Borderlands is a weekly rundown of developments in the world of United States-Mexico cross-border trucking and trade. This week: El Paso border crossing looks to rebound in 2021; logistics firm expands with Dallas shipping hub; Suddath acquires Texas-based Daryl Flood Inc.; and $2 million of meth hidden in shipment of rugs.

El Paso border commercial crossing looks to rebound in 2021

The coronavirus pandemic delivered a heavy hit last year to commercial trade at the United States-Mexico border crossing in El Paso, Texas.

Trade at the Port of El Paso fell 62% to $29.2 billion during 2020, compared to $76.6 billion during the same period in 2019, according to data from the U.S. Department of Transportation. In 2020, the El Paso port of entry handled 286,434 commercial trucks, compared to 792,441 during the same period in 2019.

Matt Silver, co-founder and CEO of Forager, said while COVID-19 caused unprecedented disruption last year in El Paso, there is reason for optimism that trade will rebound in 2021.

“The semiconductor chip shortage has had an impact on all supply chains, I imagine that is affecting volumes out of El Paso,” Silver said. “Rates have been lower in the last 30 days in El Paso then they have been compared to the last 60 to 90 days before that.”

Forager is a Chicago-based FreightTech firm. Forager launched SCOUT — the company’s cross-border booking and pricing platform — in October 2019. The company also recently launched a cross-border load board.

“I think it’s some sense of a little bit of normalcy coming back to volume shipping. As the U.S. keeps opening up, there’s more volume coming out of El Paso going into the U.S., and so rates going into that market are going to be cheaper,” Silver said. “I think that it’s a result of just more consumption in the U.S, the country opening back up again and a lot of volume coming out of Juárez and Chihuahua, Mexico.”

Looking at the Lane Signal application available on the FreightWaves SONAR platform, a median-cost carrier should be fetching around $1.30 a mile moving from El Paso to Houston.

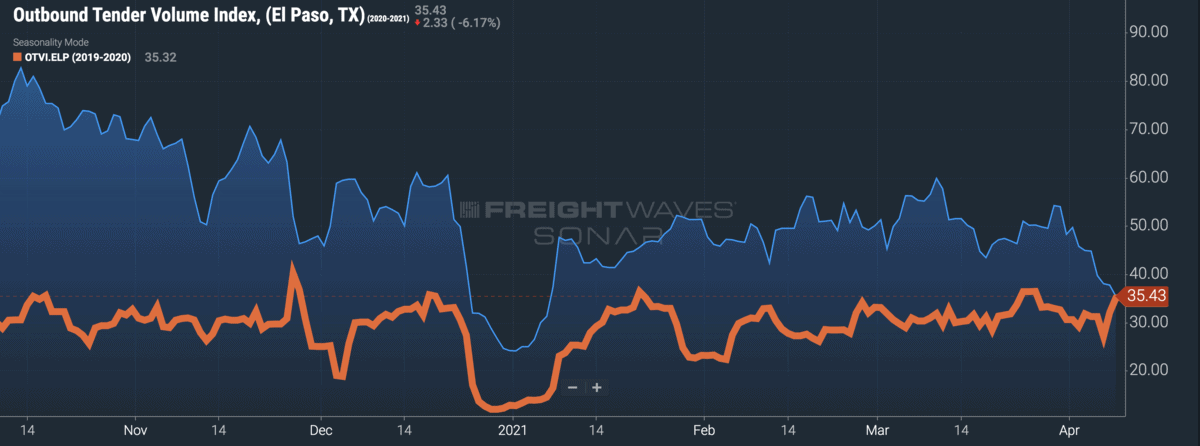

As of Friday, El Paso’s Outbound Tender Volume Index (OTVI.ELP) is up slightly year-over-year. El Paso’s headhaul index (HAUL.ELP) has fallen more than 40% since last week, suggesting a tightening of capacity in the market.

Juárez, just across the border from El Paso, has around 300 maquiladoras — export factories in Mexico run by foreign companies — employing around 340,000 workers.

The factories make everything from automotive parts and electronics to food and beverage products, which are mostly shipped to the U.S. using commercial trucks.

The coronavirus pandemic was tied to several outbreaks among workers at maquiladoras in Juárez.

Commercial trucks accounted for $22.4 billion worth of shipping activity in El Paso during 2020, compared to $65.3 billion during the same period in 2019.

“Coming into the summer I think there are a couple of beverage shippers that ship out of the El Paso area and so we’ll start to see even more volume come out,” Silver said.

The city of El Paso owns three of the four international bridge crossings with Mexico and collects southbound tolls at them. The fourth facility, the Bridge of the Americas, is owned by the U.S. government.

The El Paso bridges’ top three imports for February were:

— Passenger vehicles, $193 million.

— Commercial vehicles, $111 million.

— Windshield wipers, electric light parts, $28 million.

The top exports during February were:

— Liquefied natural gas, other petroleum gases, $399 million.

— Medical instruments, $43 million.

— Gasoline, $39 million.

Logistics firm expands with Dallas shipping hub

Gulf Relay, a Mississippi-based third-party logistics company, is expanding in Texas.

Gulf Relay is leasing more than 350,000 square feet of distribution space at the Crossroads Trade Center 1 at 1221 E. Centre Park Blvd. in DeSoto, a suburb of Dallas.

The new location will more than double the company’s Texas shipping facilities. Gulf Relay also has a facility about 35 miles away in the Dallas suburb of Coppell.

“Gulf Relay is laser-focused on executing as a seamless integrated element of our customers’ supply chain through services and technology,” Scott Fleener, Gulf Relay’s chief supply chain officer, said in a statement.

Based in Clinton, Mississippi, Gulf Relay has more than 700,000 square feet of warehouse and logistics operations. The company has 212 truck drivers and operates 228 power units, according to the Federal Motor Carrier Safety Administration.

Suddath acquires Texas-based Daryl Flood Inc.

The Suddath Cos. recently announced the acquisition of Daryl Flood Inc.

Daryl Flood Inc. (DFI) is a moving and logistics company based in Coppell.

DFI has 15 locations in Texas, Oklahoma, Louisiana, Tennessee and Florida. The company has around 1 million square feet of warehouse space around the country.

The sale includes all of DFI’s operating companies, including Daryl Flood Relocation Inc., Daryl Flood International Inc., Dependable Relocation Services Inc., Daryl Flood Workplace Services Inc., Daryl Flood Logistics Inc. and VERSA Relocation Inc.

Jacksonville, Florida-based The Suddath Cos. is a global transportation, relocation management and logistics company, serving 180 countries with 2,000 employees around the world.

$2M worth of meth hidden in shipment of rugs

U.S. Customs and Border Protection (CBP) officers in Louisville, Kentucky recently found 243 pounds of methamphetamine hidden in rugs.

CBP agents examining an air cargo shipment at the UPS Worldport facility that had originated in Mexico and was destined for Hong Kong discovered a white crystal substance concealed within foil bags in the shipment.

The powder tested positive methamphetamine, with a street value of $2.16 million.

Borderlands is sponsored by Forager. More information on Forager’s offerings can be found at: https://www.foragerscs.com/.

Click for more FreightWaves articles by Noi Mahoney.

More articles by Noi Mahoney

Canadian construction firm picked for $1B Mexico-Canada rail link project

Odyssey Logistics expands into Laredo

Samsara launches data report to show fleets how they stack up