Analysts lower truckload carriers’ earnings expectations ahead of Q1

Ahead of Q1 earnings reports, analysts are adjusting their earnings expectations for truckload companies as excess capacity continues to weigh down pricing and margins. While spot rates jumped after January’s winter weather, for large publicly traded trucking companies, most of their exposure comes from contract rates rather than spot. The winter weather caused lower equipment utilization, which had a larger impact, leading to fewer revenue miles.

Shipper behaviors and inventory replenishment were additional headwinds. FreightWaves’ Todd Maiden writes, “analysts have indicated that channel checks and conversations with management teams suggest March will likely be softer than expected. Shippers have toggled back to a just-in-time inventory strategy, knowing the market is loose and that should consumer buying trends suddenly indicate the need for more merchandise, trucks are readily available to quickly accommodate.”

“To be sure, retailers still appear highly hesitant on restocking, but the trajectory of sales in the context of the destock that’s occurred should be positive for inventory balances and in turn freight flows,” said Deutsche Bank analyst Amit Mehrotra. Despite challenges for truckload carriers and freight brokers, those companies exposed to rail and intermodal are expected to fare better. Bascome Majors, analyst at Susquehanna Financial Group, told clients Monday, “We continue to see outsized earnings risk from asset-based carriers and brokers exposed to the annual contractual pricing cycle relative to LTL and rails.”

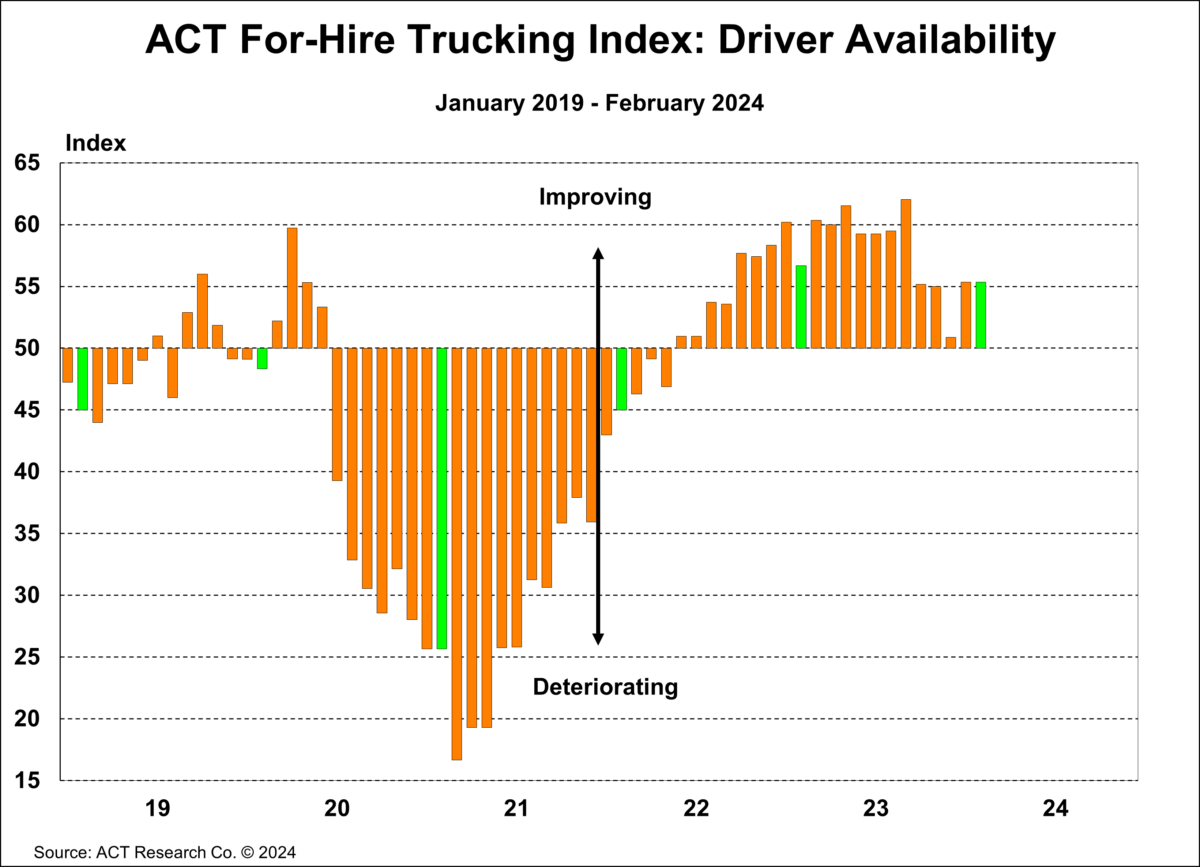

For-hire driver availability continues to improve in February

ACT Research recently released February data for its For-Hire Trucking Index, which saw early green shoots and suggested improvements to the freight market into 2024. The index uses survey data to create a diffusion index, with a reading above 50 showing growth and below 50 indicating contraction. The volume, productivity and driver indexes all saw positive growth in March, with volumes at 52.3 points in February compared to 50 in January. Pricing continued to show declines month over month but at an improving rate from 43.5 points in January to 46.1 points in February. Capacity continues to leave the market, from 49.8 points to 48.7 points, but private fleet growth is still offsetting headwinds in the for-hire space.

For driver availability, the index remained unchanged from January at 55.4, but the February result is not seasonally adjusted. Looking ahead, the report expects more downward pressure on drivers due to competition from higher-paying jobs in construction, manufacturing and private fleets. There was one demographic surprise, the report adds: “Baby boomer retirements should continue, but our survey also found drivers delaying retirement because of the recent surge in inflation. One [respondent] even noted some of their best ‘runners’ are past retirement age.”

For finding more drivers, there may be a novel solution. The Commercial Carrier Journal writes that Ken Gronbach, author, demographer and marketer, told an audience at the Truckload Carriers Association convention in Nashville, Tennessee, that one large pool of overlooked labor is convicted felons. Gronbach noted that a third of the 60 million men between the ages of 25 and 55 fit that criteria.

Market update: Contract rates down 8% versus last year

Commentary courtesy of the Daily Watch, a newsletter for SONAR subscribers.

The average dry van contract rate (VCRPM1) is down about 8% versus where it was in early March last year, according to FreightWaves invoice data. Contract rates tend to take stairsteps downward versus the more reactive and volatile spot market rates, which negotiate for shorter durations. Spot rates excluding estimated fuel costs above $1.20 a gallon — comparable to an average fuel surcharge — are only down about 1.6% compared to the previous year and appear to have shifted their direction.

The market remains in a heavy state of oversupply, and there is little support for the idea that spot or contract rates will turn sustainably higher in the near term. The positive takeaway for transportation service providers is that the contract rate declines have slowed significantly over the past six months, falling only 2% since late September.

Spot rates are actually 5.7% higher over the same period. This could be the result of shorter-length-of-haul freight having a stronger presence in the spot market, which can inflate the average rate per mile. A sustained directional shift in rates is expected later in the year. A driving reason behind this logic is simply that this market cannot last forever. These two values do suggest that is likely if you apply the previous 12-month trend line forward, albeit the market shifts have been more dramatic in recent years.

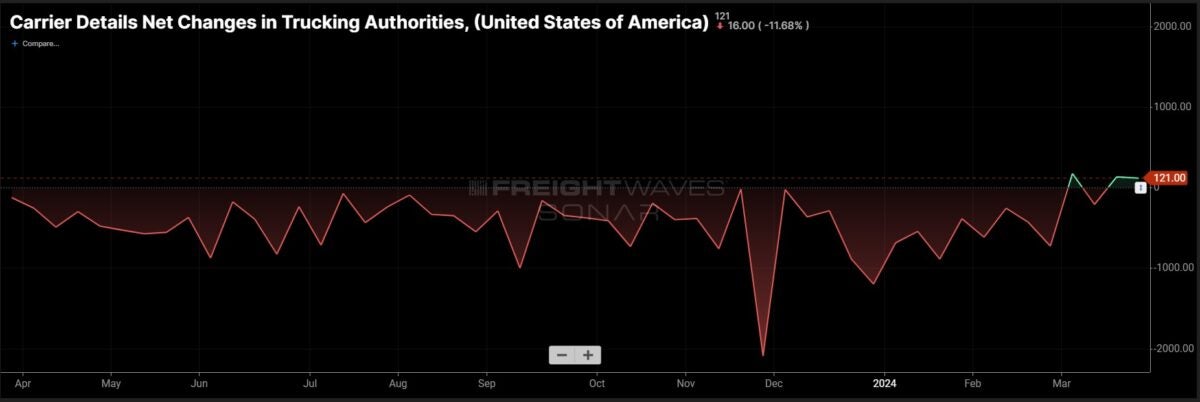

FreightWaves SONAR spotlight: Net changes in carrier operating authorities flash positive

Summary: The net change in motor carrier authorities for March showed positive despite prolonged softness in both contract and spot markets and unfavorable conditions for trucking. The Carrier Details Net Changes in Trucking Authorities (CDNCA) showed a net gain of 258 unique operating authorities in the past two combined weeks ending March 15 and 22. The gains were 137 and 121 unique authorities, respectively. Despite this flash of optimism, that same two-week period saw 2,219 net revocations in operating authorities before adding new entrants, which caused the positive net change.

Truckload capacity as measured by the total number of unique operating authorities continues to decline but at a lower rate, with 1.33% fewer carriers year to date since January 2024 compared to a 6.4% decline year over year. The explosive growth of trucking capacity to handle the pandemic surge in consumer demand remains staggering when looking at the number of unique authorities compared to five years prior. There are 41% more unique operating authorities at 351,384 compared to the week ending March 31, 2019, at 249,605 authorities.

The Routing Guide: Links from around the web

‘Truck-to-truck worms’ introduced via ELDs could threaten major fleet disruption (FreightWaves)

Bills of interest to trucking businesses pass committees (Land Line)

Baltimore port closure puts truck drivers who haul autos in a bind (FreightWaves)

Baltimore bridge collapse may cost billions, dramatically disrupt supply chains (FreightWaves)

A trucking and rail strategy that boomed during pandemic shocks is heating up again (CNBC)

RXO slashes driver wait time 30% with visual AI (Commercial Carrier Journal)