A new capacity crunch is coming to the industry very soon, and that is a very good thing for rates and an industry that is struggling with an overcapacity situation. That is one of the takeaways from a conversation on Thursday with Joey Hogan, president and COO of Covenant Transport (NYSE: CVTI), at the ACT Research Seminar 62 conference in Columbus, Indiana.

Hogan was joined by Kevin Burch, president of Jet Express, as the duo discussed a range of topics from the economy to safety with Tim DeNoyer, vice president and senior analyst at ACT Research.

“From a capacity standpoint, I can paint a picture that it’s going to get really bad in April, the middle of May,” Hogan said. To illustrate, he pointed to the timing of the coronavirus that shut down factories in China right after Chinese New Year had already shuttered facilities. The shutdowns have slowed goods movement from that country.

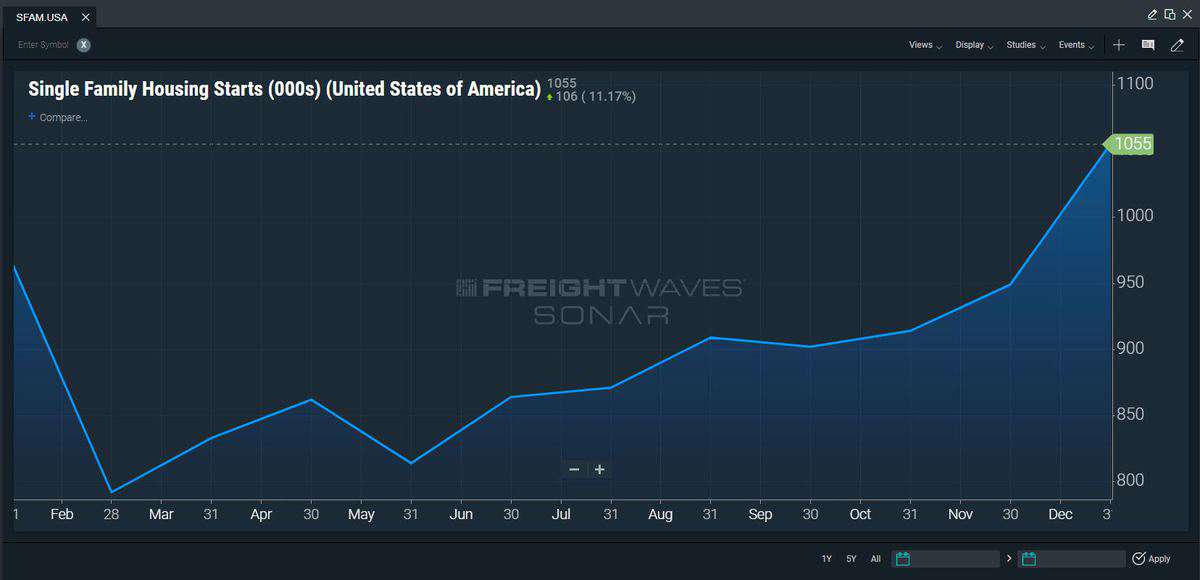

Hogan also pointed to the importance of May 15. That date represents the start of produce season in California. The possibility exists that a capacity surge from the ports could coincide with produce season, straining the supply chain. Carriers will be feeling pressure from all sides — strong housing starts, an economy that is humming along and regulatory pressures from the Drug & Alcohol Clearinghouse and the increase in the random truck driver drug testing rate to 50% this year.

“We think there is going to be some capacity shortages in March or April,” Hogan said.

“I think it’s going to jump from an over[capacity situation] to under very quickly,” Hogan answered later in response to an audience question. “I don’t think there will be an in-between.”

Burch, whose fleet runs automotive parts for the Detroit automakers, focused much of his discussion time on the image of the industry. A former chairman of the American Trucking Associations, Burch relayed several stories, including the time he was cut from a career day at a high school. He now wears an I heart trucks button everywhere he goes.

“I’ve been wearing the I heart trucks button for about 10 years,” he said. “People ask, ‘Why do you do that?’ It gives me an opportunity to talk about trucking.”

Burch said the industry needs to tell its story more often. To illustrate, he said that 10 years ago, he was speaking to a group of about 100 people and asked them to raise their hands if they would promote the industry to their children. “One and a half people raised their hand,” he said. “I say a half because one woman wasn’t sure she wanted to raise her hand. I knew then we had an image problem.”

Fifteen years later, after he was rejected at that career day, Burch was back at the same school and following his presentation, the students voted trucking the second-best career option out of more than 100 presented, he said.

Turning to topics of immediate concern to the industry, both men expressed frustration with insurance rates.

“Insurance is a disaster. It’s a bloody disaster,” Hogan said. “And shippers out there, we need your help. Carriers can’t afford $25,000 a truck, which is what some carriers are getting quoted. They can’t afford $25,000 – some trucks only make $25,000 a year.”

Wages and the lack of drivers also are hot-button issues. Both said there is a driver shortage, despite some who claim the driver shortage is merely an economic problem.

“In 2018, most carriers didn’t do one or two pay increases, they did three or four and then in 2019 things settled down,” Burch said. “But when things pick up again, we’re going to need drivers. We’ve got a good story to tell.”

The driver situation is compounded by the average age of truck drivers in this country: 52. The average age of all U.S. workers is 42, confirming that trucking is having a problem luring younger generations to the job. Burch and Hogan are advocates for allowing 18-year-olds to drive interstate trucks.

“We shouldn’t have state lines that act as an inhibitor for drivers,” Burch said.

The Federal Motor Carrier Safety Administration (FMCSA) had been working on a proposed rule to allow 18-year-old CDL holders to cross state lines. CDL holders can drive intrastate at 18 but not interstate.

“The industry is saying, ‘If you can drive intrastate, why can’t you drive interstate?’ That’s all trucking is asking,” Hogan added.

Burch noted the random drug testing rate, which is now at 50%, and the impact it may have, especially as more states legalize marijuana, which remains an illegal substance for truck drivers who work under federal regulations.

“We want professional people behind the wheel and it’s why with 17 states [legalizing marijuana], you are seeing more [positive tests for] marijuana,” he said.

The FMCSA proposal that would introduce sleeper berth flexibility was praised by Burch and Hogan.

“Once you log in, your clock starts and you can’t stop it, and you have 14 hours to drive 11, and you’re also limited by the 70- and 80-hour rules,” Hogan said. “Who can imagine working 70 hours for 52 weeks straight? What fuels churn? It’s a tough job. We’re not trying to add to the 70 or 80, we don’t want to add hours.”

Burch added that the current hours-of-service rules and the tighter controls that have resulted from the electronic logging device rule have made truck parking worse.

“As we get tighter with the hours of service, and we’re going to mandate our drivers’ hours, don’t you think we need to give them a place to park?” he asked.

Neither executive wanted to wade too far into the AB5 regulation dominating the news in 2020, but Burch did praise owner-operators.

“I consider the owner-operators the backbone of the industry, and there is a need for them,” he said, noting that 90% of the industry operates six trucks or less. “I would say there will continue to be owner-operators. Maybe there will be some push to make them employee drivers or to change the tax laws or eliminate [or add] some deductions.

“We can’t have different work rules in different states,” he added.

Stephen

The only reason there might be a shortage of trucks is the cost of insurance for truck drivers with less than 3 years experience. In Canada right now trucking rates are so low that owner ops have parked trucks and working at construction or in the mines as the oil and trucking are not making money at this time.

CM Evans

There’s a shut down coming people. The tension in this thread is thick. One day soon a couple guys are gonna say screw it and shut down a couple trucks. A few others w/the balls are gonna say why not, let’s do this and momentum will grow. My hunch is it’s not far off, likely during peak season and it will be a couple old hands hauling produce with nothing to lose on their way out the door.

A Driver

Problem here is that driver live paycheck to paycheck and not saving up for a shutdown to actually happen! So theoretically everyone is for it on Facebook, but on the streets, everyone will continue to work to make that paycheck to pay the bills and all the “expensive toys” truck drivers buy, not all, but most are the same…

Stephen Webster

In Canada I have to $3,100 cd a month towards dads on top of his pension check plus a wife in Russia is $750.00 cd per month plus am only able to work some time after a accident over 5 years ago when I was hit from behind by a Ryder truck . So some people including my self can not afford a apartment with the current pay model. The truck drivers spending power is 60 percent of what it was in 1980. I spent money of my fathers medical bills. The insurance company delay in payments cost me use of my right foot and caused me to be homeless.

Noble1 suggests SMART truck drivers should UNITE & collectively cut out the middlemen from picking truck driver pockets ! UNITE , CONQUER , & YOU'LL PROSPER ! IMHO

Wishful thinking . If enough were to shut down then carriers would be racing to fill your positions to fulfill their transportation contracts with clients or go bust .

Two things may occur .

1- Whoever among truck drivers oppose your shut down will become your competition and fill your spot .

2- If certain carriers can’t fill positions quickly enough , carriers with excess capacity will gain market share and a carrier contraction will occur .

Remember , there is no shortage of drivers . Peak season is when demand tends to increase but not enough as in a cyclical peak . We’re years away from another cyclical peak to manifest itself .

I’m certainly not going to share any ideas on how to succeed in shutting down due to disagreeing with such a primitive act , however, it’s entertaining to see some propose it without a plan for a sustainable favourable truck driver change . You better hurry , cause if you want your 15 minutes of fame , autonomous cargo vehicles are right around the corner and your biggest threat yet .

If enough of you do manage to shut down ,Hopefully I’ll be in a position with enough UNITED truck drivers to make a sustainable prosperous move for them to reap from and pick up the slack you primitive thinkers cause , LOL !

Careful , I don’t agree with causing consumer suffering due to our hardship in the industry . If the “Alliance” steps in to pick up the slack to cater to consumer needs , the Alliance will be viewed as a HERO by consumers and government . We’ll have both forces on our side and out number you thousands to 1 (wink)

I repeat , I will not support any shut down in the trucking industry that will cause unrelated victims to suffer , but I’ll certainly take advantage of your primitive attempt , GUARANTEED !

In my HUMBLE opinion …………

LSE

It is time to take Companys that do not pay actual miles, to Court. Wife and I drive. 13,728 unpaid miles every 11 months. This is indisputable fact. This equates to $17,984 the company is stealing from us. Put in simpler terms…….its the same as an individual working 1 year, 40hrs/wk, pay rate 9.37/hrs and then have the Company steal every dime of his hard earned money, this must stop. I have several O/O as well as myself giving our Attorney all this information and documentation for past years. This may lead to a multi-million dollar lawsuit and it should. Enough is Enough.