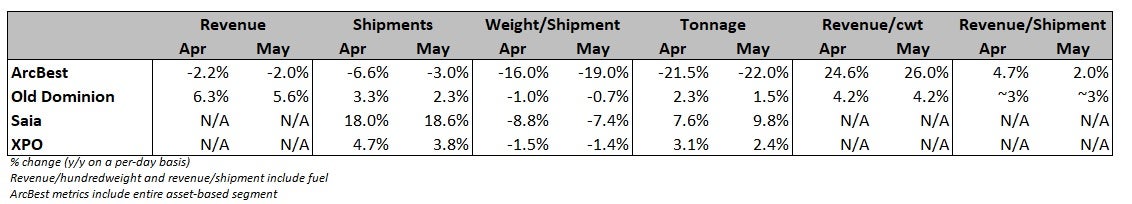

ArcBest continues to trade volume for higher yields. The company’s May update showed tonnage was off 22% year over year (y/y) for a second consecutive month while yield increased 26% y/y in the month (after it was up 24.6% y/y in April).

Lower shipment weights, down 16% y/y in April and 19% y/y in May, are positively impacting the yield metrics (revenue per hundredweight). Higher yields were also driven by price increases on transactional shipments and a favorable mix shift toward contractual business. The company recorded price increases just north of 5% y/y on contract renewals during both the first and fourth quarters.

Early on in the downturn, ArcBest (NASDAQ: ARCB) made the decision to more heavily lean on a dynamic pricing strategy, which adjusts lane pricing to available capacity on a daily basis. Prices are lowered on lanes where excess network capacity exists and raised in markets that are capacity-constrained. This typically creates an influx of transactional shipments, which can keep the network full but can produce inferior yields and margins when compared to loads from core contractual customers.

The company deployed the model to defray fixed costs and avoid mass furloughs of workers, who can be expensive to reemploy. It began reversing the strategy when Yellow Corp (OTC: YELLQ) shut down last summer and freight from some of its existing contractual customers came back to the market. Management previously said the large y/y swings in the metrics should begin to moderate during the third quarter.

The May update for its asset-based segment, which includes less-than-truckload operations, was provided on Friday in a filing with the Securities and Exchange Commission.

It showed shipments from core accounts were up 14% y/y in May with tonnage from the group up 11% y/y. That was a modest acceleration from April, when core shipments increased 13% y/y and tonnage was 9% higher y/y.

All-in, revenue in the asset-based unit was down 2% y/y in May, compared to a 2.2% y/y decline in April and a 3.8% y/y decline in the first quarter. On a two-year stacked comparison, ArcBest’s total tonnage was off 20% for the two-month period and down by a midteens percentage on a three-year comp.

The filing reiterated that the unit normally sees 200 to 300 basis points of operating ratio improvement from the first to the second quarter. However, on the first-quarter call on April 30, management didn’t provide definitive guidance for the sequential change this year.

The company should see a favorable tailwind in operating leverage in the second half as rate increases outpace wage increases. The company will lap the first year of a five-year labor deal with the Teamsters union on July 1. More than half of that agreement’s total labor expense increase was implemented in year one.

ArcBest’s asset-light unit, which includes truck brokerage, reported just a 5% y/y decline in revenue during May, following a 12.4% y/y drop in April. Asset-light revenue was off 10% y/y in the first quarter. The unit was booking midteen to mid-20% declines last year (even though it was operating a larger platform with the late-2021 addition of MoLo) as the truckload market fell deeper into recession.

Asset-light shipments per day increased 11% y/y in May, following an 8.5% y/y increase in April. However, revenue per shipment was down 14% y/y in May after a 19.2% y/y decline in April. Purchased transportation expenses increased to 86% of revenue in May (compared to 84.8% in April), which the company attributed to “tighter capacity associated with the Department of Transportation’s inspection week.”