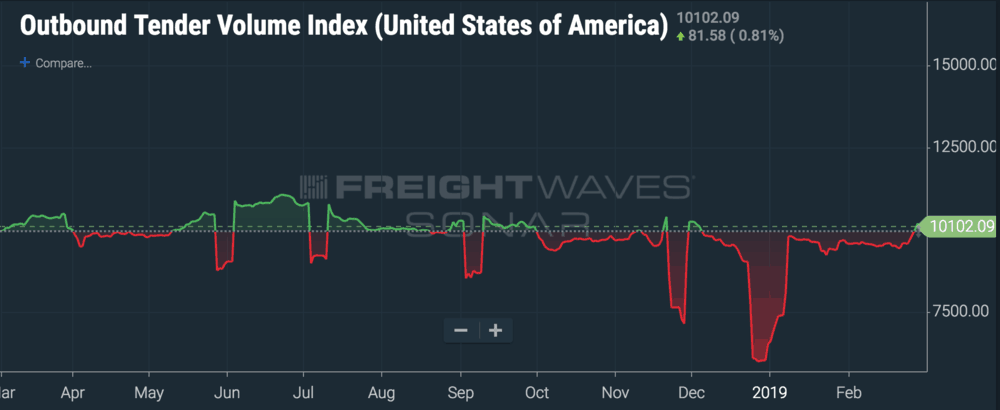

National contracted freight volumes (OTVI.USA) posted a strong recovery toward February’s month-end as a flurry of regional moves in Southern California to relieve congested warehousing drove load counts higher and higher. The growth in Los Angeles and Ontario was a kind of consistent slow burn, giving carriers time to reposition their trucks in the region; eventually that pushed down both spot prices and tender rejections in Southern California markets.

DAT’s dry van spot rates exclusive of fuel from Los Angeles to Dallas (DATVF.LAXDAL) fell to $1.28/mile by the end of February, and carriers are now only rejecting 1.81 percent of loads outbound from Los Angeles (OTRI.LAX). Given current market conditions, FreightWaves data scientists now believe capacity is overweight on the West Coast, especially Southern California.

Carriers may be catching on to the over-saturation in those markets, because they appear to be less willing to send their trucks in.

“Dallas to Ontario, inbound California is starting to show signs of flipping toward busy season,” said William Kerr, President of Edge Logistics in Chicago. “It’s not aggressive yet, but loads stay on the board for a little bit longer than before – we’re seeing slightly longer built-to-covered timelines.”

Fortunately for carriers and brokers, volume growth is increasingly widely distributed across major markets. Volumes in Charlotte (OTVI.CLT) are up 19 percent since February 24, while Indianapolis (OTVI.IND) gained 12 percent since February 21, and Harrisburg (OTVI.MDT) is pushing out 11 percent more loads since February 21.

The Midwest has been tight for most of the year, but data coming in from markets further east also supports the thesis that freight markets have tilted out of balance toward an oversupply on the West Coast. Indianapolis, Harrisburg, Allentown, Baltimore and Boston all tightened today.

“Weather has impacted prices in day-of markets on the East Coast,” Kerr said. “We’re mostly in the two- to three-day out market, and our primary carriers are doing their best. Still, there’s a lot of equipment out of service and off the road.”

Kerr said that rates in Texas especially have stayed down despite a 16 percent growth in volumes (OTVI.DAL) since February 15.

Jason Roberts, Director of Business Development at Chattanooga-based Avenger Logistics, said that flatbeds have been strong through the winter.

“Our flatbed business has been good; dry van was certainly down, but it’s starting to spread out. Construction’s out there, and there are a lot of shows and conventions early in the year, so we handle project moves to Las Vegas and other cities,” Roberts said.

The Southeast has started heating up, Roberts continued, saying that Avenger was moving a lot of plants and trees for nurseries.

“The Southeast is starting to liven up a bit, and when produce hits – which is soon upon us – that trend will continue,” Roberts said.

An executive at Convoy reaffirmed that volume growth has been stable and distributed, without anomalous capacity shortages in any major market.

“We are beginning to see an uptick in tenders across the country as we come out of the traditionally slow months of January and February; especially for contracted volumes,” wrote Bryce Bennett, Director of Market Growth at Convoy, in an email. “Even as Convoy’s volume grows rapidly, we have not seen major price adjustments as it appears that truck capacity has started to catch up with the increased shipper demand over the past couple years.”

Convoy said that 95 to 100 percent of its loads, depending on lane, are moved without human intervention, but that the company maintains teams of brokers to deal with exceptions and market anomalies.

“Our operations teams are designed to monitor and manage any localized fluctuations in the marketplace that do periodically change week to week, but there are no immediate concerns,” Bennett wrote.

FreightWaves will continue to closely monitor and report on freight markets throughout the country as spring approaches. With multiple ocean alliances announcing void sailings on China – North America West Coast services – even well after the Chinese New Year – volumes in Southern California may eventually moderate and growth will have to be sought elsewhere.