There are many factors that influence disruption in our industry including economic growth, e-commerce, legislation, and extreme weather. Data and analytics play a key role in staying profitable during times of tight capacity in the freight marketplace. What is the data telling us right now, and how are these interpretations impacting the market?

Alex Perry, Data Analytics Consultant for DAT, presented at an education session at this year’s TIA 2018. “Without a doubt the capacity crunch is at unprecedented levels,” he says.

“If you look at the load-to-truck ratio,” says Perry. “The past few months things have just skyrocketed.”

Perry also shows the DAT hot market map over time (from 2014 through 2017). While things have been hot at times, he says, “This is a crazy crunch. We are seeing what you are feeling,” he says.

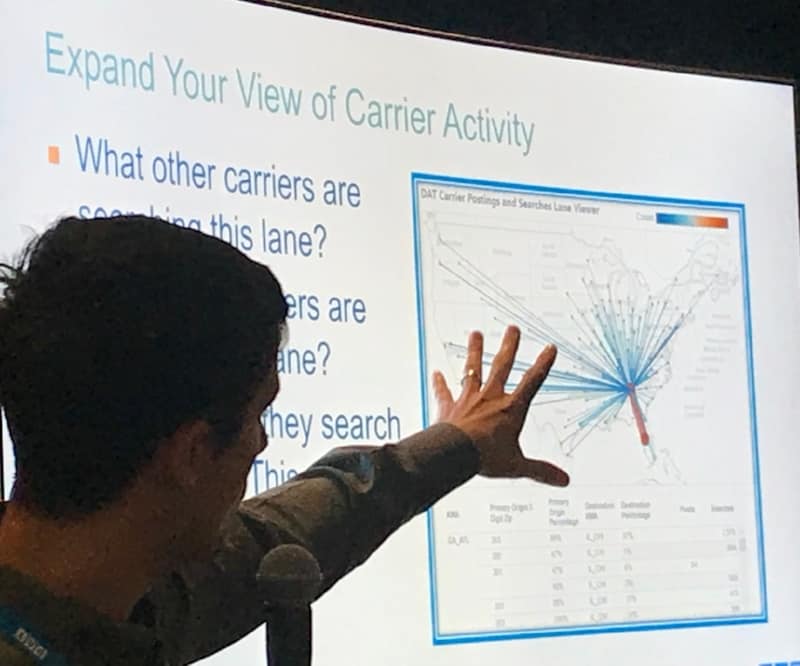

Perry says the basic approach in using their system is to begin with your basic data. Then, search carriers that like running lanes you need covered. The key then, as it is so often, is to build relationships with carriers you trust. He also says to search first in your own TMS. Other tips and tricks he mentions are to enhance your load posts, post and search with care, and use all available tools.

What are all available tools? The DAT extended network is seen by drivers near your load’s pickup location. It’s super easy to use, he says. You just click and send to the extended network. Also, there are ways to find hidden capacity with a more customizable approach. You can expand your view of carrier activity and keep up with changing rates. Finally, there’s also data they can provide that gives seasonal or other exceptional rates.

So what exactly is the problem with the postings right now, Perry asks. “What we’re seeing is the fact that carriers aren’t posting is not a new phenomenon. We’re seeing more of them not doing it. Because they can find the loads they want to cover without posting. What we’re seeing is that if they post their load, their phone blows up. So they don’t post.”

“This is a crazy crunch. We are seeing what you are feeling.”

In many cases carriers just search within their own networks and find what they need without posting. “Then with the fewer posts, it kind of has a cascading effect,” says Perry. “Because there’s fewer trucks, the reaction they’re seeing from those posts has worsened because there’s fewer trucks on our load board. It’s a feedback loop.”

Perry then showed another look “at just how bad things are.” He compared the red load posts to the blue truck posts.

“Just over the past six months or so, and it might not look too bad because of the scale here. The scale is with the load search behavior. The carriers who are not posting but they are still interacting with our load board. What you can see here is the carriers are here, they are searching, they’re just not posting. There is capacity if you know to find it, right?”

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.