TEMPE, Ariz. — The Ukraine war has massively disrupted the European economy. Amsterdam Schiphol Airport is an example of how Western sanctions on Russia have had ripple effects on non-targeted businesses.

The closure of European airspace to Russian aircraft and the U.S. ban on flying U.S.-origin aircraft forced AirBridgeCargo, the scheduled cargo airline subsidiary of Moscow-based Volga-Dnepr Group, to cease operations.

AirBridgeCargo was Schiphol Airport’s second-largest cargo customer but its 21 weekly flights immediately disappeared three months ago when the sanctions kicked in, said David van der Meer, director of cargo partnerships, in an interview at an air cargo conference here.

Flowers are a key commodity for Russia that AirBridgeCargo stopped handling at Schiphol. The Netherlands is the largest exporter of cut flowers in the world and Russia is an important market.

“It’s too soon to say if the war is going to have a long-term effect on Schiphol,” said van der Meer. Since the start of hostilities freight volume is down 16.7%, but AirBridgeCargo’s coveted slots are quickly being filled up by other airlines as relatively strong shipping demand amid shortfalls in passenger capacity drive usage of freighter aircraft.

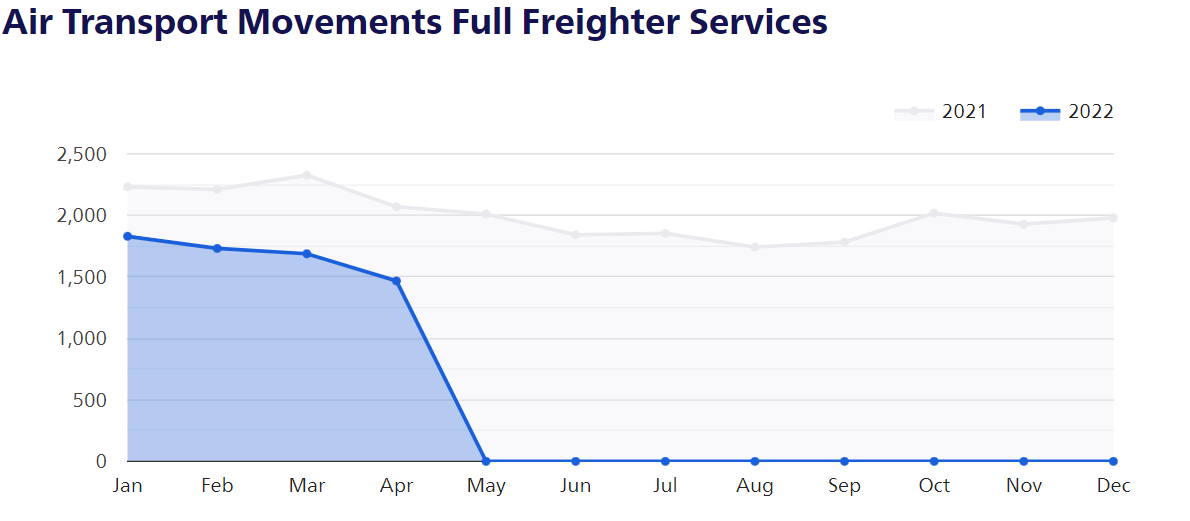

Through April, total cargo shipments are down 12% from last year. The number of freighter movements has dropped 24% so far this year, according to airport operator Royal Schiphol Group. Reduced availability of freighters because of the Ukraine war, production slowdowns in China because of COVID, infrastructure and labor constraints at airports, and softer consumer demand have dented airfreight throughput this year in Europe.

Contributing to the decrease too is Brexit because more freight from Asia goes directly to the United Kingdom rather than via Amsterdam, said van der Meer.

Amsterdam has one of the most slot-constrained airports in the world. National rules limit annual takeoffs and landings to 500,000 per year to minimize noise for local residents. Positions are allocated to airlines based on a variety of factors but can be taken away if not regularly used. According to EU rules, airlines need to fly 80% of their slots in the requested flight schedule or risk losing them. Netherlands authorities are considering raising the number of annual slots to 540,000 per year as the number of quieter, less-polluting aircraft increases.

The long-term cargo situation could depend on whether the EU applies more sanctions to close off Russia and Belarus from its economy, van der Meer said.

Volga-Dnepr “is a victim too. They had nothing to do with it [the war],” van der Meer said. “That’s really painful to see because you have a working relationship with these people.”

An Aeroflot jetliner remains parked at Schiphol because the EU sanctions prevent it from flying back to Russia.

Cargo volume at Schiphol increased 13.4% last year to 1.2 million tons compared to 2019. Pure freighters accounted for two-thirds of the throughput, with passenger aircraft carrying a third of goods.

A key growth factor was the return of sufficient slot capacity at the airport. Freighters often have difficulty getting slots because many operate as needed, on non-fixed schedules or on a seasonal basis, with one-way routes dictated by cargo flows. Passenger airline reductions during COVID left more room for freighter services, according to Royal Schiphol Group.

More than 700 representatives from across the air logistics sector attended the Cargo Network Services conference. CNS is part of the International Air Transport Association. The strong turnout indicated the eagerness of delegates to meet in person for the first time in three years without COVID restrictions.

More FreightWaves/American Shipper stories by Eric Kulisch.

Subscribe to the American Shipper Air newsletter.

RECOMMENDED READING:

Russian cargo airline provides air bridge between Russia, Asia

Volga-Dnepr freezes Boeing freighter operations over Russia sanctions