Continued belt tightening wasn’t enough to offset a “challenging freight environment” during the third quarter, ArcBest said in a Friday news release.

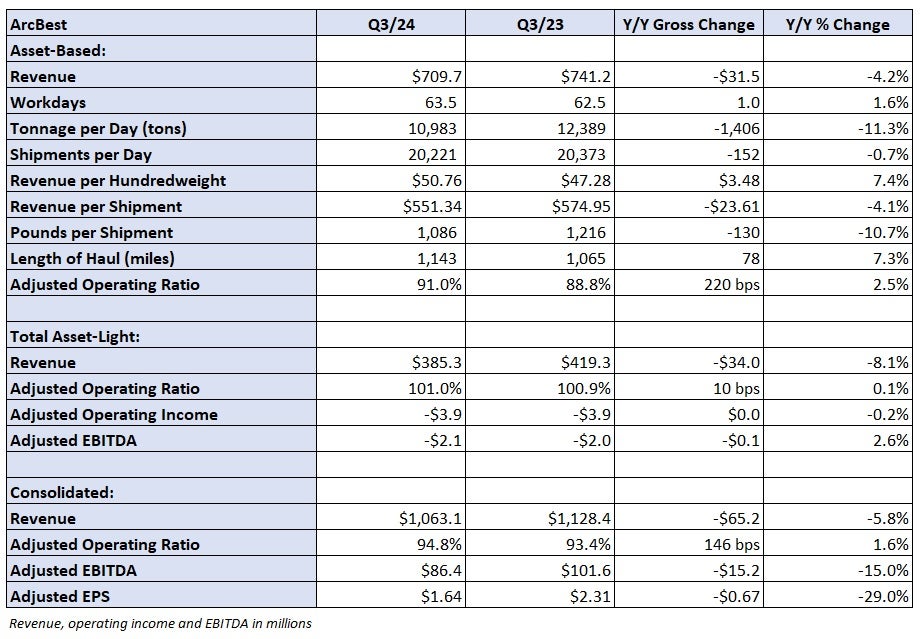

ArcBest (NASDAQ: ARCB) reported third-quarter adjusted earnings per share of $1.64, 21 cents below the consensus estimate and 67 cents lower year over year. Consolidated revenue of $1.06 billion was 5.8% lower y/y.

ArcBest’s asset-based segment, which includes results from its less-than-truckload subsidiary ABF Freight, reported revenue of $709.7 million, a 4.2% y/y decline (down 5.8% on a per-day basis). The result was driven by an 11.3% decline in tonnage per day, which was only partially offset by a 7.4% increase in revenue per hundredweight, or yield.

Click for full article: “LTL, brokerage woes weigh on ArcBest’s Q3”

The tonnage result was the combination of a slight decline in shipments and a 10.7% drop in weight per shipment. Lower shipment weights significantly boosted the yield result.

A separate filing with the Securities and Exchange Commission on Friday showed asset-based revenue per day was down 12% y/y in October as tonnage per day declined 9% and yield was off 3%. The month had a tough comparison to October 2023, which benefited from a cyberattack at competitor Estes.

ArcBest expects asset-based revenue per day to be down y/y by a mid-single-digit percentage in the fourth quarter.

The unit recorded a 91% adjusted operating ratio (inverse of operating margin), 220 basis points worse y/y and 120 bps worse than the second quarter. The segment normally sees no change to 100 bps of OR improvement from the second to the third quarter. “Lower tonnage combined with higher labor and insurance costs,” were the culprits, the news release said.

Click for full article: “LTL, brokerage woes weigh on ArcBest’s Q3”

The asset-light unit, which includes truck brokerage operations, reported a fifth consecutive operating loss. A $3.9 million adjusted operating loss was in line with the year-ago result but $1.4 million worse than the second quarter.

The unit is expected to record a $5 million to $7 million operating loss in the fourth quarter.

The adjusted EPS result excluded items expected to be nonrecurring like costs associated with technology pilots and acquisition-related expenses. It also excluded a $69.1 million after-tax reduction in the MoLo acquisition earnout provision. The MoLo truck brokerage unit didn’t meet financial targets last year and isn’t expected to meet them this year.

Shares of ARCB were off 5% in pre-market trading on Friday.

ArcBest will host a conference call at 9:30 a.m. EDT on Friday to discuss third-quarter results.