The outlook for trucking calls for more of the same, according to industry heads on hand virtually at BofA Securities’ transportation conference Thursday.

Healthy consumer spending, inventory still in need of replenishment and an industrial economy that is heating up are among the catalysts they cited for the high-demand environment continuing through the rest of 2021.

Even removing elevated demand from the equation, industry fundamentals favor the carrier as capacity is historically constrained.

“We’re not through this demand condition. Let alone, when you start to include the supply side of this, which is still incredibly difficult, we think we have several quarters of more legs here,” said Mark Rourke, CEO and president of Green Bay, Wisconsin-based truckload carrier Schneider National (NYSE: SNDR).

Rourke pointed to a significant number of drivers sidelined due to failed drug tests as well as increased carrier compliance with the Drug & Alcohol Clearinghouse as reasons for the lack of capacity. Additionally, driver schools have operated at restricted capacity throughout the pandemic, still not reaching pre-COVID levels even as pay for truckers has soared.

Further complicating the issue is a tight labor market with competing vocations like construction and warehousing struggling to fill job orders. Rourke said the e-commerce boom has also created a driver headwind as a couple hundred thousand courier driver positions have been filled, potentially taking away CDL candidates.

Derek Leathers, chairman, president and CEO at Omaha, Nebraska-based Werner Enterprises (NASDAQ: WERN) thinks the structural issues will take time to play out.

“If you think about the flaw in the trucking industry over time is the barriers to entry were always too low. It’s a fragmented industry with fairly low barriers to entry. If you think about the current version of the trucking industry, those barriers are quite a bit higher,” Leathers commented.

He said operators are in a much more capital-intensive environment as in-cab and network technologies are now a requirement to successfully operate a fleet. Add in sky-high insurance premiums, higher liability coverage requirements and meeting expectations of drivers, who want to operate the latest equipment and return home daily, and the barriers are much higher than they have been in the past.

Leathers believes further pay increases will help, though he noted that several carriers have already implemented multiple rounds of pay hikes and total transportation employment is still off 3% year-over-year.

“The backdrop against all of that is a consumer that’s heavily engaged. They’re out there buying and we’re seeing record same-store sales growth across winning customers who we worked hard to align ourselves with,” Leathers said.

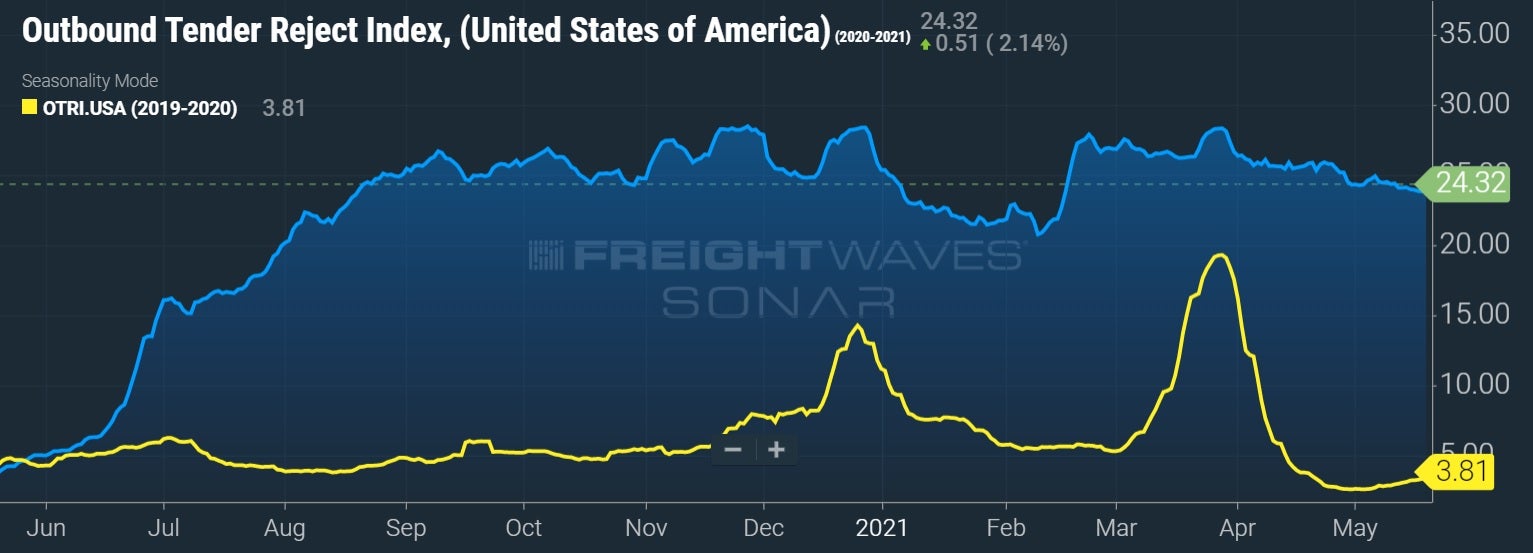

The current condition has carriers rejecting roughly one in four loads under contract, a level that has been held since August.

Regarding current fundamentals and the potential challenges an infrastructure plan would present to driver labor, Eric Fuller, president and CEO at Chattanooga, Tennessee-based U.S. Xpress (NYSE: USX) said, “I really think that we’re probably looking at more of a late-2022, ’23 situation before we start to feel any kind of pullback in this environment.”

Delays slowing capacity additions

A lack of drivers is certainly the primary hindrance to capacity additions currently. But semiconductor, parts and raw material shortages have crimped production schedules at the original equipment manufacturers as well.

“We are running a few months late already on getting trucks delivered, and that truck delivery issue is related to the supply chain,” Fuller said. “There’s a lot of components that are in backlog or are having massive supply chain issues that are slowing down the ability for us to even buy new tractors and get new equipment, much less finding drivers to actually seat them.”

The company’s 2021 capital expenditures budget calls for continued growth in its new digital fleet, Variant. The unit is expected to have 1,500 tractors operational by year-end.

Werner has been successful taking equipment deliveries so far but noted the supply chain issues could curb its capex plan. The company entered the year attempting to grow its fleet by 1%-3% year-over-year but acknowledged OEM headwinds will likely take away the top end of the range. The company’s fleet count declined 1% in the first quarter.

Schneider is looking to add a couple hundred tractors to its dedicated unit in the second quarter but noted production issues could limit those plans. The carrier previously cut its net capex plan for the year on the concern.

Schneider also wants to add several thousand new containers to meet its intermodal growth initiatives and address delays its customers are having unloading equipment as they deal with their own labor issues. Management said many of the ordered containers have been built but are sitting in China waiting to be shipped. Limited availability in ocean sailing schedules is causing the delays.

Asked about the Port of Los Angeles’ goal to clear the port and potentially free up capacity, Leathers said, “I think it’s an aspirational goal. They’ve been talking about trying to clear the port for several quarters now.

“Even if they were to hit those aspirational goals, you’re really sitting on the doorstep of peak. At that point, you’re starting to think about fall surge, fall peak, fall growth in purchasing. Getting it off the boat and on the dock and ready to move is one thing, but actually moving it is another thing. I don’t see that capacity coming online.”

Stephen Webster

Many truck drivers do like that receiver’s tell them to leave with no hours. Pay truck drivers overtime after 10 hours per day and 50 hours per week and make all companies provide 10 hours parking with electric plugs and wi do or pay a $50 per delivery to a local group to provide offsite parking.