Trans-Pacific spot container shipping rates have crossed two bearish thresholds. It depends on which indexes you believe, but according to Drewry’s, spot freight rates are now below where they were at this time last year, and according to Xeneta’s, spot rates are now below current contract rates.

Spot shipping rates now versus last year

Drewry’s weekly spot rate assessment, released Thursday, put Shanghai-Los Angeles rates at $7,952 per forty-foot equivalent unit, down 7% year on year (y/y). Drewry put the Shanghai-New York rate at $10,403 per FEU, also down 7% y/y.

That’s a big change from the week before, when Drewry’s Shanghai-Los Angeles assessment was still up 32% y/y and Shanghai-New York spot rates were up 33%.

The huge week-on-week flip was not due to a collapse in rates in the past week. Drewry’s trans-Pacific assessments pulled back the most this year between mid-March and mid-April. Declines have been more gradual since.

Rather, the main driver of the y/y decline was a spike in spot shipping rates during this week last year, when Drewry’s Shanghai-Los Angeles and Shanghai-New York spot assessments surged 34% and 39% week on week, respectively.

The current week also marks the first time that Drewry’s Global Composite Index has gone into the red since container shipping began its run. It’s now down 10% y/y.

Nevertheless, trans-Pacific spot rates remain far above pre-COVID levels. Drewry’s Shanghai-Los Angeles assessment is still 5.7 times the rate in the same week in 2019. The Shanghai-New York rate is still 4.3 times higher.

Spot shipping rates versus contract rates

Xeneta tracks data on both contract rates and spot rates. China-U.S. West Coast spot rates have been below contract rates since June 4, according to Peter Sand, Xeneta’s chief analyst.

As of Tuesday, Xeneta assessed average short-term rates on the China-West Coast route at $7,768 per FEU, 3% below average long-term rates of $7,981 per FEU.

Different indexes continue to post different price assessments (leading to some skepticism toward indexes). Unlike Drewry, Xeneta does not see a y/y drop in the spot rates yet. It still shows a y/y increase of 46.5%. But its data shows a 160% y/y increase in long-term rates, leading to a flip in the relationship between the two.

According to Sand, “What we’ve seen over the last year is strong growth for both sets of rates, but really spectacular gains for contracted agreements.

“That has led the gap between the two to diminish and, with supply chains bursting at the seams and shippers looking to manage risk as much as possible, the demand for spot deals has fallen slightly on this trade, bringing prices down.”

According to Xeneta, China-West Coast spot rates exceeded contract rates by a peak of $4,000 per FEU in September “before long-term rates hit overdrive and reeled in the difference. Long-term rates have stayed more or less stable since April, while spot rates have slowly fallen from their peak in March.”

Downside risks for ocean carriers

Ocean carriers have widely predicted a y/y decline in spot rates in the second half. Even so, liner operators Maersk, Hapag-Lloyd and Zim (NYSE: ZIM) all expect 2022 results to be better than in record-setting 2021.

The reason: Both spot and contract rates were up y/y in the first half and y/y declines in spot rates in the second half should be offset by much higher contract rates.

However, there are at least four looming risks to container shipping bottom lines. If business conditions are much worse than expected, 2022 might only be the second best year in the industry’s history.

The first risk: Spot rates, while pulling back, have stayed at relatively high levels and not collapsed. But as Vincent Clerc, CEO of Maersk’s ocean division, said on a conference call last year, “Given the extreme levels [in] the short-term rates, the correction toward a more normal level could be quite rapid.”

Second, carrier costs are rising. On Wednesday, the world’s largest carrier, MSC, said a general rate increase for its India-U.S. service was needed on July 15 because “freight rates are at levels that are no longer sufficient given current costs.”

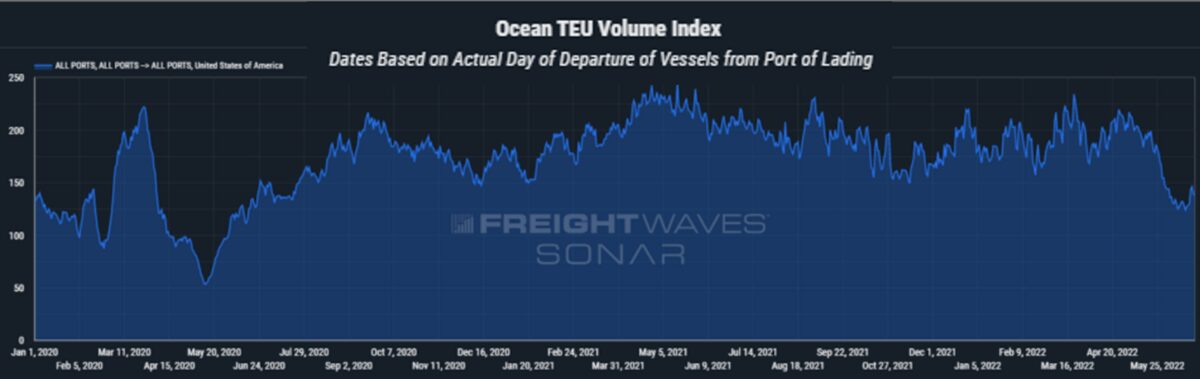

Third, cargo volumes might fall more sharply than expected. It’s too soon to know how holiday bookings and port congestion will play out, but FreightWaves SONAR’s index of bookings shows a steep decline for U.S.-destined cargo scheduled to depart in May and early June.

And fourth, contracts used by carriers to protect against spot and volume downside may not provide full protection.

Lars Jensen, CEO of Vespucci Maritime, warned in an online post on Thursday: “Unless the market tightens quickly in the next week or two, we will begin to see shippers pushing back on contracts in terms of renegotiations and/or shifting volumes to the spot market and not delivering the full contracted volumes to the carriers.”

Click for more articles by Greg Miller

Related articles:

- A potential economic recession and the supply chain bullwhip are colliding

- Retail slump? E-commerce sales still ‘stunning,’ clothing ‘crazy hot’

- Los Angeles port: Peak season coming soon, strong imports ahead

- Boom times not over yet: US container ports still near highs

- Container shipping jackpot continues: CMA CGM profits soar

- Blockbuster container shipping results collide with sinking sentiment

Tal Kohn

Xeneta doesn’t include the premium fees that shippers paid last year to move their containers. That’s why they’re showing an increase in rates YoY. In reality, the rates are down, like Drewry and Freightos show