Canadian Pacific (NYSE: CP) and Kansas City Southern (NYSE: KSU) are planning to merge in a deal worth $29 billion (US). CP says the acquisition will “create enhanced competition and better service for customers” while also fostering North American economic growth.

The acquisition will include an assumption of $3.8 billion in outstanding Kansas City Southern (KCS) debt. The merger also has the unanimous support of both boards of directors, according to CP.

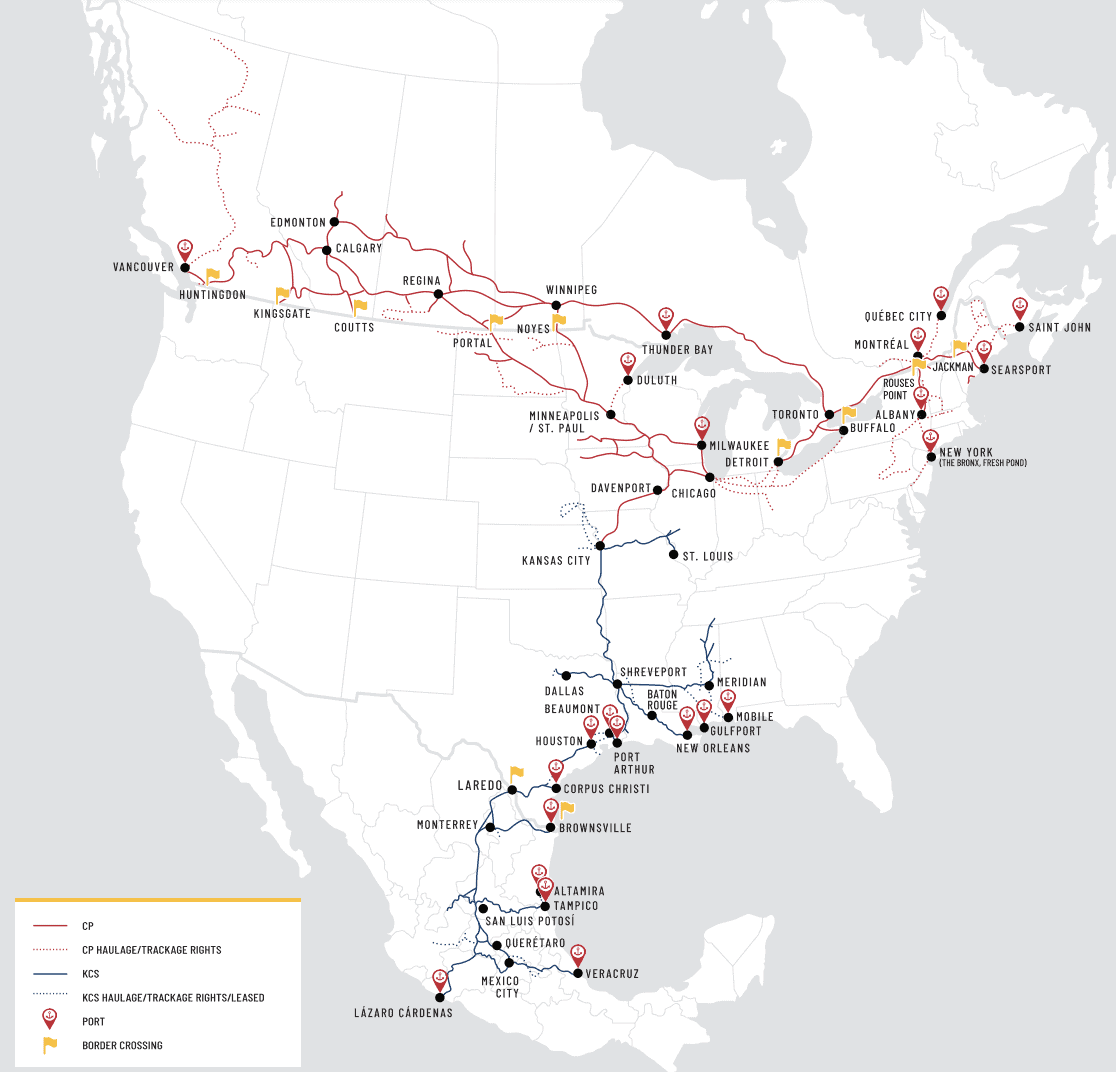

The approval is pending approval from the Surface Transportation Board, and CP estimates that STB’s review would be completed by the middle of 2022. Should the merger proceed, it would provide shippers with access to both Canadian coasts as well as the U.S. Gulf Coast and KCS’ operations in Mexico.

“This transaction will be transformative for North America, providing significant positive impacts for our respective employees, customers, communities and shareholders,” said CP President and CEO Keith Creel. “This will create the first U.S.-Mexico-Canada railroad, bringing together two railroads that have been keenly focused on providing quality service to their customers to unlock the full potential of their networks. CP and KCS have been the two best performing Class I railroads for the past three years on a revenue growth basis.”

“The new competition we will inject into the North American transportation market cannot happen soon enough, as the new United States-Mexico-Canada Agreement (USMCA) trade agreement among these three countries makes the efficient integration of the continent’s supply chains more important than ever before. Over the coming months, we look forward to speaking with customers of all sizes, and communities across the combined network, to outline the compelling case for this combination and reinforce our steadfast commitment to service and safety as we bring these two iconic companies together,” Creel said.

According to CP, the combined company would operate approximately 20,000 miles of rail, employ close to 20,000 people and generate total revenues of approximately $8.7 billion based on 2020 actual revenues.

Both companies are already ready working together to send Canadian crude oil down to the Gulf Coast.

Said KCS President and CEO Pat Ottensmeyer: “KCS has long prided itself in being the most customer-friendly transportation provider in North America. In combining with CP, customers will have access to new, single-line transportation services that will provide them with the best value for their transportation dollar and a strong competitive alternative to the larger Class Is. Our companies’ cultures are aligned and rooted in the highest safety, service and performance standards.”

Ottensmeyer continued, “Importantly, KCS employees will benefit from being part of a truly North American continental enterprise, which creates a strong platform for revenue growth, capital investment, and future job creation. Customers, labor partners, and shareholders will all benefit from the inherent strengths of this combination, including attractive synergies and complementary routes.”

Following the merger, both companies plan to keep their targets to reduce greenhouse gas emissions. Those targets are inline with the Paris Agreement, they said.

If STB approves the merger, Creel will be CEO of the combined company. In a separate announcement on Sunday morning, CP said Creel would stay on through at least early 2026.

The merged company would be named Canadian Pacific Kansas City, or CPKC. Calgary would serve as the global headquarters of CPKC, and Kansas City, Missouri, would be designated as the U.S. headquarters. The Mexico headquarters would remain in Mexico City and Monterrey, CP said. CP’s current U.S. headquarters in Minneapolis-St. Paul would remain an important base of operations, the railway said.

BMO Capital Markets and Goldman Sachs will serve as financial advisors to CP, while Sullivan & Cromwell, Bennett Jones and the Law Office of David L. Meyer will serve as legal counsel. Creel-García-Cuéllar, Aiza y Enríquez, S.C. are serving as Mexican legal counsel to CP. Evercore is serving as the Canadian Pacific Board’s financial advisors and Blake, Cassels & Graydon is serving as the Board’s legal counsel, CP said.

BofA Securities Inc. and Morgan Stanley will serve as financial advisors to KCS. Wachtell, Lipton, Rosen & Katz, Baker & Miller, Davies Ward Phillips & Vineberg, WilmerHale, and White & Case, S.C. will serve as legal counsel to KCS.

Impact on customers

Both companies insist the merger “will provide an enhanced competitive alternative to existing rail service providers and is expected to result in improved service to customers of all sizes. Grain, automotive, auto-parts, energy, intermodal, and other shippers, will benefit from the increased efficiency and simplicity of the combined network, which is expected to spur greater rail-to-rail competition and support customers in growing their rail volumes.”

They continued, “no customer will experience a reduction in independent railroad choices as a result of the transaction. Additionally, with both companies’ focus on safety and track records of operational excellence, customers will benefit from a seamless integration of the two systems without service disruption.”

“CP and KCS interchange and operate an existing shared facility in Kansas City, Missouri, which is the one point where they connect. This transaction will alleviate the need for a time consuming and expensive interchange, improving efficiency and reducing transit times and costs,” both companies said in a joint release. “The combination also will allow some traffic between KCS-served points and the Upper Midwest and Western Canada to bypass Chicago via the CP route through Iowa. This will improve service and has the potential to contribute to the reduction of rail traffic, fuel burn, and emissions in Chicago, an important hub city.”

Additional information on the merger and its progress and impacts will be available on www.FutureForFreight.com.

Subscribe to FreightWaves’ e-newsletters and get the latest insights on freight right in your inbox.

Click here for more FreightWaves articles by Joanna Marsh.

Related articles:

CP: Land assets and partners provide growth opportunities

Kansas City Southern eyes lower operating ratio

What Keystone pipeline cancellation means for crude-by-rail

Construction of Alberta crude unit expected to start in April