A perfect storm of regulations, court proceedings and general capacity concerns has left some carriers and shippers questioning where the industry is heading in 2020. Just two months ago, it appeared to be smooth sailing, but disruption from California’s AB5 contractor bill, rising insurance rates and the Federal Motor Carrier Safety Administration’s (FMCSA’s) surprise announcement at the end of December that it was increasing the drug testing rate have suddenly added complexity to the market.

Thomas Bardwell, vice president of logistics for BR Williams, an Oxford, Alabama-based transportation company offering logistics, trucking and warehouse services, said that unlike the capacity crunch that helped drive up rates in late 2017 and early 2018, the current conditions have taken some by surprise.

“The timing leading up to the last one … most of us saw that one coming,” he told FreightWaves. “Most of us bidding were aware of what we were getting into.”

This time, the suddenness of recent events, combined with the fact that many carriers and shippers have already entered into contracts for 2020, means the industry could face more disruption this year and tender rejections could skyrocket in the first half of the year.

“Many have just locked in rates with shippers for 2020 based on the consensus forecasts calling for ‘stability’ … until a few weeks ago,” he said. “Tender rejections should explode toward the end of Q1 and certainly in Q2.”

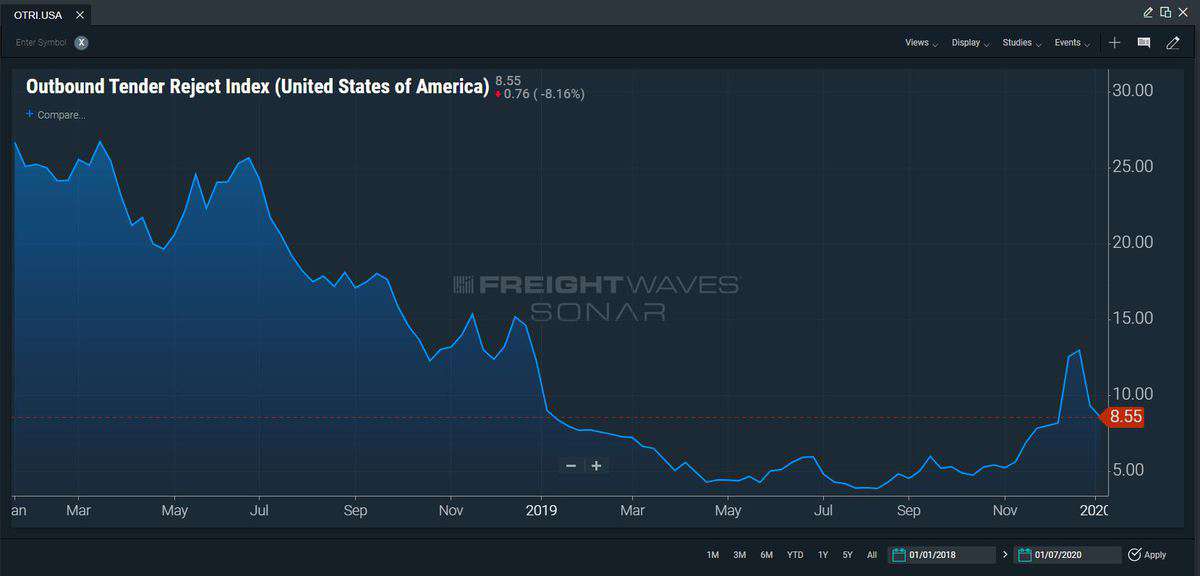

The national Outbound Tender Rejection Index has been below 10% for much of the past year, according to FreightWaves OTRI index (SONAR: OTRI.USA). It had climbed above 25% in in the first half of 2018.

The recent bankruptcy of Celadon has contributed to this uncertainty, but Bardwell, whose fleet operation runs about 90% dedicated accounts, said the uptick in fleet closings in the final quarter was largely unpredicted.

“What we didn’t anticipate as a market was just how quickly capacity was going to come out of the market in late 2019,” he said. “Celadon [was a big hit]. From what we’re reading, it’s some 50-60,000 power units removed from the market. Much of those [contract] bids had already taken place before it was clear to our marketplace that this was coming.”

Bardwell cited FMCSA and FTR Consulting data that showed 34,936 power units had been removed from the market by the end of September. He estimates that number has now grown higher than the 46,000 estimated at that time. This is bound to have an impact on capacity and rates.

“We’re already seeing that on the spot market,” Bardwell said. “From the shipper’s standpoint, those that locked in dedicated rates or dedicated services did themselves a huge service. Routing guide compliance is absolutely going to fall, so whatever they had budgeted for transportation spend is not going to be accurate.”

The FMCSA’s decision to increase the random drug testing rate for drivers to 50% for the 2020 calendar year caught many off guard. The rate is set based on 2018’s positive drug testing results.

“This data was collected in early 2019, and to my knowledge there has been no indication from FMCSA about the increase in positive tests that led to the minimum random testing rate change,” Dave Osiecki, president and CEO of Scopelitis Transportation Consulting, told FreightWaves. “Not only is it a financial hit that no one was expecting, it’s disappointing to know that more drivers are testing positive for using drugs.”

Osiecki said it could result in a $50 million to $70 million financial hit from increased testing costs for carriers, plus an unknown impact on productivity. It is unclear what caused the positive test rate to climb above 1% — the threshold that triggers a higher random testing rate — after consecutive years of 0.7% and 0.8% rates, but the increase of legal marijuana and the nation’s opioid crisis could be factors.

Several other factors put forecasts in doubt, Bardwell, said.

“We’re [generally] concerned about AB5 because from a regulatory standpoint, and a legal standpoint, things tend to migrate from California,” he said, although BR Williams is not heavily reliant on owner-operators. “It has created a level of uncertainty that has tempered the environment of owner-operators.”

The uncertainty could have a ripple effect on drivers and the ability to move goods, especially on the West Coast. The initial impact could be more owner-operators choosing to sign on to fleets as company drivers, but many fleets are not as excited about expanding right now after doing so in late 2018 and early 2019 in response to tight capacity only to see capacity loosen and rates collapse.

“I think the appetite in general to grow fleets has been tempered because of how difficult it was in 2019,” Bardwell said. “I think what a lot of the shippers don’t understand was that when rates ratcheted up in 2018 it was due to regulatory reasons,” such as the electronic logging device requirements and insurance increases.

Evidence of fleet expansion plans can be seen in declining new truck orders, which had their worst year in 2018 since 2009. Fleets ordered just 179,000 Class 8 models in 2019, FTR said, although retail deliveries were expected to hit a record for the year, buoyed by the 2018 ordering cycle.

Orders reached 50,000 units in September 2018 before dropping off each month since (SONAR: Orders.CL8)

“Overbuying through 2019 and insufficient freight to absorb the ensuing capacity overhang continued to weigh on the front end of the Class 8 demand cycle in December,” said Kenny Vieth, ACT president and senior analyst.

For shippers that may see lower truck orders and are expecting lower rates as result, Bardwell said other factors influence operational costs for carriers.

“The truck orders certainly don’t tell the entire story,” he said. “When we talk to shippers, we talk a lot about operating costs. We do have the responsibility to our shippers to explain to them our costs and how they change over time.”

In addition to the aforementioned industry-wide capacity changes, AB5 regulation and drug testing, Bardwell noted that insurance premium increases and IMO 2020 — the new low-sulfur fuel regulations in the maritime industry — are adding pressure to carriers’ operational costs.

The Truckload Carriers Association is reporting that its members had seen an almost 10% rise in insurance costs as a percentage of revenue through November 2019 year-over-year.

“That is huge. It’s causing a lot of bankruptcies, but it is also causing a rise in operating costs,” Bardwell said, noting that insurance liability increases and the unknown impact of IMO 2020 could “disproportionally impact smaller carriers.”

Bardwell said that, since joining the industry in 2006, he has been fascinated by the “fluidity of our market as it changes.”

“One of the more interesting facets of it is that you do have these big chunks of change that come, and if you have enough capacity in the market, you hardly notice them,” he said, “but, if you have 97% [capacity efficiency], those shocks to that other 3% are massive. The spread between operating costs and spot costs are higher than they’ve been since 2009 and it’s going to eliminate some capacity, and it’s not done.”