The benchmark price for most diesel surcharges fell the most in a week since the early days of the 2009 financial crisis, with physical markets suggesting there are further declines to come.

Not since October 2009 has the Department of Energy/Energy Information Administration weekly diesel price fallen as much as the 17.4 cents it dropped Monday. The price came in at $4.967 a gallon, the first time it has been below $5 since Oct. 3.

This week’s decline is only 1 cent more than the 16.4-cent drop recorded July 25. The DOE/EIA had not dropped more than 17.4 cents since a decline of 19.4 cents Oct. 27, 2009, which wrapped up a four-week decline of more than 67 cents as the full impact of the collapse of Lehman Brothers and other financial market turmoil was kicking into high gear.

The latest price decline came on an eventful day for oil and diesel markets. Those markets also suggest that retail diesel prices still have a long way to fall to catch up with broader market conditions.

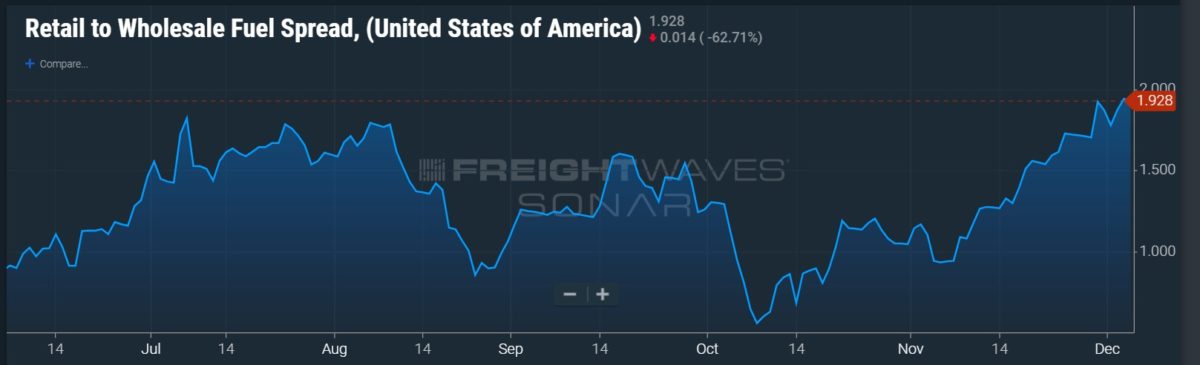

The FUELS.USA data series in SONAR, which reflects the spread between retail and wholesale prices, has pushed past $1.90 a gallon in recent days. That is easily the highest number in the more than four and a half years that SONAR has tracked the spread, which before the enormous volatility of this year tended to move toward a range of $1 to $1.10, though with significant swings above and below that range.

If wholesale prices were to be locked into place at the current level, retail diesel would be expected to fall at least 50 cents and likely more just to get back to some level of normalcy.

That retail/wholesale spread has been affected not only by recent declines in the ultra low sulfur diesel (ULSD) price on the CME commodity exchange, but also by weakness in the physical markets that trade as a differential against the ULSD futures price.

For example, the daily basis differential for ULSD in New York Harbor published by DTN Energy stood at $1 on Nov. 15. That means that delivery of ULSD in New York Harbor in the subsequent few days after Nov. 15 traded at $1 more than the price of ULSD on the CME commodity exchange. On Nov. 15, ULSD on CME would have been reflecting product to be delivered during December.

That spread is normally a few cents. And on Monday, it was down to that level, being assessed by DTN at a spread of 1.5 cents. The differential has shed 98.5% of its value in just three weeks.

The benchmark U.S. Gulf Coast physical price never soared as East Coast prices did. On Nov. 15, it was negative 28.5 cents, according to DTN, meaning physical diesel in the U.S. Gulf Coast was that much less than the CME ULSD price. It has gotten stronger since then, to negative 23.5 cents. But that is still well below normal prices, which are also generally 10 cents or less under the CME price.

Those strong spreads on the East Coast and in other markets incentivized refiners to run their plants at high levels, and they have responded. In the more than 30 years of data on refinery operating rates published by the EIA, there have been only three times in the final weekly report of November when the nation’s refineries ran at an operating rate more than the 95.2% they recorded in the week ended Nov. 25, the latest report published by EIA.

That has led to a significant easing of inventories. The closely watched Days Cover figure for distillate inventories — which are generally 85% to 90% ULSD — came in at 29 days in that report for the week ended Nov. 25. That figure was less than 26 days just a few weeks earlier and the highest since the end of September. Days cover represents the number of days of current consumption that could be supplied solely by inventories.

The background of this movement in diesel prices Monday was the start of a price cap implemented by Western nations on purchases of Russian crude, combined with an EU ban on waterborne imports of Russian crude.

The $60/barrel cap for now would not have an impact on sales of Urals crude, the grade of oil it ships out to Western markets, because the price of Urals has been less than $60.

But a more immediate test will come with sales of ESPO, a crude exported out of Russia’s east coast, which before the large declines of Monday was selling for more than $70 a barrel.

The prospect of the Russian cap being implemented and the possibility it might end up restricting Russian crude exports was seen as a factor in early gains Monday in global oil markets.

But the later weakening of equity markets pulled oil down with it. The end result was that the DOE/EIA price was not the only one to break through a key number; the CME price for ULSD did too, falling below $3 a gallon for the first time since Feb. 25, settling at $2.9998 a gallon.

The volatility in Monday’s market could best be seen by the fact that while ULSD settled at less than $3 a gallon, it traded as high as nearly $3.24 earlier in the day.

More articles by John Kingston

Louisiana staged truck accident case back in court; 2 more plead guilty

Truck transportation jobs move little in November but trend still upward

BMO trucking indicators in Q4 weaker but only by small amount