FreightWaves’ SONAR chart of the week (May 26, 2019 – June 1, 2019)

Chart of the Week: Outbound Tender Rejection Index (USA), DAT Van Freight Rate Index (National) (SONAR: OTRI.USA, DATVF.VNU)

This week SONAR celebrates its one-year birthday. Since its release in late May of 2018 hundreds of data points and indices have been added to the platform, with a release of new data and features almost every week. Without a doubt the flagship index of the platform that has drawn the highest level of interest over the past year has been FreightWaves proprietary Outbound Tender Rejection Index (OTRI) that measures the rate at which carriers reject their electronically tendered freight. With a daily reporting cadence, yesterday’s rejection rates today, the index reveals how loose or tight the freight market is on a near real-time basis. This week, it is telling us Memorial Day week will not be nearly as tight as it has been in years past.

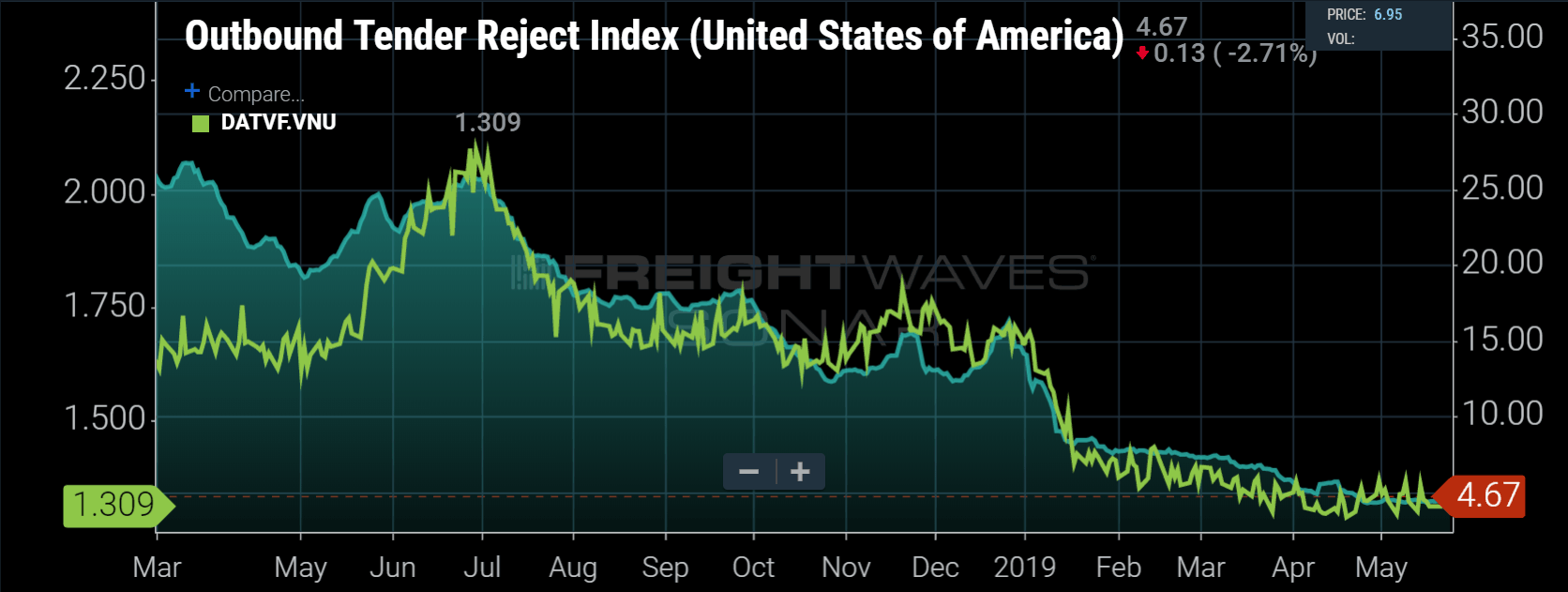

The current value of the national OTRI is 4.67%, falling from 4.8% a day prior. To put this in perspective, this same time last year OTRI was right around 24%, a significant change in market conditions and carrier behavior over the past 365 days. Most people who have been involved in freight and transportation over the past few years would all agree that 2018 was a bit of an anomaly as spot market rates were 25% to 30% higher at times than previous year. The problem with this thinking is it ignores the timing and magnitude of each year’s peaks and valleys.

Looking at the chart of the past year comparing national OTRI to the national DAT Van Freight Rate Index, which measures average spot rates for dry van truckload moves not including fuel surcharges and other assessorial charges, we can clearly see a seasonal rhythm as spot market and tender rejection rates surge in June and fall steadily until Thanksgiving and Christmas.

These patterns have been ingrained in transportation managers’ and freight brokers’ heads as the gospel truth every year. They are correct for the most part, but what they cannot tell is how big of an impact produce season will have on national capacity or what is this year’s holiday shipping impact. This Memorial Day appears to be no more than a blip on the radar in comparison top previous years.

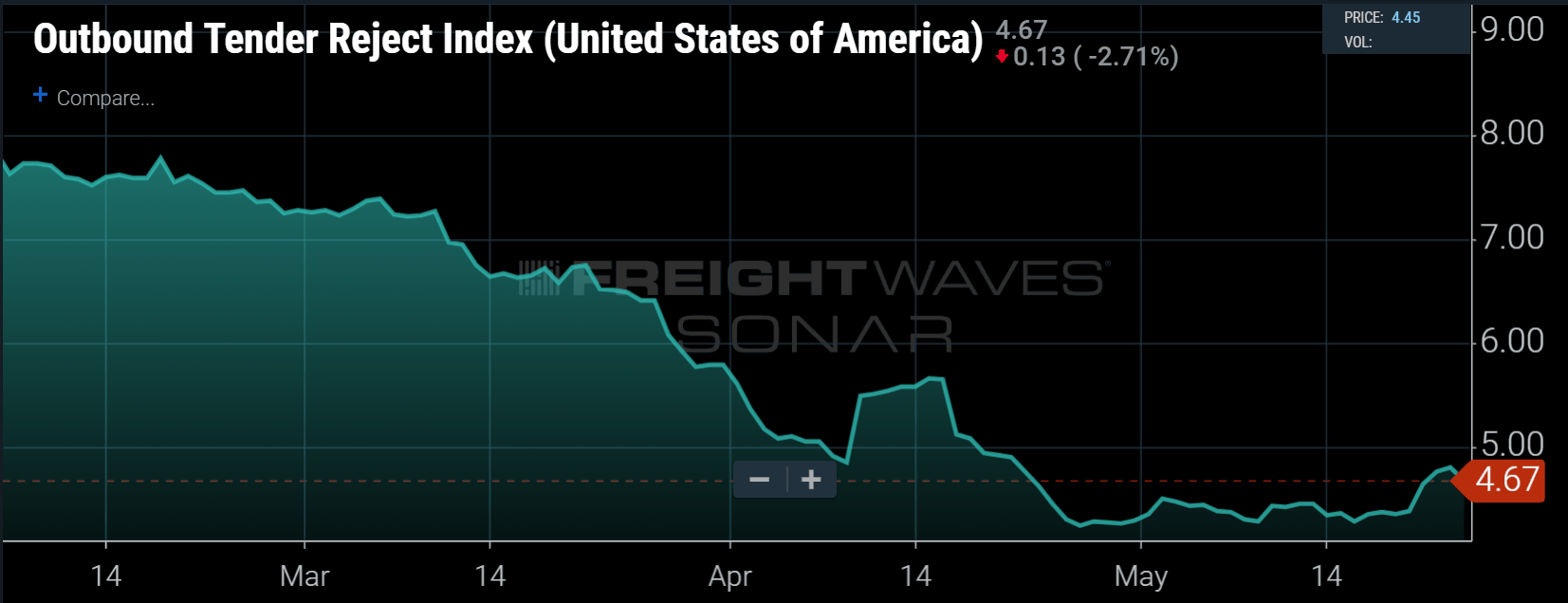

Tender rejection rates started increasing in the beginning of May in 2018, rising from 19.17% on May 2nd before hitting a peak of 24.69% on May 27th, the day before Memorial Day. This year rejection rates dropped from 4.5% on May 2nd to 4.38% on May 20th, hovering up and down incrementally. On May 21st rejection rates jumped 26 basis points (bps) to 4.64%, its largest daily upward movement since a mid-April jump when it increased from 4.85% to 5.49% in a single day as Easter approached.

Spot rates have been trying to increase since the end of April but have failed to have a breakout moment thus far. Looking at the recent OTRI movement we can anticipate some upward rate pressure surrounding the holiday, but it will not be the 10% to 15% jump we saw last year.

One thing that separates OTRI from spot market rates is the fact it is reporting on carrier actions and not a broker or carrier’s attempt to judge the market by increasing a proposed rate to see if someone will take it. This year, carriers are accepting more loads entering peak season than they did in February. With volumes falling off a cliff earlier in the month, carriers are realizing they need to take advantage of any potential freight they can find, even on a holiday.

Have a safe and happy Memorial Day and thanks to all the veterans who fought and served our country.

About Chart of the Week

The FreightWaves Chart of the Week is a chart selection from SONAR that provides an interesting data point to describe the state of the freight markets. A chart is chosen from thousands of potential charts on SONAR to help participants visualize the freight market in real-time. Each week the Sultan of SONAR will post a chart, along with commentary live on the front-page. After that, the Chart of the Week will be archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presenting the data in charts and maps and providing commentary on what freight market experts want to know about the industry- in real time.

The FreightWaves data-science and product teams are releasing new data-sets each week and enhancing the client experience.

To find out more about SONAR go here or to setup a demo click here.