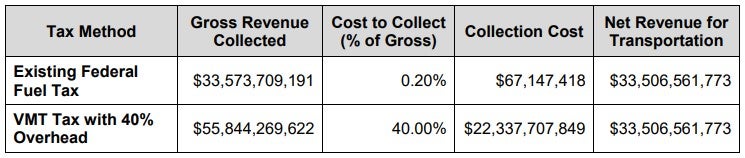

New research released Wednesday from the American Transportation Research Institute (ATRI) found that replacing the federal fuel tax with a vehicle-miles-traveled (VMT) tax could result in collection costs of more than $20 billion annually.

The main reason for that price tag – which is 300 times higher than the current cost to collect fuel taxes – is a “shift in collection points” from a limited number of fuel terminal operators to 272 million registered motor vehicles in the U.S.

The report comes as Congress begins to negotiate the next infrastructure bill and figure out how to keep the federal highway trust fund (HTF), which pays for the country’s roads and bridges, from going bankrupt. The Congressional Budget Office estimates the HTF will be exhausted by 2022.

“With policymakers preparing to lay out a vision for the future of America’s infrastructure, ATRI’s analysis could not come at a more critical time,” said American Trucking Associations (ATA) President and CEO Chris Spear. “Most experts agree that some sort of VMT system is a part of that future, and ATRI’s report makes clear that implementing it will take thoughtful leadership, cooperation from stakeholders and a strong plan to transition away from current funding streams.”

While a VMT tax system would likely be applied to all vehicles, ATRI noted that it conducted its research in response to a proposal last year supported by several U.S. senators for VMT applied exclusively to trucks. It called for electronic logging devices to track truckers’ movements and report them back to the Internal Revenue Service. The proposal is strongly opposed by ATA but is getting a fresh look from the Senate Finance Committee, according to Politico.

ATRI’s study found that to establish and run a VMT, hardware costs would initially cost $13.6 billion and require ongoing replacement. It found telecommunications costs would be approximately $13 billion annually, with account administration an additional $4.3 billion per year. In addition, credit card transactions for electronic payment and the cost to ship the hardware could each cost more than $1 billion, ATRI found.

“Beyond these technical and programmatic findings of a VMT tax program, numerous tangential issues remain, particularly public acceptance,” the report noted.

“For example, taxpayers today do not ‘see’ the state and federal fuel taxes that are embedded in fuel prices, and they most definitely do not directly pay fuel taxes. This reality will change dramatically with a VMT tax program, particularly when the VMT fees are increased to meet infrastructure investment needs. Regardless of politics and income, it is rare for taxpayers to request considerably higher taxes (or fees).”

Consequently, according to ATRI, a VMT tax public education plan is needed to convince people that the system will be:

- Fair. Compliance must be ubiquitous; cheating must be prosecuted.

- Unintrusive. Privacy must be ensured and the data must not be used for any secondary purposes. The goal of the system is to pay for roadways, not track individuals, or overtly control human behavior.

- Cost-efficient. Administrative costs must be relatively minimal, on par with existing fuel tax efficiencies as that is the primary promise of technology utilization. Anything more will be viewed as inflationary and wasteful.

Related articles: