Time is the most valuable commodity in the world of trade. It’s priceless. A new report out on transit times from digital freight forwarder Shifl shows the impact the massive congestion off the coast of Los Angeles and Long Beach has had on transit times.

The pipes of trade on the West Coast are so clogged it is now faster for vessels to travel to the East Coast and call on the Port of New York and New Jersey than to travel to the West Coast ports and wait, the report says.

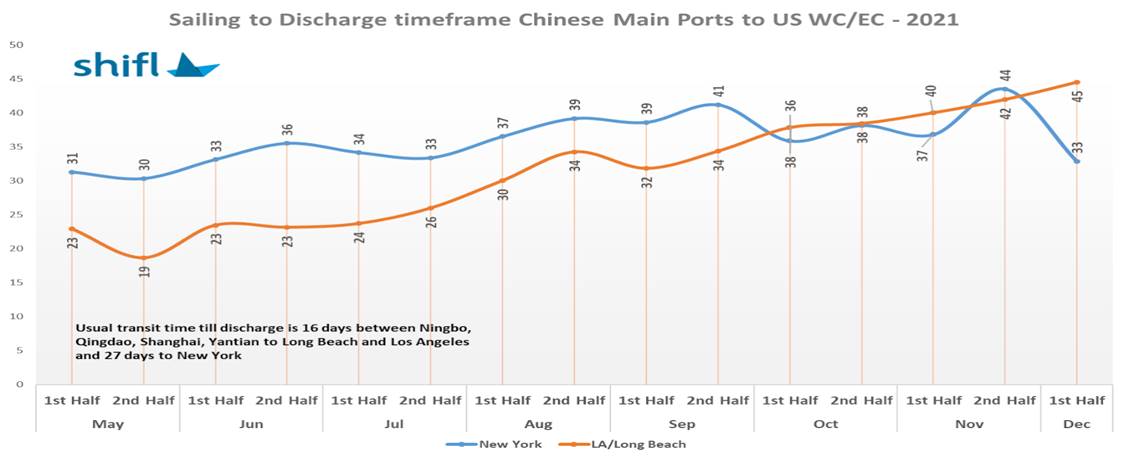

According to Shifl’s data, the average transit and discharge time from China’s main ports to the West Coast ports is 45 days, an increase of 96% since May of this year. Pre-pandemic transit and discharge averaged 16 days.

Meanwhile, the transit time from the main ports in China to the East Coast is standing at 33 days. This is a marked decrease from the 44 days in November.

It’s important to note that the decrease in transit time for the East Coast’s largest port is not a reflection of a decrease in trade. Just like the ports of LA and Long Beach, the Port of New York and New Jersey, along with other ports on the East and Gulf coasts and in the Pacific Northwest, are all shattering container volumes.

Shabsie Levy, founder, and CEO of Shifl, told American Shipper, “Considering the increase in ad hoc vessels and new strings added along with the East Coast ports, it was amazing to see the transit time results. What’s amazing with the results in New York/New Jersey, some terminals are underutilized and operate only till 4 p.m. [ET].

“Can you imagine how many more containers could be processed if those terminals were operating longer?”

In the report, Levy noted the slow steaming of vessels to the West Coast to avoid long anchorages and an increase in incoming vessels as possible reasons for the increased transit times.

“Unless we start gauging the capacity at the destination ports, we will continue to be in this circle of congestion,” Levy added.

The impact of this congestion, according to Levy, can be seen in freight costs. The report noted that “the freight rates are on the rise again and this is attributed to the increased demand for space out of China brought about by the lack of ships to load cargo on as the ships are still waiting in Los Angeles/Long Beach.”

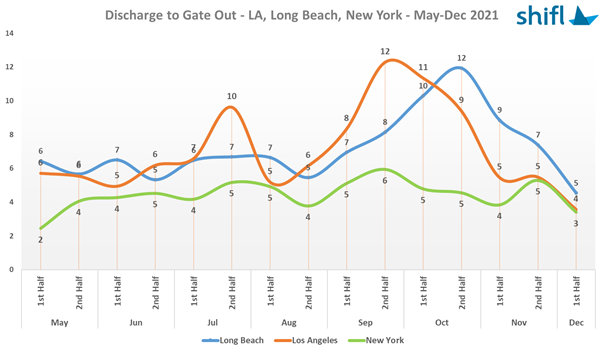

One bright spot in the data was the reduction of container dwell times.

Since the Biden administration’s pressure on the ports of LA and Long Beach shareholders to move containers out at a faster pace, there has been some improvement, per Shifl’s data. The announcement of the container dwell charges on long-dwelling containers at the ports of LA and Long Beach terminals has been credited for the improvement.

Since mid-October, the Port of Long Beach saw import container dwell times drop from 12 days to five days — a 140% improvement. The Port of Los Angeles recorded a 125% improvement, dropping from nine days to four.

Dwell times for the Port of New York and New Jersey have been consistently low, never going beyond six days since May, according to Shifl. The dwell time at the port of NY/NJ is now three days, a 67% reduction since mid-October.

Noel Hacegaba, COO of the Port of Long Beach, told American Shipper, “We continue to chip away at the number of inbound containers dwelling on terminal longer than 9 days, which is down 39% since Nov. 1. At the same time, we continue to make a dent on the number of empty containers on terminal, which account for 36% of all containers on terminal today, down from 45%.

“The extraordinary collaboration by our supply chain partners in combination with our expanded gate hours and 130-plus acres of vacant land that we have activated at the Port of Long Beach is helping to keep boxes moving through our terminals so that we can process and bring more ships to berth faster.”

Port of Los Angeles Executive Director Gene Seroka said, “On dock container dwell times, a priority for LA, have been reduced but need more work. Street dwells are peaking once again and require urgent attention.”

Sam Ruda, director of the Port of New York and New Jersey, told American Shipper the constant flow of trade through its terminals is a result of all stakeholders working together.

“The Port of New York and New Jersey is proud to be able to keep our container terminal operations smooth, fluid and continuous throughout this global health pandemic while at the same time experiencing an ongoing cargo surge that has resulted in more than a year of record-breaking volumes and unprecedented growth,” he said.

“Our partners and stakeholders – from the terminal operators, NYSA, labor, trucking interests, depot operators, chassis lessors, federal and state partners to CSX, NS and Conrail – continue to work collaboratively and in lock-step to keep critical supplies, food and goods moving and workers in the regional supply chain safe and healthy.”

Stephanie Richter

I’ve made $84,000 so far this year working online and I’m a full time student. I’m using an online business opportunity I heard about and I’ve made such great money. MMn It’s really user friendly and I’m just so happy that I found out about it. The potential with this is endless.

Here’s what I do…>>>>> http://www.EarnApp3.com

Thomasine

I am making 💵 $200 to 💵$300per hour doing online work from home. I kept hearing other people tell me how much money they can make online so I decided to look into it. Well, it was all true and has totally changed my life. if you interested…Go to this link, fill out a basic online form and hit submit at,Home Profit System And Follow The instructions as Home Profit System And Set Up your Account.. GOOD LUCK★★

↓↓↓↓THIS WEBSITE↓↓↓↓>>>>>>HERE☛ http://Www.PAYCASH1.com