system?”

Open access hasn’t happened yet, but CargoAi appears to be heading in that direction, the NAP chief said. CargoAi is promoting a CargoWallet on its website and says access to its system is available “whether or not you’re an IATA . . . agent.” Forwarders don’t need to participate in the IATA account settlement system or have bank guarantees.

Air New Zealand last month began offering capacity on CargoAi to forwarders in the U.S. and Canada.

Upgrading to Cargo.one pro starts at about $108 a month per branch, with preferential pricing for forwarders that belong to registered purchasing cooperatives.

The FreightTech firm said it has started a payment protection program to bridge the trust gap when dealing with new agents for the first time. The company is able to guarantee full payment because it leverages extensive data in its system to understand how participants deal with airlines and their payment history. Development of a payments infrastructure that will allow the entire transaction to take place within a closed system is underway.

Berlin-based Cargo.one was one of the first multiparty airfreight distribution channels when it opened for business in 2017. Forwarders were slow to adopt the technology until the COVID crisis because of perceived concerns by many about heavy IT expenditures, being first adopters and sharing proprietary data. Cargo.one says more than 40 airlines are listed on its site and more than 2,000 forwarders use its system.

The startup, which charges a small fee on each transaction, has raised more than $65 million to date from several blue chip venture capital firms and Lufthansa Cargo but has yet to turn a profit as it continues to invest in product development and marketing.

Claussen said Cargo.one is experiencing more searches on the platform despite the market downturn because there is excess capacity and shippers are searching for the best deals.

“It’s sometimes a little counterintuitive. But if you’re in a market where there is no capacity available, you really need to work your personal relationships with that airline guy you know to get a little bit of capacity,” he said. “So while rates are going down, the usefulness of a platform like Cargo.one is increasing.”

China’s wholesale market

Meanwhile, Freightos last week said its WebCargo platform for dynamic booking has added three master loaders in China who will sell space to forwarders in the same fashion as its 35 airline contributors. They are the first airfreight wholesale distributors available on WebCargo with guaranteed space and rates.

About a dozen consolidators control most of the capacity out of China because airlines directly sell to them. The main difference between co-loaders in Asia and traditional consolidators in the West is that cargo shipments in Asia are consolidated and mixed by actual weight and volume to maximize profit but without consolidating the shipping documents. Multiple master airway bills (the receipt issued by airlines for goods received from the forwarder) are issued for several destinations for cargo in one or more containers as opposed to traditional consolidation in which freight is billed by the wholesaler to the forwarders via the house airway bill. By building a master load for multiple destinations in a region they can offer lower rates than airlines and what is seen on spot market indexes.

Freightos said Sinotrans Global E-Commerce Logistics (Sinoair), CIMC Anda Shun International Logistics Co. and Sinotech Logistics are now offering forwarders in Europe and North America real-time access to Chinese air cargo export capacity.

Direct access to China’s huge export capacity saves time and money, according to Freightos. Traditionally, Chinese non-aircraft-operating common carriers offer their services to local forwarders who then resell capacity to overseas forwarders looking to import goods from China. The common barriers to efficiency are cumbersome offline communications, different time zones and language.

“The opportunity to offer direct sales with Western forwarders will expand access to a large customer base and provide us with financial [customer verification] through WebCargo’s payments functionality,” said Wenxuan Zang, Sinoair’s general manager of logistics and information technology, in a news release.

What WebCargo is doing in China makes sense, said Spyrou, because it is such a unique market.

Freightos (NASDAQ: CRGO) recently went through an initial public offering to raise money and is now listed on the Nasdaq exchange. It too is losing millions of dollars a year as it strives to expand product offerings and geographic reach.

Twitter: @ericreports / LinkedIn: Eric Kulisch / ekulisch@freightwaves.com

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

Sign up for the weekly American Shipper Air newsletter here.