The growth of Amazon’s air cargo fleet and the number of daily flights has slowed in recent months, except at its Northern Kentucky hub and a few other geographic pockets. That reflects the mega-retailer’s more cautious approach to expansion in line with a recent pullback in warehouses because of decelerating e-commerce demand, according to research released Tuesday.

Amazon Air’s total flight activity only grew 3.8% from March through August, much less than the 14.3% growth in daily flights during the previous six months and 18.4% over the past year, the report from a team at DePaul University showed.

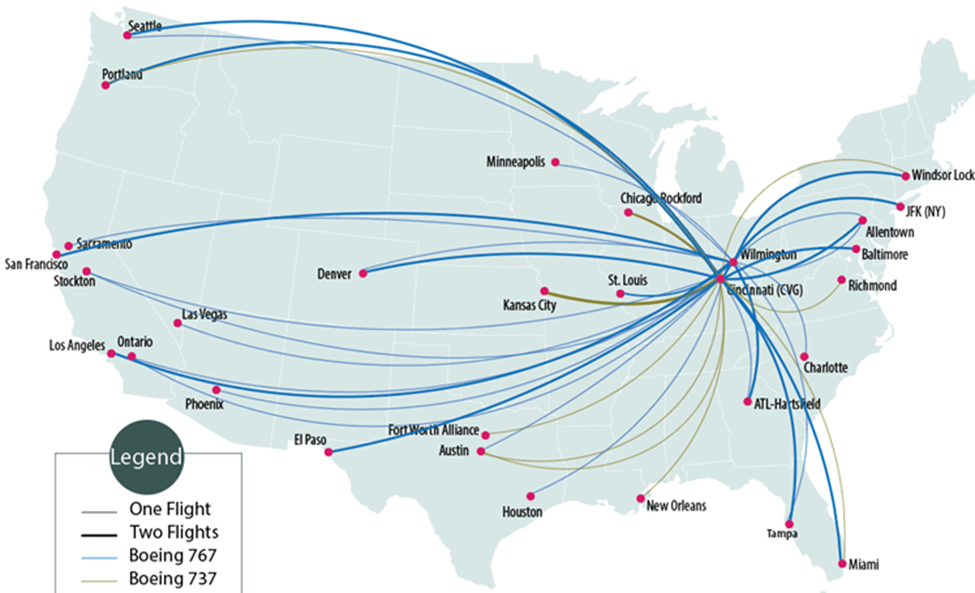

The retailer’s in-house cargo airline is operating about 194 flights per day in the U.S. and Europe compared to 187 in March. Amazon Air currently has 88 Boeing 767 medium widebody and 737-800 standard freighters in its fleet – about the same as in the spring – and will not reach 100 aircraft by the end of the year, as previously estimated, researchers said.

The reduced activity dovetails with recent news that the e-commerce giant has closed or canceled 44 warehouses this year on the heels of a $3.8 billion first-quarter loss. That is two and a half times more locations than previously identified for cancellation or delay in July.

The company is now rationalizing its air network because there are fewer warehouses to supply and fewer packages moving through the network as e-commerce growth normalizes to pre-pandemic levels.

DePaul University’s Chaddick Institute uses flight tracking data and geographical imaging software to analyze Amazon’s air logistics network on a periodic basis.

Cincinnati hub becoming large, nighttime operation

Despite a downturn in systemwide growth, Amazon (NASDAQ: AMZN) has scaled up flight activity to take advantage of its $1.5 billion expansion of the air hub at Cincinnati/Northern Kentucky International Airport (CVG), which was completed last September, the latest report showed. More synchronized scheduling is also enabling quick aircraft-to-aircraft transfers that support next-day deliveries, much like FedEx (NYSE: FDX), UPS (NYSE: UPS) and DHL operate, beyond the company’s traditional goal of inventory replenishment for fulfillment centers.

The primary sort facility is now handling 44 flights per day, a 71% increase from early this year. When so-called “shadow” flights by partner airlines such as ABX Air and Air Transport International, using non-Amazon branded aircraft, are included, the number of regular takeoffs and landings approaches 60 per day.

Amazon has since organized flights into tight arrival and departure intervals, with inbound flights concentrated between 3:45 and 8:50 a.m. and between 4:30 and 8:30 p.m. Departures are concentrated between midnight and 1:45 a.m., 5:15 and 7:45 a.m., and noon and 3:45 p.m.

“Amazon’s CVG now more closely resembles FedEx and UPS hubs in Memphis and Louisville than it did in March, with a new cluster of ‘overnight flights’ … that positions Amazon for more next-day fulfillment from its vast warehouse network in Kentucky, Indiana, and Ohio” as well as third-party delivery, the report said.

Amazon is maintaining flight levels at Wilmington Air Park in Ohio, only 60 miles away. The two airports together represent the main crossroad in Amazon’s air network, accounting for 21% of all flights serving points in the U.S.

Concentrating more flights at CVG and Wilmington simplifies Amazon’s supply chain and helps improve aircraft utilization.

Amazon’s ability to replenish inventories by truck from its Ohio Valley hubs likely explains why it hasn’t added air service to areas such as Buffalo, New York; Raleigh, North Carolina; or Memphis, Tennessee, according to the researchers.

The expanding capabilities at CVG also bolster Amazon’s Buy with Prime program, which launched in April and allows merchants to offer fast and free delivery to Amazon Prime members even for purchases made on online stores other than Amazon.com.

Buy with Amazon differs from the more established Fulfillment by Amazon program because consumers are clearly notified that Amazon will provide delivery when they place orders, and it creates another incentive for shoppers to sign up for Prime.

“This rollout of Buy reinforces our belief that Amazon’s core strength lies in business-to-consumer delivery rather than next-day ‘anywhere to anywhere’ delivery akin to that provided by FedEx and UPS. This segment is also a better fit for Amazon than business-to-business delivery, such as delivering components and parts to manufacturers,” the DePaul team, led by professor Joseph Schwieterman, wrote. “One reason is that CVG is still small compared to major FedEx and UPS hubs. Moreover, Amazon remains significantly far from being able to universally offer early morning delivery on next-day shipments throughout the entire U.S. mainland. Even so, with CVG’s development, the company is gradually closing the gap.”

The DePaul researchers estimate that a merchant who ships via Amazon Air from metropolitan Cincinnati and has packages ready for shipment by early afternoon could have those packages delivered by the next afternoon, or early evening, to points in all of the 25 largest U.S. metropolitan regions. And the merchant could have packages delivered by sometime the next day to about 95% of the U.S. mainland’s population. Amazon also appears to be close to having the capacity to offer second-day delivery between any two points on the mainland using only its own network.

Amazon more closely resembles FedEx and UPS as it opens its logistics network to companies with no relation to its e-commerce business, but it still isn’t considered a fully integrated carrier because it only offers one-way delivery to consumers for companies that can stock inventory at several locations or need only two-or-three day delivery. Amazon doesn’t pick up packages or provide business-to-business delivery.

European air network

Amazon Air is also growing in Europe, the Mountain states and Florida.

Logistics managers are prioritizing growth in Europe, particularly in Leipzig, Germany, and Milan, Italy. Intra-European Amazon Air flights, operated by ASL Airlines, grew from 36.4 to 44.3 daily between March and September. Amazon has simultaneously dialed back service at Cologne, Germany, from six flights per day to one. Amazon’s European operation is probably larger than it appears at face value because many shadow or “ghost” freighters, operated by partner carriers under their own aircraft registration, are carrying Amazon shipments too.

Since March, Amazon Air has added airport gateways in El Paso, Texas; Las Vegas; and Lihue, Hawaii, putting more than 73% of the U.S. population within 100 miles of one of its airports, up from about 60% 18 months ago.

The number of flights at Florida’s Lakeland Linder Airport, near Tampa, has grown to about 18 per day, while activity at Chicago Rockford Airport rebounded to 12 flights daily. Conversely, activity fell at Fort Worth Alliance airport in Texas; Portland, Oregon; Seattle-Tacoma and other destinations.

Both Ontario International Airport in Riverside, California, and a new hub in San Bernardino have seen reductions in flight activity. The airports are only 21 miles apart and are only handling 10 and five flights, respectively, raising questions about whether Amazon might consolidate operations in the area.

Amazon Air is still in growth mode, just not at the same pace as it was during the pandemic when domestic e-commerce sales exploded by 40%. Schwieterman’s team expects Amazon to add another seven to nine freighters to the fleet, continue to expand nighttime operations at CVG and other hubs, and add a dozen more daily flights at CVG by next spring.

The report also predicts Amazon will soon develop an overnight network in Europe to mirror the one in the U.S.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

RECOMMENDED READING:

Amazon uses ‘ghost freighters’ to increase cargo flights over 30%