The Boeing Co. (NYSE: BA) on Tuesday said it is recommending simulator training in addition to computer-based training for all pilots that will fly the 737 MAX, prior to its return to service. The move is likely to add further time and cost to the resumption of commercial flights and is a major change for the manufacturer, which previously questioned the need for such wholesale training unless airlines voluntarily requested it.

European regulators, in particular, were expected to require full flight-simulator training for pilots before approving a return to passenger service for the MAX after it was grounded last March in the wake of two crashes that killed 346 people. Safety reviews afterwards determined that less-experienced pilots didn’t know how to cope with the alerts from the plane’s automated flight control system.

Over the weekend, the Wall Street Journal reported that the Federal Aviation Administration is considering requiring extra flight simulator training before pilots start flying the plane again.

In recent pilot trials, which tested how crews react to various emergency scenarios involving the MCAS, pilots were able to right the aircraft, but many did so without following the prescribed procedures. Investigations indicated that pilots in the Lion Air and Ethiopian Airlines crashes were flummoxed when MCAS, responding to faulty signals of a possible stall during takeoff, pushed the nose of the plane down against their manual efforts to stay on course.

“Safety is Boeing’s top priority,” said interim Boeing CEO Greg Smith in a statement Jan. 7. “Public, customer and stakeholder confidence in the 737 MAX is critically important to us and with that focus Boeing has decided to recommend MAX simulator training combined with computer-based training for all pilots prior to returning the MAX safely to service.”

The final determination on simulator training rests with aviation authorities.

It’s the latest in a series of recent setbacks that could extend the aircraft’s no-fly ban beyond early spring, adding uncertainty and expense for Boeing and its customers.

Another potential delay could arise from news Sunday that the U.S. Federal Aviation Administration is reviewing a potentially serious design flaw in wiring that helps control the tail of the 737 MAX.

Boeing may also need to check whether the wiring problem exists in the 737 NG, the predecessor to the MAX. About 6,800 of the Next Generation 737s are in service.

The New York Times first reported the MAX wiring concern, which Boeing discovered after conducting an audit of key systems under orders from the FAA. The company is assessing whether two bundles of wire are too close together and could cause a short circuit that leads to a crash. At this point, the danger is considered hypothetical, and Boeing officials say any necessary correction is relatively simple.

Until recently, efforts to lift the grounding focused on modifying software for the automated flight-control system, known as the Maneuvering Characteristics Augmentation System (MCAS), implicated in the crash of two jets that killed 346 people. Boeing confirmed the wiring review to several news outlets.

Incoming CEO David Calhoun has his hands full trying to steer Boeing through the 737 MAX crisis, which continues to hurt the manufacturer’s bottom line and credibility with regulators, lawmakers, investors and the flying public. Boeing three weeks ago said it would temporarily shut down the MAX assembly line in Renton, Washington, in January after the FAA indicated it would take longer than expected to review Boeing’s safety fixes, pushing certification of the plane until sometime in the first quarter.

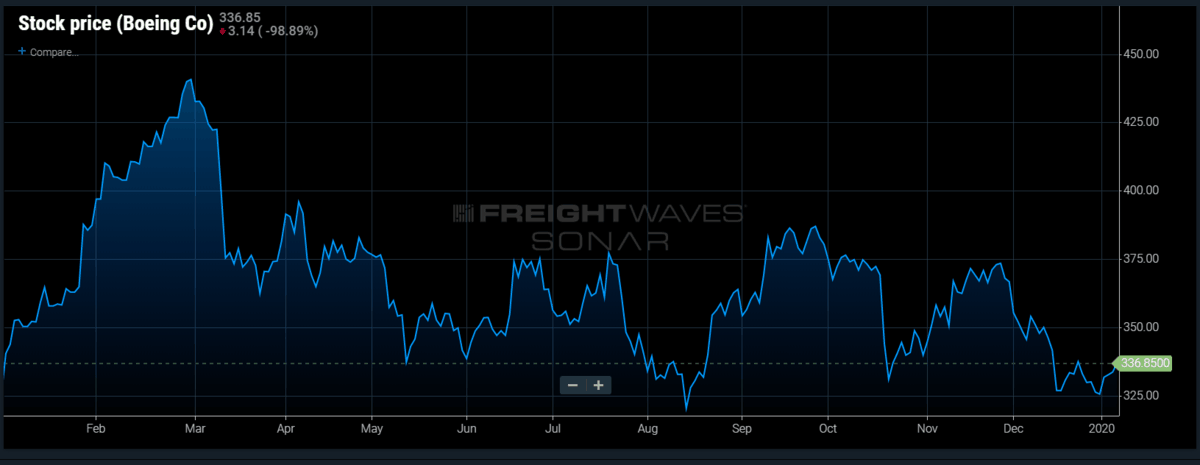

Now, it’s possible the timetable could extend further into the spring or summer, creating more economic hardship for suppliers, airlines and their employees, who were depending on Boeing’s fast-selling plane for revenue. The crisis has cost Boeing $9 billion so far, and its stock has dropped more than 20% since last spring. It faces billions of dollars in further charges for production expenses, stakeholder compensation, payouts to victims’ families and lost sales.

The New York Times also reported that the FAA is scrutinizing the Leap engines made by CFM International, a joint venture between General Electric (NYSE: GE) and Safran of France, for possible weakness in a rotor that could shatter. At this point, regulators are only looking at the possibility of stepped up inspections for any faults.

And Boeing notified the FAA of a manufacturing problem that removed lightning protection to the fuel tanks and fuel lines.

Last month, a Boeing whistleblower told Congress that workers were making sloppy mistakes because Boeing had sped up production rates too much without adding enough skilled labor, leading to fatigue, poor communication between shifts and process errors.

The Leap engines also pose another challenge for Boeing — a supply shortage, according to The Wall Street Journal. The newspaper said CFM recently decided to shift resources to build more engines for Boeing rival Airbus and its A320 neo, rather than maintain similar production levels. And even if CFM has enough capacity to meet all orders, the move indicates the company believes it will be a long time before Boeing works through delivering the 400 MAXes parked in a massive staging area and gets back to full production of 57 planes per month.

Reuters said U.S. and European aviation regulators are scheduled to review the software upgrade during the next couple of weeks, and The New York Times said a certification test flight could take place this month.

Airline compensation

On Monday, American Airlines (NASDAQ: AAL) disclosed it had reached a confidential agreement with Boeing on compensation for financial damage incurred last year due to the grounding of the airline’s 24 MAX jets. The Dallas-based airline has an additional 76 of the planes on order and has said it expects the cancellation of MAX flights will knock $540 million off its profits.

Last week, Turkish Airlines said it had reached a settlement with Boeing for an undisclosed amount.

The MAX is about 20% more fuel efficient than previous models, and airlines have incurred other expenses, such as leasing older aircraft to fill scheduled routes or refunding the cost of tickets to passengers who don’t want to fly on a MAX plane. Airlines that bought the Boeing planes to expand their routes are also losing revenue.

American said it will share more than $30 million of the settlement with employees through its 2019 profit-sharing program, even though the compensation will be received over several years in the form of reduced payments to Boeing. Pilots and flight attendants have lost wages because of the cancellations. American said in a statement that it will continue negotiations with Boeing regarding compensation for damages related to the MAX grounding beyond 2019.

A month ago, Southwest Airlines (NYSE: LUV) said it had agreed on compensation with Boeing and will give $125 million of it to employees.

It will take weeks after the MAX is cleared to fly for airlines with the idled aircraft already in their fleets to ready them for service because of needed maintenance and pilot training.

Southwest and American have canceled 737 MAX flights through early April, while United Airlines (NASDAQ: UAL) has removed the aircraft from its schedule until June 4.

Ryanair CEO Michael O’Leary told a German publication last week that the discount carrier may not receive its first 737 MAX delivery until October, after the busy summer season, and won’t discuss compensation until all deliveries are made. The European airline was supposed to receive 58 of the aircraft by midyear.

Meanwhile, Airbus announced Monday it had finalized an order with South Florida-based Spirit Airlines for 100 aircraft in the A320 neo family, which are designed to cut fuel consumption by 20% compared with earlier models.

Dave

Thank God!!!!!!!!! The last thing we need is them not knowing what new buttons to press.