This week’s FreightWaves Supply Chain Pricing Power Index: 40 (Shippers)

Last week’s FreightWaves Supply Chain Pricing Power Index: 35 (Shippers)

Three-month FreightWaves Supply Chain Pricing Power Index Outlook: 40 (Shippers)

The FreightWaves Supply Chain Pricing Power Index uses the analytics and data in FreightWaves SONAR to analyze the market and estimate the negotiating power for rates between shippers and carriers.

This week’s Pricing Power Index is based on the following indicators:

Volumes falling ahead of the holiday

The truckload market is experiencing the seasonal drop in volumes. Both Christmas and New Year’s fall on Wednesdays this year, creating the earlier slowdown in volumes. The drop in volumes is expected and there will be a rebound after the first of the year. The questions that remain are, how significant is the recovery at the beginning of the year, and how substantial are the seasonal pressures that impact volumes during the first quarter?

To learn more about SONAR, click here.

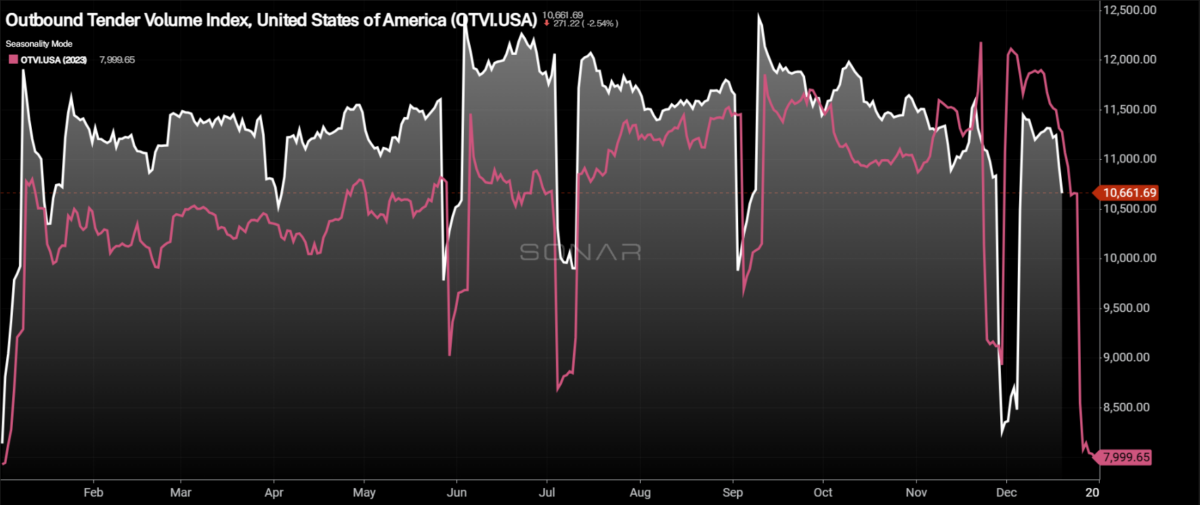

The Outbound Tender Volume Index (OTVI), a measure of national freight demand that tracks shippers’ requests for trucking capacity, has dropped significantly over the past week, falling by 5.4% week over week. Compared to this time last year, tender volumes are down 2.43%. Until the holidays clear, the volume picture will be murky, but based on current levels, it appears that barring a significant weather event, volumes will likely be softer in January.

Volumes across the all levels of the mileage band are down over the past week, but long-haul volumes had the least significant decline. Long-haul volumes, or loads moving more than 800 miles, fell by 2.1% week over week, whereas the shortest length over haul, local, or loads moving less than 100 miles, fell by 11.1%. Even with the drop, local volumes are up 5.4% y/y while long haul volumes are down 7.1%.

To learn more about SONAR, click here.

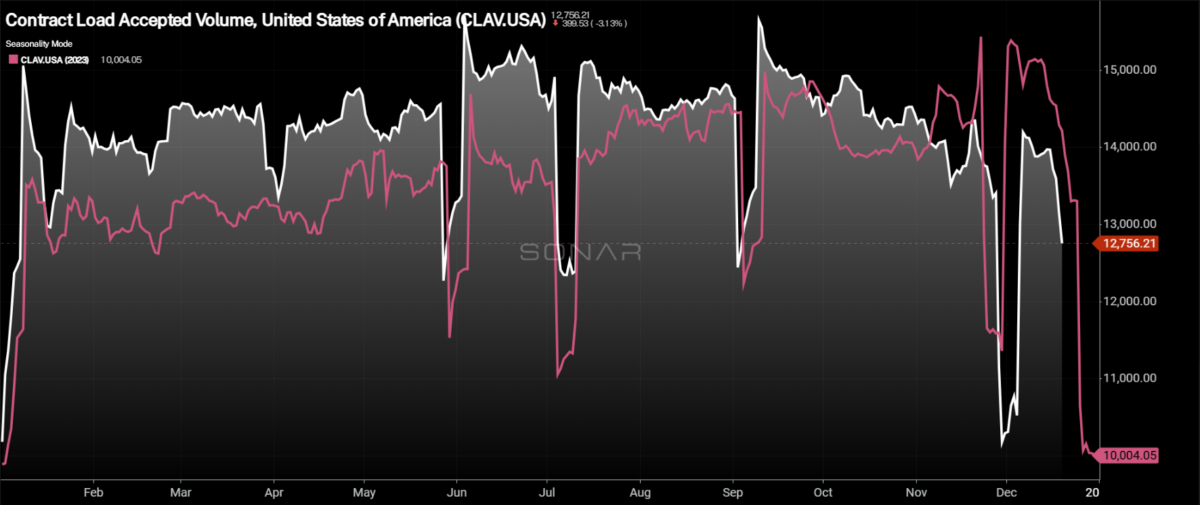

Contract Load Accepted Volume (CLAV) is an index that measures accepted load volumes moving under contracted agreements. In short, it is similar to OTVI but without the rejected tenders. Looking at accepted tender volumes, the recovery is far less pronounced, rising 6.9% over the past week, driven by an upward movement in tender rejection rates. Compared to this time last year, CLAV is down 6%.

November’s retail sales data is set to be released later this week, but early reads on spending in November were strong. Bank of America’s card spending report showed that spending was up 0.6% year over year in November. Even with the late Thanksgiving holiday that pushed Cyber Monday into December, expectations are for sales to grow by 0.5% m/m.

To learn more about SONAR, click here.

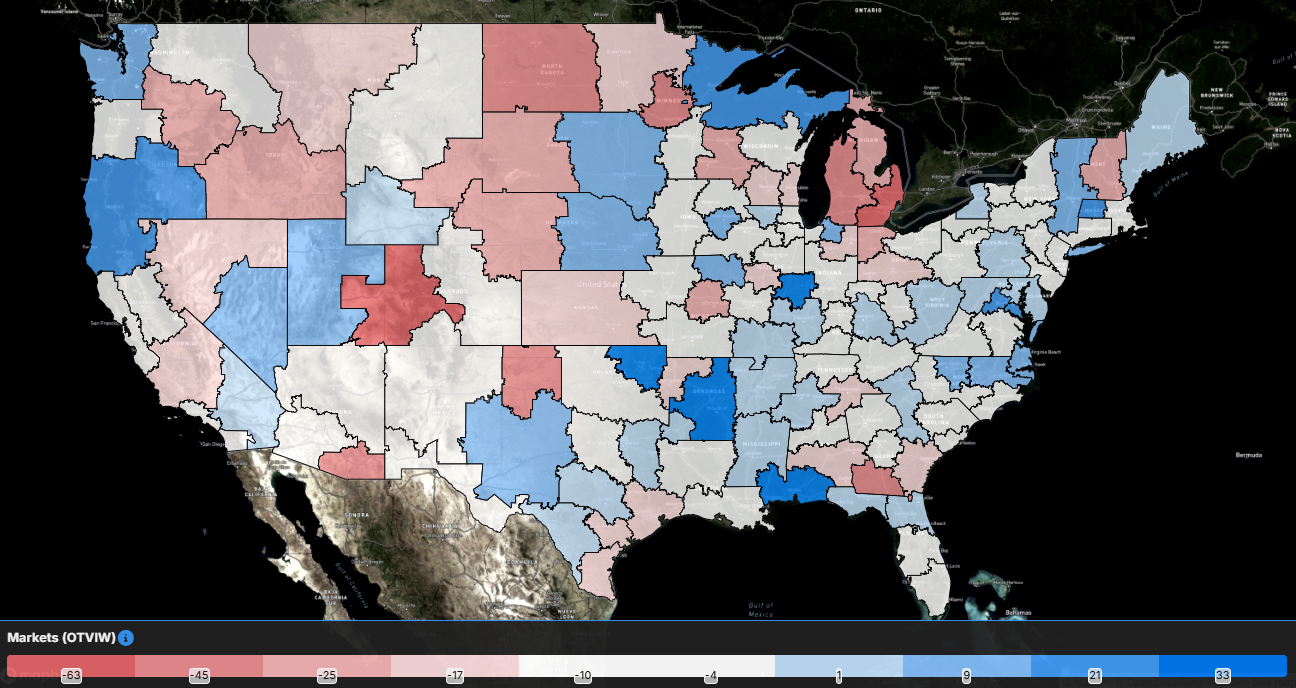

With the significant slowdown in volumes at the national level, the vast majority of markets have experienced lower volumes over the past week. Of the 135 freight markets tracked within SONAR, 47 have seen tender volumes increase over the past week, down from 108 in last week’s report.

The largest markets in the country have seen volumes increase over the past week, including the major Southern California markets. In Ontario, California, tender volumes increased by 4.17% over the past week. Farther east in Dallas, tender volumes increased by 3.56%.

It wasn’t all positive for the largest markets in the country. The Atlanta market saw volumes fall 2.34% over the past week, and in Chicago volumes were 6.3% lower w/w.

To learn more about SONAR, click here.

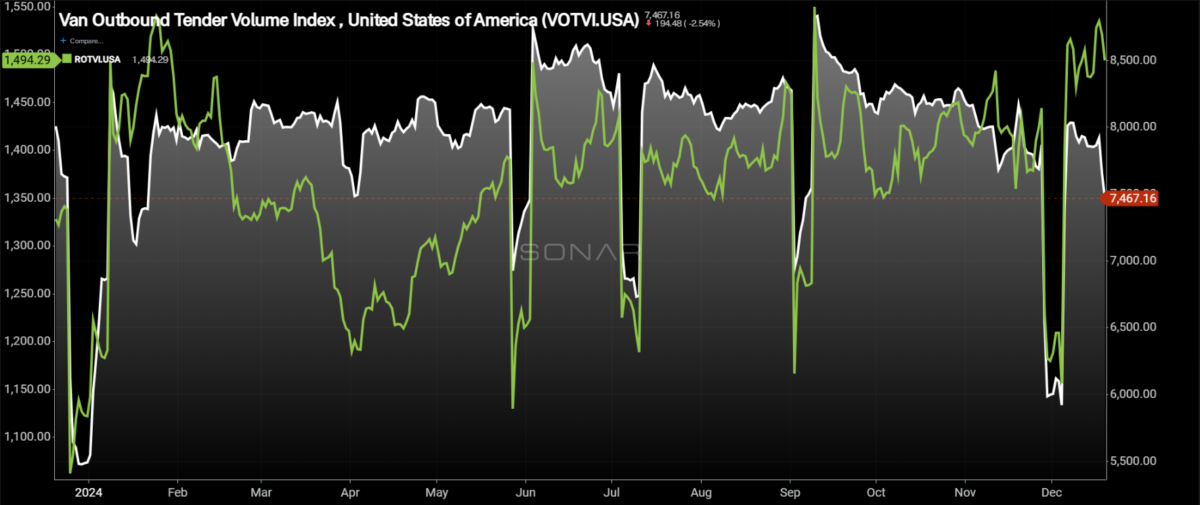

By mode: The dry van market was leading the way lower over the past week. The Van Outbound Tender Volume Index fell by 5.8% during the past week to the lowest level of the year excluding holidays, though a holiday is impacting this week’s decline. Compared to this time last year, dry van volumes are down 5.5%.

The reefer market’s decline in volume is far less severe than that of the dry van market, at least this week. The Reefer Outbound Tender Volume Index declined by just 0.7% over the past week. Reefer tender volumes remain well above where they were this time last year, currently up 13%.

Tender rejection rates surge to highest level in more than 2 years

The capacity side of the market is seeing the first significant reaction to holidays in more than two years as tender rejection rates have been soaring over the past week. The positive sign for the market is that the increase in rejection rates is widespread, not isolated.

To learn more about SONAR, click here.

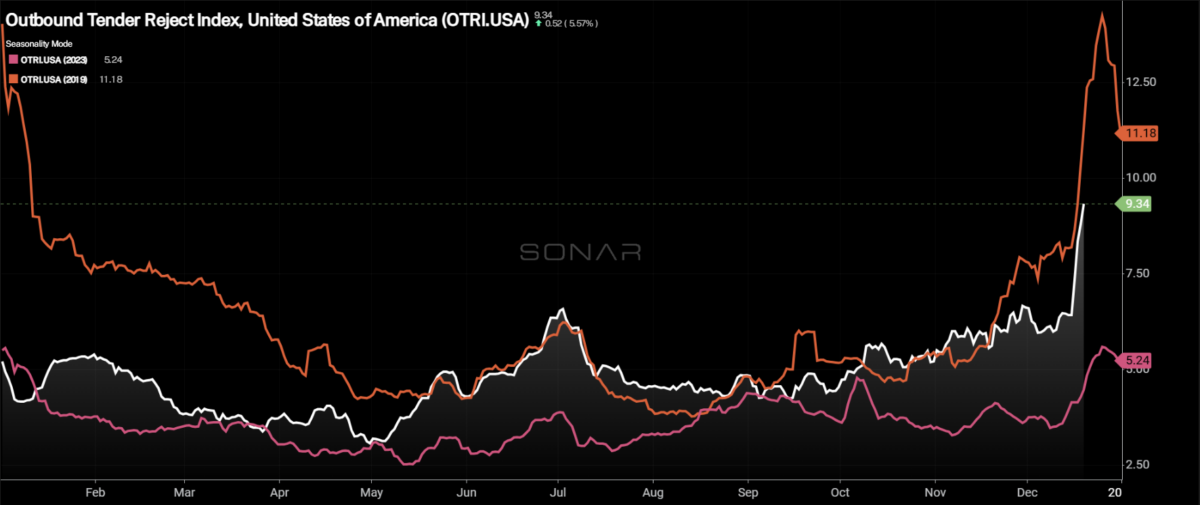

Over the past week, the Outbound Tender Reject Index (OTRI), a measure of relative capacity, rose by 286 basis points to 9.34%. The OTRI is 449 basis points higher than it was this time last year, a sign that the market is tighter now than it was then. The increase over the past week is similar to what happened in 2019, showing signs that 2025 will be a tighter environment, especially after the beginning of the first couple of months, when seasonal weakness will likely appear.

To learn more about SONAR, click here.

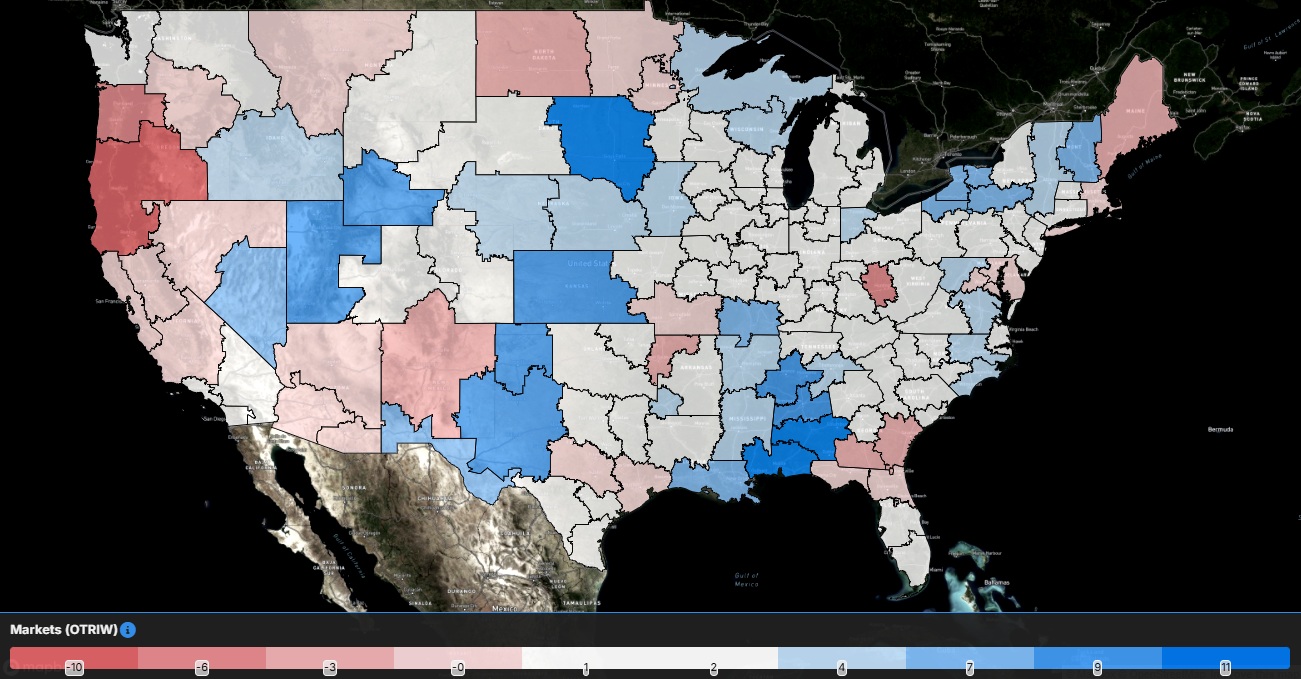

The map above shows the Outbound Tender Reject Index — Weekly Change for the 135 markets across the country. Markets shaded in blue and white are those where tender rejection rates have increased over the past week, whereas those in red have seen rejection rates decline. The bolder the color, the more significant the change.

Of the 135 markets, 121 reported higher rejection rates over the past week, up from the 88 that saw tender rejection rates rise in last week’s report.

All of the largest markets in the country have experienced increases over the past week, with the Chicago market experiencing the largest increase of the week. Rejection rates in the Chicago market increased by 367 bps over the past week, eclipsing 10%.

Across the country, tender rejection rates in Los Angeles increased by 256 bps, in Dallas they were up 252 bps, in Atlanta they increased by 340 bps and in Harrisburg, Pennsylvania, they rose 216 bps. This week marks the first time in multiple years when all the largest markets in the country moved significantly higher at the same time.

To learn more about SONAR, click here.

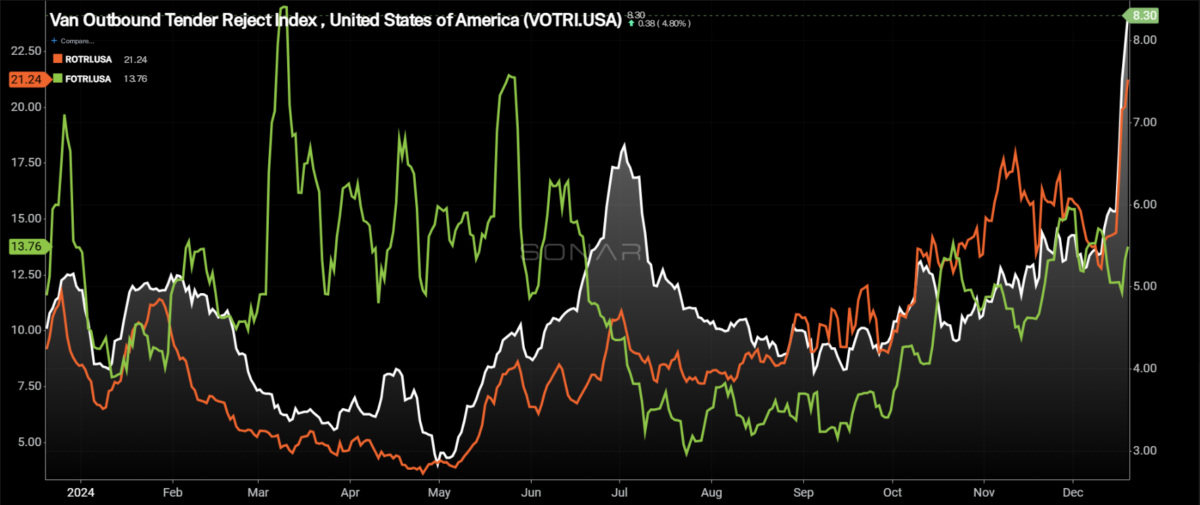

By mode: The dry van market had lagged behind the reefer market in terms of tender rejection rates rising, but the past week has been a positive sign for the dry van market. The Van Outbound Tender Reject Index increased by 243 basis points over the past week to 8.3%. Dry van rejection rates are 362 bps higher than they were this time last year.

The reefer market has continued to tighten as reefer rejection rates have now eclipsed 20%. The Reefer Outbound Tender Reject Index increased by 704 bps over the past week to 21.24%. Reefer rejection rates are more than double what they were this time last year, up 1,153 bps.

Flatbed tender rejection rates provide insight into the market that is more project-based, and the Federal Open Market Committee’s release of future projections suggested fewer cuts to the federal funds rate in 2025 than previously expected. That would create a potential challenge for future flatbed projects in 2025 and beyond, but flatbed rejection rates showed some signs of life this week. The Flatbed Outbound Tender Reject Index increased by 80 bps over the past week to 13.76%. Compared to this time last year, flatbed tender rejection rates are up 132 bps.

Spot rates remain elevated heading into the holiday weeks

Spot rates retreated from the peak experienced last week, but the recent upward trend set the baseline higher for the next two weeks. Spot rates will likely move significantly higher over the next two weeks and help set the stage for what’s to come in 2025.

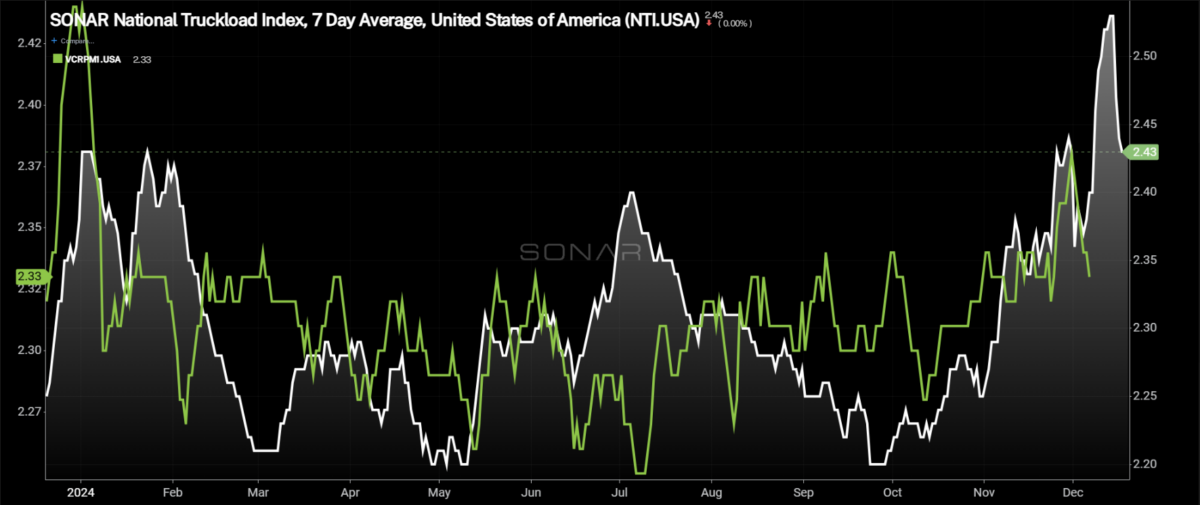

To learn more about SONAR, click here.

The National Truckload Index – which includes fuel surcharge and various accessorials – fell by 9 cents per mile to $2.43. The NTI is 18 cents per mile higher than it was this time last year, but given the move rejection rates made over the past week, it is likely the gap will widen during the next week. The linehaul variant of the NTI (NTIL) – which excludes fuel surcharges and other accessorials – experienced a slightly smaller decline than the overall NTI, falling 8 cents per mile to $1.89. The NTIL is 27 cents per mile higher than it was this time last year, showing how the underlying rate has moved over the past year.

Initially reported dry van contract rates, which exclude fuel, fell off their recent Thanksgiving high, returning to the range they have been in for much of the year. The initially reported dry van contract rate, excluding fuel, fell by 2 cents per mile over the past week to $2.34. Contract rates are 2 cents per mile higher than they were this time last year. With the responsiveness in rejection rates and spot rates, contract rates will likely increase in 2025.

To learn more about SONAR, click here.

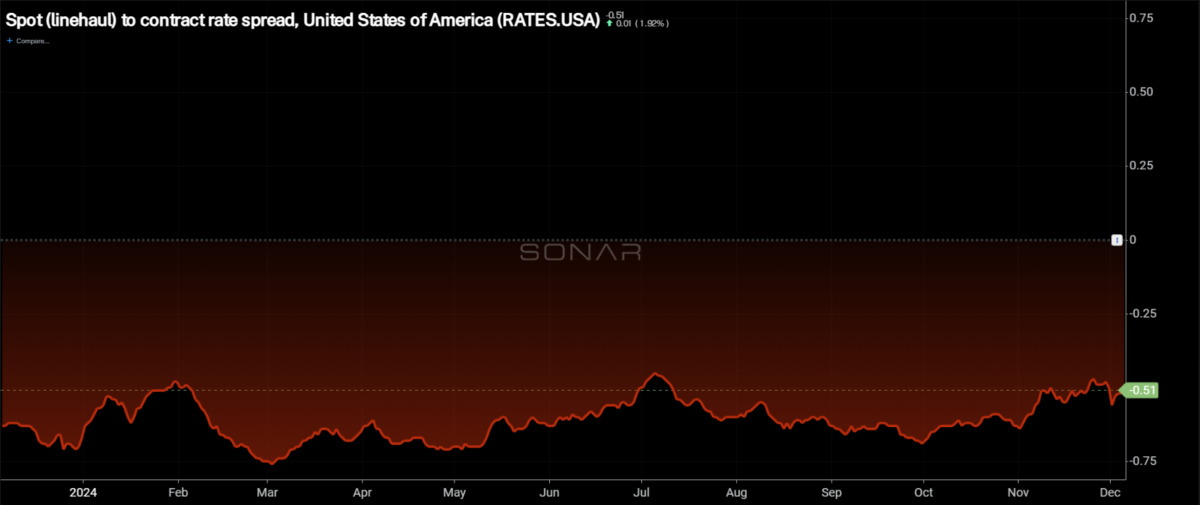

The chart above shows the spread between the NTIL and dry van contract rates is trending back to pre-pandemic levels. The spread remains wide, but with the recent pullback by spot rates of the highs and contract rates remaining fairly stable, the spread widened over the past week to 51 cents. With that said, the spread is 12 cents narrower than it was this time last year. As the spread continues to narrow, the market will feel significantly tighter, especially in lanes where the spread between contract and spot rates is significantly narrower than the national average.

To learn more about SONAR, click here.

The SONAR Trusted Rate Assessment Consortium spot rate from Los Angeles to Dallas continued its increase this week. The TRAC rate from Los Angeles to Dallas increased by 2 cents per mile to $2.77. Spot rates along this lane are 28 cents per mile above the contract at present, which is why rejection rates out of Los Angeles are on the rise, now above 7.5%.

To learn more about SONAR, click here.

From Chicago to Atlanta, spot rates have been volatile, but they really haven’t moved significantly since the beginning of November. The TRAC rate for this lane decreased over the past week by 2 cents per mile to $2.67. Spot rates are 14 cents per mile below the contract rate, but that spread is at a level at which spot rates offer optionality for carriers and can make the market feel tighter for shippers than it was just a few months ago when the spread was in the 40-cent range.