The volume of containers being unloaded at California ports has surged this month, but it’s a final hurrah before a big plunge.

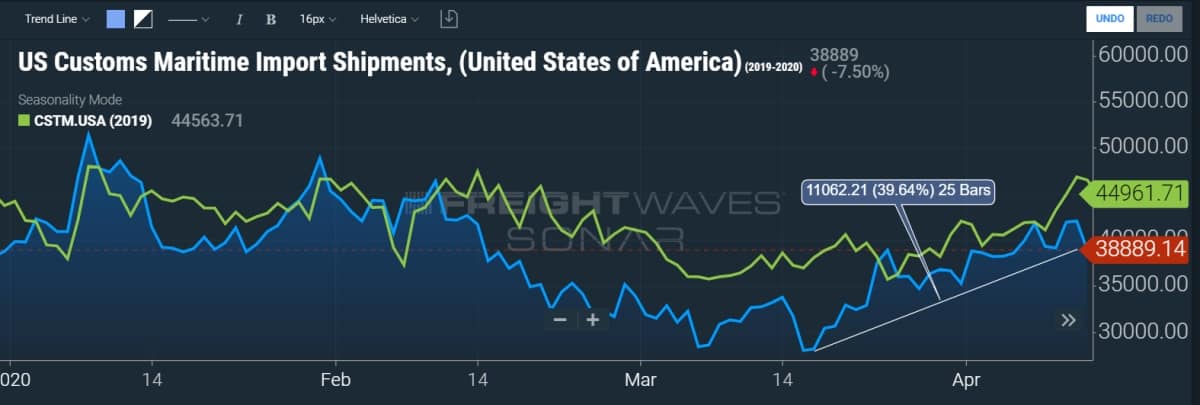

The FreightWaves SONAR platform collects data on maritime import shipments, measured in terms of a five-day weighted average of the number of customs filings. The five-day average for the entire U.S. (SONAR: CSTM.USA) has jumped 40% between March 17 and April 12.

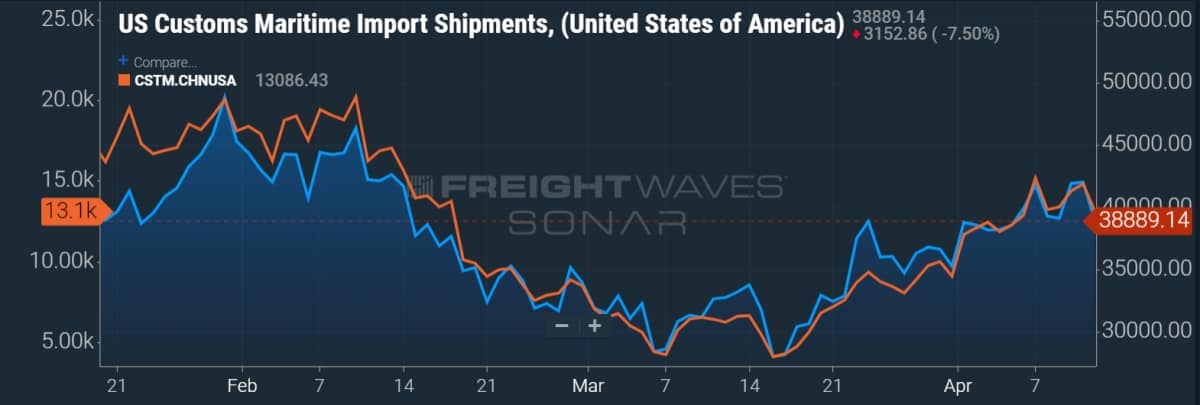

The customs data reveals the driver of the increase: China. A comparison of countrywide maritime import customs filings and those from China (SONAR: CSTM.CHNUSA) shows an almost exact match on the way down in mid-February through the third week of March, and on the way up since then. Imports from other countries do not show the same correlations with total U.S. imports.

The SONAR data also shows where the import spike is geographically centered: Southern California. The customs data for maritime imports through the Port of Los Angeles (SONAR: CSTM.LAX) correlates with overall U.S. customs filings much more so than data from other ports. In fact, customs declaration volumes in Los Angeles have recently been trending up slightly more than the national average.

Looking at data for the past three weeks in isolation, one might conclude that resurgent containerized imports from China to California are erasing the coronavirus-related decline, bringing volume almost back to where it was at this time last year. However, without context, the data trend is deceiving.

The lag effect

Telescopes have been compared to time machines: The stars you see are not actually there; they were there billions of years ago.

In the same way, cargo coming ashore in Los Angeles in mid-April does not reflect what’s happening now. It reflects what happened in the past.

After Chinese New Year (CNY), the Hubei province of China was put on strict lockdown to prevent the spread of the virus. The normal CNY halt to exports was extended by several weeks.

As soon as the Chinese export system came back online, U.S. importers scrambled to get their delayed orders onto ships for delivery.

Using ship-tracking data and algorithms, Boston-based CargoMetrics confirmed that container export volumes outbound from China were back to normal — and actually above normal — in March.

It takes 14-22 days for ships to transport boxes from China to the U.S. West Coast, then four to five days for customs declarations to flow through to the data platform. The spike in customs activity in the first half of April represents the catch-up volume delayed by the post-CNY Hubei lockdown that is finally arriving.

“This is the cargo from when the Chinese factories came back up [after CNY],” confirmed Nerijus Poskus, vice president and global head of ocean freight at Flexport, a San Francisco-based digital freight forwarder and customs broker.

“The numbers for the first and second week of April might actually come in higher than the same weeks last year — but the good news is almost over for Los Angeles,” he told FreightWaves.

U.S. importers began rapidly cancelling their orders from China in late March as social-distancing rules closed down American stores and distribution centers. In response, container lines started “blanking” (cancelling) previously scheduled sailings, first on routes from China to Europe, then on routes from China to the U.S.

Copenhagen-based Sea-Intelligence reported that carriers had cancelled 369 sailings to Europe and the U.S. through April 11 due to pandemic-related demand declines. Further sailings have been cancelled since then.

The blank-sailing announcements started several weeks ago, but departure dates for those sailings are only just starting, and due to transit time, there is a multi-week delay until those lost departures are felt at U.S. ports in the form of reduced arrivals.

“Two weeks ago, there were no blank sailings to Los Angeles,” said Poskus, referring to ships that would be arriving in the U.S. now.

Poskus said that departures representing only 7% of arrivals to the U.S. were cancelled during the week of March 30-April 5. That rose to 13% in April 6-12, 20% in April 13-19 and 28% in April 20-26. “The cancellations are now all the way through the end of June [departure dates],” he said, adding that U.S. ports would begin experiencing container-import reductions starting next week.

Based on current sailing schedules, including cancellations, “May will be down significantly,” he warned. “We think May bookings should be 15-20% less than they were last year.”

Just as the post-Hubei-lockdown upside has been felt at U.S. ports a month later, the service-cancellation downside is coming, but with a lag effect. Click for more FreightWaves/American Shipper articles by Greg Miller

iomiymqumv

ythgxkpcgbrovjfzcpmdkwfufiuwgk