The clock is ticking. Car rental giant Hertz (NYSE: HTZ) has less than a week to negotiate a deal with creditors in a desperate attempt to avoid bankruptcy amid the coronavirus pandemic.

How that plays out has serious implications for the new and used car markets, and even for government policy, according to analysts and industry insiders.

Hertz started the year with positive momentum, but two months later the pandemic “created a major business disruption as global travel demand dropped to almost zero and the U.S. used car market effectively shut down,” said Kathryn V. Marinello, chief executive of Hertz, on the company’s first-quarter earnings call Monday.

Estero, Florida-based Hertz Global Holdings — parent of The Hertz Corp.— has until Friday to come up with $400 million after it entered into an agreement with some of its lenders and holders of its asset-backed securities following a default on its April lease payment.

Hertz Global posted a net loss of $356 million, and its adjusted corporate earnings before interest, taxes, depreciation and amortization (EBITDA) was negative $243 million in the first quarter of 2020.

While the company has approximately $1 billion in cash on the balance sheet, it has a total outstanding debt load of around $17 billion.

Hertz is reviewing all available options to preserve liquidity and recently announced it has canceled 90% of its remaining model year 2020 fleet orders, Marinello said.

The rental car company has a fleet of more than 560,000 vehicles in North America, with an additional 200,000 internationally.

Marinello said Hertz’s revenue trend went into free fall in April after the U.S. government suspended international travel, states enacted lockdowns and resale auctions sent employees home. The company “immediately shifted our business priorities to focus on employee and customer safety, expense mitigation, and preserving liquidity,” she said.

In North America, Hertz furloughed 16,000 corporate and field employees, with 12,000 of those furloughs transitioning into “permanent separations” in late March.

Those steps should deliver around $2.5 billion in annualized savings and “help extend our cash runway,” Marinello said on the earnings call.

Closely linked to its effect on the rental car industry, the pandemic has cripped the travel, tourism and hospitality industries as well.

After a 5% uptick in passenger volumes in January and February, global travel bans and stay-at-home orders put in place in March and April led to a 93% drop in passenger travel in mid-May, according to Airlines for America.

Hertz derived 66% of its revenue from airport rentals in 2019, according to its fourth-quarter and year-end filing.

Majority shareholder Carl Icahn, who has a 39% stake in Hertz, could pump more money into the company to keep it afloat and attempt to protect his investment, according to Bloomberg. However, if Herz files for bankruptcy, creditors have priority over equity holders’ claims, so it’s tricky.

At the end of trading on Friday, Hertz’s share price was $2.54. Less than three months earlier, on Feb. 21, it had spiked to $20.25 per share.

Hertz is scarcely alone in its financial dilemma. Avis Budget Group (NASDAQ: CAR) posted revenue of $1.8 billion in its first quarter, down 9% from the same quarter a year ago.

The parent company of Avis Car Rental posted a net loss of $158 million in the first quarter of 2020, compared with a net loss of $91 million posted in the same quarter a year ago.

“We took early actions to accelerate the number of cars sold in March and were able to “dispose of 35,000 cars,” said Joe Ferraro, interim chief executive officer of Avis, on the first-quarter earnings call on May 5.

The car rental company said it expects revenue in April and May to drop 80% as a fallout of the coronavirus (COVID-19) pandemic, but expects business to recover gradually in June “as travel restrictions are lifted and leisure demand begins to recover,” Ferraro said.

Will it be enough?

One analyst said he struggles to see a scenario in which Hertz’s finances improve adequately over the next few days to satisfy bondholders.

“They’ve been an underperformer for at least the last five years, and honestly for more than a decade,” said Daniel Pickett, chief data scientist at FreightWaves. “Hertz wasn’t strong before this as they carried a lot of debt, but I think COVID-19 accelerated some problems that they might have been able to wiggle their way out of before the pandemic. However, it’s unlikely they will be able to do that now.”

Pickett previously traded bonds for the auto sector, including rental car companies, as a senior fixed income researcher and trader at Unum Group, a Fortune 500 company.

In 2016, Hertz spun off its construction equipment rental business, and while the company raised $2 billion and paid down some debt, it bought back $400 million in shares at that time, Pickett noted.

“When times were good, instead of paying down debt and beefing up savings, Hertz went out and bought back their own stock, so they basically paid themselves bonuses, which is why they are in this pickle,” he said.

Deutsche Bank AG and Barclays PLC, the two major banks holding Hertz’s debt, have six days to decide whether Hertz is worth saving by allowing the company to sell off some of its fleet on the used car market or file for bankruptcy.

Even Hertz executives are unsure if the already-undertaken $2.5 billion worth of cost-cutting measures in the form of canceled fleet orders and eliminated jobs will keep Hertz afloat.

“[T]here can be no assurance that we will be successful in arranging additional sources of financing or that there will be a significant recovery in the economic conditions in our major markets in the current environment,” Jamere Jackson, chief financial officer of Hertz, stated on the earnings call. “And while there is significant uncertainty in the demand forecast, know that we have taken aggressive actions and are reviewing several options to preserve the company’s liquidity during this unprecedented period.”

The perfect storm

Hertz’s primary short-term problem is high debt relative to earnings, Pickett said.

As states enforced shelter-in-place orders and employees worked remotely instead of commuting to work each day, personal vehicle travel dropped nearly 50% in April, according to Inrix, a traffic data provider.

Fewer cars on the road means fewer collisions, Pickett said, and up to 50% of the rental car company’s business relies on providing cars to customers whose vehicles are in the shop.

“Everything just went wrong for them all at once,” he said. “COVID-19 not only impacted their collision replacement business, but it also impacted their travel business. The pandemic destroyed their earnings because nobody is crashing their cars and nobody is flying.”

Those two sources of rental car demand make up at least 75% of Hertz’s revenue, Pickett said.

“So without earnings, they can’t pay their debt service, because their safety cushion, cash and ability to borrow is so small,” he said. “Fewer crashes mean fewer insurance-funded rentals.”

Longer-term, Hertz also has to come to grips with competition from ride-sharing companies like Uber and Lyft as well as from car-sharing companies, which have chipped away at Hertz’s market share. Advances in technology could make things even dicier.

“If we ever get truly autonomous cars, then the airport business will really lose share to Uber and Lyft,” Pickett said, adding that collision-avoidance systems being installed in new cars could further hurt the rental car industry.

“There may still be a place for rental cars in the future, but it’s clearly half, or less, the size of the 2019 market,” he said.

Impact on used car market

If Hertz files for bankruptcy protection or is allowed to sell off some of its fleet, it could potentially flood the used car market with several hundred thousand cars, triggering a price collapse.

April used car sales fell more than 34% from 2019, according to Manheim.

Most dealerships and in-person car auctions are still closed, and few buyers are purchasing used vehicles at the select online auctions that remain open, according to Dale Pollak, executive director of Cox Automotive.

As a result of the coronavirus pandemic, retail sales and service volume screeched to a near standstill, Pollak said.

In a letter to dealers, Pollak said showroom traffic dropped more than 80% in April, the number of scheduled service appointments declined more than 50%, and the show rate on service appointments plummeted nearly 90% compared with the same month a year ago.

“In short, cars are coming in, but they aren’t selling,” the letter stated. “Today’s huge supply of wholesale inventory suggests supplies will be even larger in the months ahead.”

Compounding the issue, roughly 36 million people have filed for unemployment in the eight weeks since the pandemic began, according to the latest U.S. Department of Labor statistics, forcing millions of companies to shutter operations and slash their workforces.

That has depressed demand for new and used vehicles as millions of Americans struggle to put food on the table and make rent or mortgage payments.

A former Cox Automotive executive says Hertz failed to adjust to the changing business landscape as ride-hailing services gained market share the past several years.

“With the advent of Uber and Lyft and the decreased demand for rentals, Hertz kept fighting the inevitable and thought they could hold on,” said John Blobner, former vice president and general manager of Manheim’s Ready Logistics and Central Dispatch divisions, Cox subsidiaries.

“But with COVID’s impact on the travel industry, it’s almost time for Hertz to let go, push forward and come up with a new business model,” Blobner told FreightWaves.

Cox, which also owns Autotrader and Kelley Blue Book, partners with more than 40,000 auto dealers. Cox has not been immune from the devastating effects of the pandemic either, laying off more than 12,000 employees in the past two months.

If Hertz files for bankruptcy or unloads a significant number of vehicles, wholesale auctions will see an increased number of vehicles coming through their lanes so their volumes will increase, Blobner said.

“However, if they are unable to sell those vehicles, it will result in a significant reduction in the values those used cars are bringing, which will have a negative impact on the auctions,” he said.

Potential impact on new car sales

In addition to Hertz’s cancellation of 90% of its remaining model year 2020 fleet orders, Avis Budget Group announced it has canceled 80% of its incoming rental vehicle orders in the U.S.

Approximately 20% of new car sales are derived from fleet deals with rental car companies, so these cancellations are going to have a significant impact on automakers, which have shuttered production for nearly two months because of COVID-19, according to Jeff Schuster, president of LMC Automotive’s Americas operations and global vehicle forecasts.

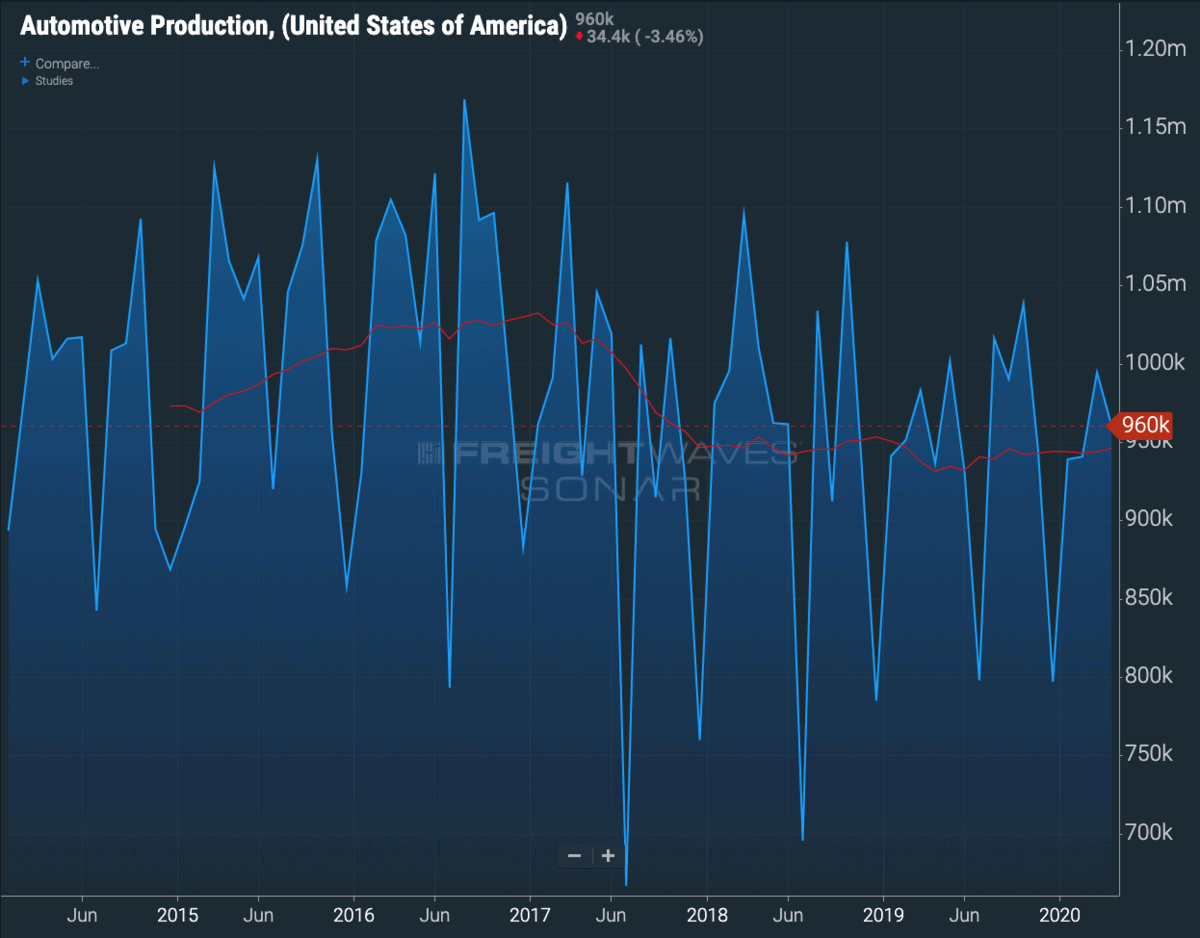

The research firm has lowered its 2020 forecast by about 3.5 million vehicles to 13.4 million this year, down from about 17 million in 2019, Schuster said.

“We all had been looking to see when the next downturn would be and now we know — it’s here,” Schuster told FreightWaves. “It’s going to be a long road back and could take a few years to rebound, possibly until 2023, to get to sales near 17 million again.”

Hertz’s potential bankruptcy, which could mean hundreds of thousands of additional used cars on the market, and its decision to cancel orders on most of its remaining model-year vehicles could impact the new car market in several ways, he said.

“It could lead to lower overall total new car sales because Hertz is not buying vehicles, and if there are more used car vehicles out there, it could create more competition for every purchase out there for consumers who are shopping both markets,” Schuster said. “The impact could be pretty substantial for the new vehicle market.”

As automotive plants plan to reopen next week, he said some automakers are offering incentives to entice new car buyers.

“I know some are doing zero-interest loans out to 84 months, which is seven years without an interest rate, to draw consumers to the new car market,” Schuster said.

Cash for Clunkers 2.0?

Some in the auto industry are calling for another government-funded program like Cash for Clunkers, launched back in 2009, that spurred consumers to buy new instead of used vehicles.

The program allowed consumers to turn in their old cars for up to $4,500 in cash to be used toward the purchase of more fuel-efficient vehicles.

“I have heard a Cash for Clunkers or some kind of government-based incentive program to get people to buy new vehicles is being kicked around, but we don’t have any details on it yet,” Schuster said. “However, I would suspect we will see some type of incentive program before the election.”

If the government rolls out a Cash for Clunkers-type program, Blobner said it will make later-model used cars more valuable because there will be fewer in the marketplace.

“Back in 2009, it was the government’s way of reducing the supply of vehicles in order to drive up the prices of new vehicles,” he said. “I think it could work again.”

Truckguy

“Back in 2009, it was the government’s way of reducing the supply of vehicles in order to drive up the prices of new vehicles,” he said…

Driving up the price of new vehicles wasn’t the goal of C4C. The goal was to stimulate sales of new cars to help keep that industry afloat. A secondary goal was to improve the average fuel economy of the national fleet.

CarlJ\ J.

Was the author of this article compensated by the number of words written because what was said could of been done in about half as many. Blah, blah, blah…….

MrBigR504

Yeah it was pretty lengthy!

Stephen Webster

Many car rental companies are in trouble both in Canada and the U S some sort of modest bailout should be planned with a 40 government interest share being brought by the government in Canada in 2 or 3 car and truck rental companies in return for 10 years interest free loans and( 10,000)days of prepaid minivans, car rentals per year for 3 years plus 6000 days of light trucks and full size vans and cube vans , The Government also needs to buy each of these fleets 200 plus full size straight trucks and disaster trucks and the rental companies have them for government and certain key customers hydro, oil gas moving government employees. The government of Canada will work with these 3 rental companies to help pay for and assistance in a fleet purchase of both conventional and electric vehicles. The government would also have the first right of refusal on the purchasing of the used cars vans and minivans. All heavy trucks will be sold with the money going back to the government with all smaller cities under (150,000) and rural areas getting first chance. The Federal Government needs to buy 10,000 wheelchair vans and busses and self insure them and put a electronic chip in each one . These will rented out with the cost being the paid 50 percent by the taxpayers and n the event it being used for medical assistance or one 5 days per year for non medical assistance for disability transport.

Art

I dont want my tax dollars bailing out rental cos.

Business investing is a risk. Sometimes investors lose.

Sometimes suppliers lose when buyers dont pay.

We cant keep bailing out every co especially those that did have rainy day savings.

Corporate capitalism during prosperous times, but socialism during slow periods.

No! Enough wasting taxpayers money.

Who will be paying off the trillions of $s for mismanagemenr?

The middle class will be taxed like crazy while poor and rich avoid taxes.

MrBigR504

Oh we’re already on the hook for the bill from#45! So may as well restructure Hertz and keep it moving! Uhhhh…but fire their accountants? Lmao