Continued pressure on ArcBest’s truckload brokerage operations diluted the improvement seen at its less-than-truckload unit during the second quarter, leading to an earnings miss versus analysts’ expectations.

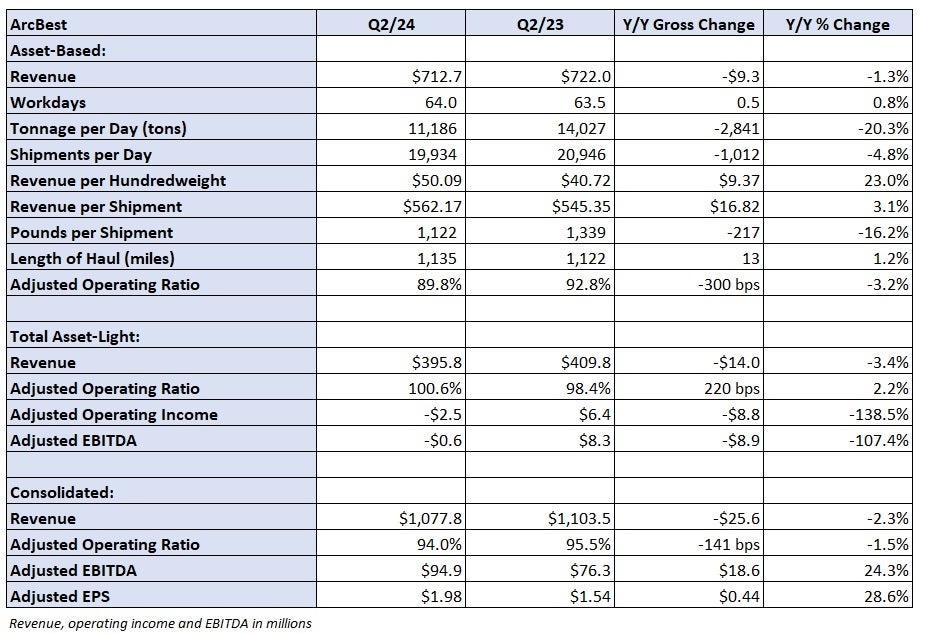

ArcBest (NASDAQ: ARCB) reported adjusted earnings per share of $1.98 for the second quarter. The result was 8 cents below the consensus estimate but 44 cents higher year over year. The adjusted result excluded items considered nonrecurring like costs from technology pilots and acquisition-related expenses.

The company’s asset-based segment, which includes less-than-truckload operations (ABF Freight), reported revenue of $713 million, a 2% y/y decline on a per-day comparison. Daily tonnage fell 20% y/y but revenue per hundredweight, or yield, increased 23%. The drop in tonnage was the result of a 5% decline in daily shipments coupled with a 16% decline in weight per shipment. The lower shipment weight positively impacted the yield calculation.

The company ended heavy usage of a dynamic pricing model a year ago as Yellow Corp. (OTC: YELLQ) was teetering ahead of its ultimate closure. The strategy included repricing underutilized lanes at lower rates to keep the network full of freight. ABF has since been purging that lower-yielding transactional freight for shipments from higher-margin core accounts. The change has resulted in pronounced tonnage declines, which have mostly been offset by large yield increases.

The y/y tonnage declines have slowed from a high of 22% in May to 13% in July. Shipments from core accounts were up 14% y/y in the second quarter and tonnage was 11% higher. Tonnage is expected to decline again in the third quarter due to tough y/y comparisons. ABF lost some of the freight it initially picked up from Yellow to lower-cost providers, management from the company said Friday on its second-quarter call. The year-ago period also included a higher amount of project freight that will not recur this year.

Revenue per day in the segment was 1% higher y/y in July as tonnage fell 13% and yield improved 16%.

Contractual price renewals averaged 5.1% in the second quarter, which was in line with previous increases of 5.3% in the first quarter and 5.6% in the fourth quarter. The company expects to capture similar rate increases in the back half of the year.

The unit posted an 89.8% adjusted operating ratio, which was 300 basis points better y/y.

Salaries, wages and benefits expenses (as a percentage of revenue) increased 180 bps y/y. A front-loaded labor contract with its union employees was a headwind in the period. However, the wage increase for the second year of the contract (effective July 1) was less severe. The wage bump and the annual increase in benefits expenses (effective Thursday) represent a total increase of 2.7%.

Rents and purchased transportation expenses were down 420 bps as a percentage of revenue.

The LTL unit normally sees flat to 100 bps of OR improvement from the second to the third quarter. Given the wage increase as well as soft freight demand, the company is expecting no change this year.

It normally sees up to 400 bps of OR deterioration from the third to the fourth quarter but the change is likely to be less severe this year due to favorable revenue opportunities in the pipeline and recent efficiency gains from productivity initiatives.

ArcBest acquired four terminals from Yellow’s estate, two of which it opened last month. The other two are expected to come on line this quarter. The company currently has 15% to 20% excess capacity (terminals, equipment and staff), which it said has prepared it for an eventual improvement in demand.

The asset-light unit, which includes truck brokerage, reported a fourth consecutive operating loss in the quarter. A $2.5 million adjusted operating loss compared to operating income of $6.4 million in the 2023 second quarter.

Revenue was down 3% y/y to $396 million (4% lower on a per-day comparison) as shipments per day increased 13% and revenue per shipment declined 15%. A mix shift favoring managed transportation revenue and a soft truckload market weighed on yields. The y/y declines in revenue per shipment narrowed as the quarter progressed. Revenue per shipment was down 10% y/y in July.

The topline trends appear to have moderated as revenue per day was down 1% from the first quarter (shipments per day declined 1.4% and revenue per shipment was flat sequentially). The unit is also seeing some improvement in operations as shipments per employee increased, leading to a decline in cost per shipment.

However, the company expects to book a similar operating loss in the asset-light segment during the third quarter. Higher purchased transportation costs due to higher carrier rates are compressing margins. Purchased transportation expenses as a percentage of revenue increased to 87% in July compared to 85.7% in the second quarter.

The company reiterated net capital expenditures of $325 million to $375 million for 2024. The capex budget includes $155 million in equipment purchases and $130 million for real estate projects. ArcBest will also invest in technology and upgrade dock equipment.

Shares of ARCB were down 11.1% at 11:28 a.m. EDT on Friday compared to the S&P 500, which was off 2.5%.