Shares of logistics provider ArcBest Corp (NASDAQ: ARCB) are surging on a much better than expected first quarter 2020 earnings report.

In the period, the company reported adjusted earnings per share of $0.36, well ahead of the consensus estimate of an $0.11 per share loss. The result excluded $0.14 per share in costs associated with its freight handling pilot test program and included a similar amount from adjustments in its life insurance program.

The company mostly escaped the freight falloff which began for most carriers in the middle of March. However, demand in April has fallen materially.

April Down 20%

ArcBest reported a 20% year-over-year consolidated revenue decline for the month of April. On its earnings call with analysts and investors, management said that they didn’t really see much of a difference in volume declines from one week to the next throughout the month. They indicated that similar declines have continued into May.

The 20% decline is in line with the revenue dip seen by less-than-truckload (LTL) competitor Old Dominion Freight Line (NASDAQ: ODFL). On its first quarter call, the carrier said that revenue per day was down close to 20% with shipments trending a little worse in April.

While ArcBest’s books aren’t officially closed for April, asset-based daily billed revenue was down 21% year-over-year as tonnage declined 14% and shipments were off 16%. Revenue per hundredweight, or yield, was down 7.5%, but contractual renewals have been up by a percentage similar to the first quarter’s 4.3% year-over-year increase. Lower fuel surcharge revenue, a change in freight mix and lower rates on spot truckload shipments have resulted in the yield declines.

Management said that they have brought in more transactional LTL business to fill empty trucks, but the yields aren’t as strong as those seen in their contractual business. They did say that these loads are incrementally profitable.

Chairman, President and CEO of ArcBest Judy McReynolds said that the pricing environment is “rationale.” She said that while there has been a delay in some contractual price negotiations, it’s “nothing dramatic.”

The asset-based division’s operating ratio, inverse of operating margin representing operating expenses as a percentage of revenue or OR, normally improves sequentially from first quarter to second. However, given the sharp decline in revenue, the company doesn’t expect OR to follow historic trends this year.

McReynolds said that she expects most automotive manufacturers to come back online in mid-May, but they haven’t heard much discussion from the rest of their manufacturing customer base regarding the resumption of operations.

Asset-light revenue was down 17% in April, but profitability has improved given the cost reduction initiatives as well as an increase in expedited opportunities in the division, which carry favorable margins. Unlike the first quarter, an 18% decline in purchased transportation expense outpaced the decline in revenue, providing a modest bump in margin as the cost of capacity declined faster than reductions in loads and revenue per load.

Revenue at the company’s commercial vehicle maintenance and repair unit, FleetNet, was down approximately 10% in April.

In response to COVID-19-related volume declines, ArcBest implemented cost savings initiatives in early April. The company believes workforce reductions, a 15% cut to non-union employee salaries, a decrease in board compensation and suspending the 401k match will provide roughly $15 million to $20 million in year-over-year cost reduction. Additionally, the company has reduced headcount of road drivers by 12% and dock and city workers by 14%.

Management expects consolidated earnings before interest, taxes, depreciation and amortization (EBITDA) to remain positive for the month of April.

First Quarter 2020

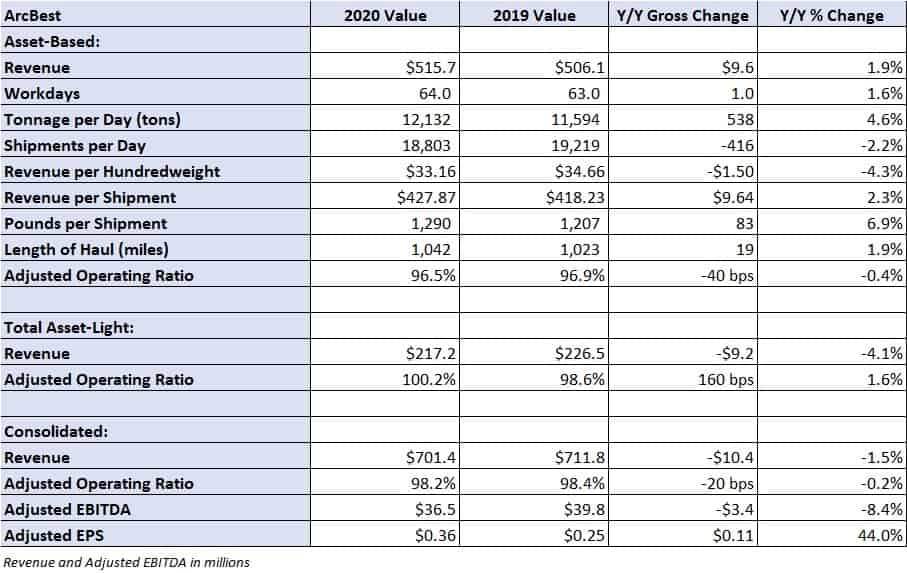

The company’s asset-based division, which includes LTL operations, reported a 1.9% year-over-year increase in revenue to $516 million as tonnage per day increased 4.6%, mostly offset by a 4.3% decline in yield. Daily tonnage was up 5.7% in January, 7.5% in February, but only 1% in March. Excluding fuel surcharges, LTL yield increased in the low single digit percentage range compared to the first quarter of 2019. Modestly better revenue and cost efficiencies resulted in a 40-basis point improvement in OR at 96.5%.

The asset-light division reported a 4.1% year-over-year revenue decline to $217 million and an operating loss of $369,000. The ArcBest segment of the asset-light division saw a 9.8% year-over-year decline in shipments per day and a 3.3% decline in revenue per shipment. Declines in demand for expedited delivery options and truckload brokerage due to excess truck capacity available in the market for the bulk of the quarter were cited as the reasons. Also, the decline in revenue outpaced the decline in purchased transportation costs leading to margin degradation, a trend that reversed during April.

Liquidity and Balance Sheet

ArcBest reported $559 million in liquidity on the call. The company previously drew down the remaining $180 million available on its revolving credit facility and borrowed $45 million under its accounts receivable securitization program to increase its resources. ArcBest ended April with $12 million more in cash and short-term investments than it had in debt.

ArcBest lowered its net capital expenditures (net capex) guidance by 30% to a range of $95 million to $105 million to further preserve capital. The company plans to spend $18 million less on equipment purchases than originally anticipated.

Shares of ARCB are up more than 15% in midday trading.