The spotlight has focused on the armada of container ships stuck in California’s San Pedro Bay, awaiting berths in Los Angeles and Long Beach. But that’s not the whole story: Anchorages are bloated with box ships elsewhere along the West Coast, in Oakland and British Columbia, and on the East Coast off Savannah, Georgia.

The common denominator is a massive surge in U.S. consumer demand for Chinese-made goods. But there are also key differences.

In an interview with American Shipper on Wednesday, Georgia Ports Authority (GPA) Executive Director Griff Lynch explained why the situation off Savannah is not the same as the one off the West Coast — and why his traffic jam is already easing.

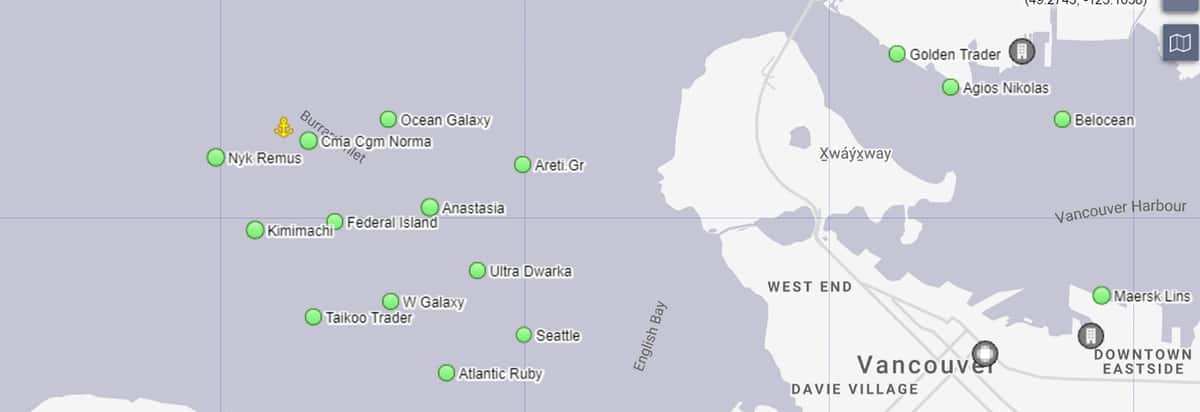

Ships at anchor off multiple ports

The number of container ships in San Pedro Bay has averaged around 30 since the start of the year and level remains stubbornly high. As of Wednesday, there were 31 at anchor. The CMA Marco Polo — with a capacity of 16,022 twenty-foot equivalent units (TEUs) — has been stuck at anchor the longest, since Feb. 27.

Up the coast of California, ship-positioning data from MarineTraffic showed 13 ships at anchor off Oakland as of Wednesday.

Even further to the north, MarineTraffic data showed 11 ships at anchor off Vancouver in British Columbia. Asian exports to the U.S. are flowing heavily through Canada as well. Ocean carrier Hapag-Lloyd said in a market update last week that there was “ongoing heavy congestion at all terminals in Vancouver and Prince Rupert [Canada] … with vessels being held off berth for days.”

Over on the East Coast, Savannah had 14 container ships at its anchorages as of Wednesday. The difference here is that the number is down from a high of 22 last week, when Savannah looked like it was headed towards California-style congestion.

Both natural and man-made causes

“Everybody’s getting slammed and overwhelmed with cargo. It’s incredible and something we didn’t see coming,” Lynch told American Shipper. “But for us I think it’s a simpler story than it might be on the West Coast.”

The Savannah River is closed by fog from time to time each year between December and February. “We had a very challenging fog season this year,” reported Lynch. In February, fog shut the river for 109 hours or 16.2% of total hours in the month. That’s up 45% from fog closures in February 2020.

On top of that, winter storms caused delays for ships coming through the Port of New York/New Jersey, which caused subsequent arrivals in Savannah to bunch up.

“We had vessel bunching compounded by fog,” he said. All of which coincided with the same surge in import volume being seen at all American ports. Lynch said that there were six or seven extra-loader arrivals last month. (Extra loaders are ships not in a regular service added to carry incremental volume.)

At one point in February, there were 83,000 containers on the terminal grounds. “That is unheard of,” he said, noting that the usual level was 50,000-60,000 containers. “While our business was up 20%, our inventory was up 50-60%.”

Rapid reduction of the queue

Because weather played such a big role in Savannah’s congestion, it has been able to bounce back quickly.

Lynch pointed out that the number of ships at anchor has been reduced by 36% in the past six days. “Essentially what we’ve done is reduce the queue by more than one vessel per day,” he said.

The number of containers in the facility is already back down to 64,000. “We’ve made a tremendous amount of progress, which has opened things up and allowed us to work vessels and turn them around more quickly.”

Meanwhile, the import boom continues apace. “Our March to date is up 32.5% year-over-year. We’ve been up double digits for months now,” he said.

“If you look at our volume last week, it was yet another throughput record for us. If we annualized that, we’d be running at a pace of over 6 million TEUs. We’re probably going to add 600,000-700,000 TEUs in one year, which is incredible.

“We’re seeing volume this year we didn’t expect to see until 2025. So, what we’re doing now is advancing expansion plans we had targeted to happen over the next five years. We’re going to get them done sooner — add more ship-to-shore cranes and more berths so we can better handle this type of volume in the future.” Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON CONTAINERS: California port pileup leaves old records in the dust: see story here. New video shows massive scope of California box-ship traffic jam: see story here. Inside California’s container-ship traffic jam: see story here.

Greg Miller, Senior Editor

UPDATE 3/16: Ship positioning data is now showing that the anchorage situation off Savannah has actually gotten worse, not better, since this interview was published. I’ve just been told that this relates to weather issues on Sunday and Monday and that the underlying trend is still positive. I’ll check back with the port in a week or two.

Steve webster

Part of the problem is almost 2 years ago rates for container shipping dropped too low. The same happened in trucking U S milk prices. All these should min rates and prices. The same shippers who helped push rates lower now complain about delays and rates up very sharply and in some cases over $5. a mile for truck freight $5000 per container.

CM Evans

I would reckon the union and Covid protocols are slowing the West coast ports as well.

John Sowerby

Whilst there are some valid points made in the article, one factor not mentioned is the outright cancellation of sailings by container lines serving the Europe/East Coast routes, in order to reduce congestion on the East Coast.

Transit times for containers from Europe to the US is now approaching 4 weeks, when the scheduled timings could be as low as two weeks in previous years.

Gerry Lopez

Imagine the efficiency of Savannah if it were not for the fog and the river. While they can make the channel deeper they can’t make it wider

Laurence Norman

Your article did not mention the Port of Houston or any of the Gulf Coast ports. Are they experiencing growth too? Are they having some of the same problems as the West Coast and Georgia?

Greg Miller, Senior Editor

Not to the same extent. I just checked the anchorage and it looks like there are currently less than a half dozen ships there