The trade war is back on. This afternoon, August 1, President Trump announced that beginning September 1, a tariff of 10 percent would be placed on the remaining $300 billion of Chinese imports that had not previously been subject to tariffs.

Treasury Secretary Mnuchin and U.S. Trade Representative Lighthizer came back from China with no progress on trade talks. President Trump also complained that China has not fulfilled its pledge to crack down on the illicit trade in fentanyl, a deadly opiate behind many overdose deaths in the United States.

These new tariffs are expected to hit consumer wallets harder – the tariffs will be placed on items like electronics, apparel and household goods, and the costs are more likely to be passed on in the form of higher prices.

The S&P 500 immediately tumbled on the news, down from a post-rate cut high. The price of West Texas Intermediate crude oil, the American benchmark, fell more than 6.5 percent on the news. Brent crude, the international benchmark, fell about 5.8 percent.

Because the tariffs are expected to be imposed at the beginning of next month, there will be little time – about a week – for shippers to load container vessels with freight in time to beat the tariffs. Transit times from Shanghai to Los Angeles are about 21 days. But if shippers believe that the Trump administration might increase those tariffs from 10 percent to 25 percent, as happened with other classes of commodities, they could still be motivated to pull freight forward on container ships.

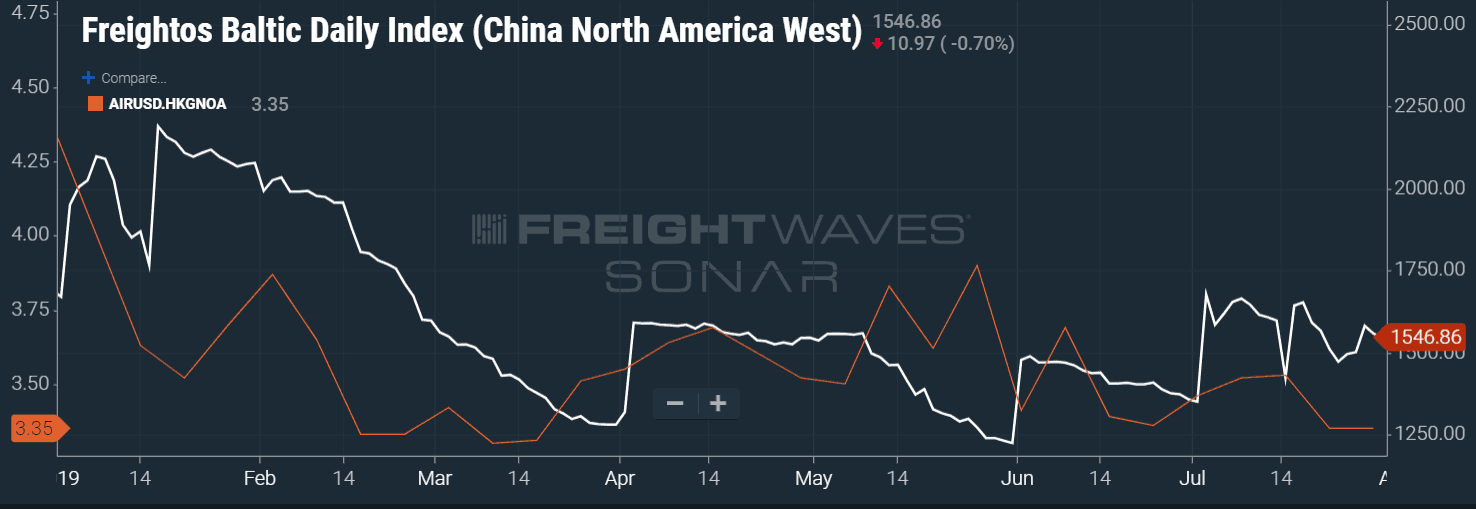

Regardless of the prospect of further escalations, FreightWaves expects shippers to take advantage of low air cargo rates to quickly move goods to the United States.

Freight markets have been resistant to steamship lines’ general rate increases, as any attempts to bump ocean rates have quickly deteriorated. These tariffs, coming ahead of peak season, may reverse that trend.

The problem is that there still isn’t much warehousing space in major port cities. According to Cushman & Wakefield data released today, warehouse vacancy rates in Los Angeles are about 2 percent compared to the long-running national average of 5.8 percent (the current national average is 4.5 percent). Savannah is even tighter, running at about a 1 percent vacancy rate.

FreightWaves believes that additional, sudden freight flows into the United States are a short-term net positive for trucking carriers as shippers scramble to find space to house new inventory. FreightWaves expects a replay of this spring’s flurry of regional movements (Los Angeles to Phoenix, Los Angeles to Stockton) as freight moves from primary warehousing markets to secondary markets looking for a home.

On a national basis, truckload volumes (OTVI.USA) have been trending above 2018 levels for about a week, and this trade disruption could juice those numbers further. Significant inflation on rates outbound from Los Angeles may occur, and FreightWaves also anticipates additional demand for expedited air freight and less-than-truckload services out of air cargo hubs.