Carriers forced to do more with less in lieu of market upswing

At last week’s annual FTR Transportation Intelligence conference in Indianapolis, industry leaders and market experts offered sometimes painful commentary on the current and future state of the freight industry. One topic was the impact of continued softness in the spot market. Despite 2024’s poor performance, 2025 is expected to bring growth. Avery Vise, vice president of trucking at FTR, expects truckload spot rates to increase 6.5% to 7% in 2025 compared to 1% overall in 2024. Contract rates are predicted to rise 3% after falling 3.5% in 2024.

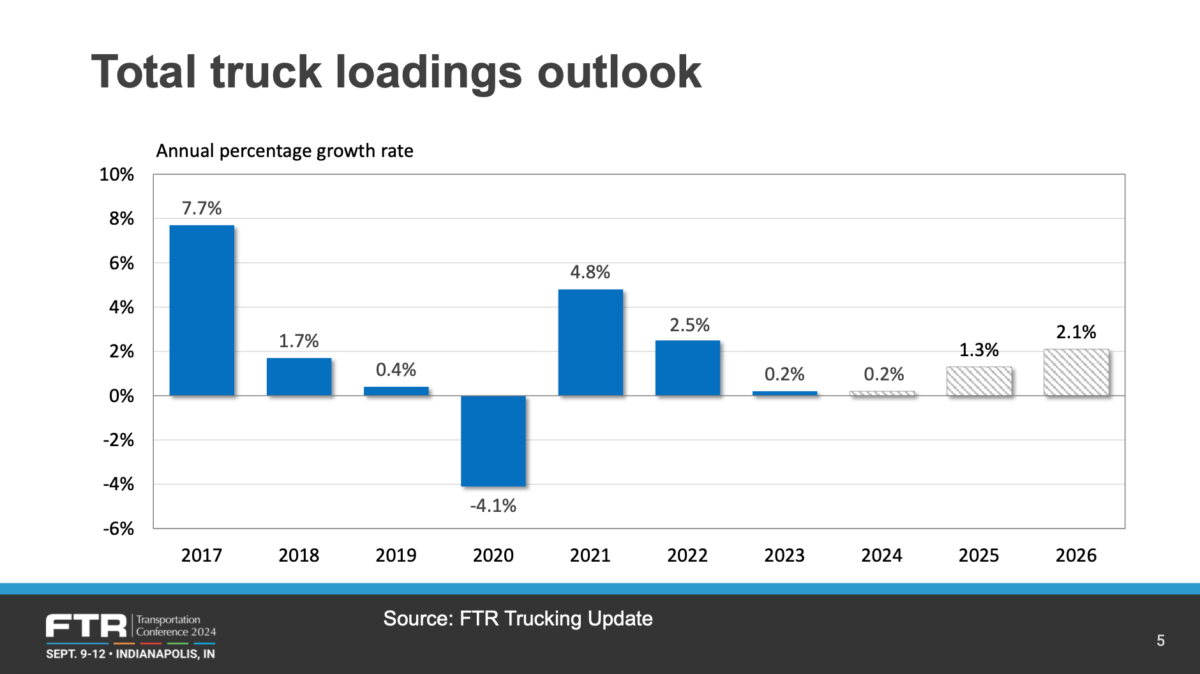

Vise expects truckload volumes to rise next year in the dry van and reefer segment, compared to 0.2% overall in 2024. For next year, Vise expects dry van loadings to increase 1.5% while reefer loadings are estimated to rise to 2.6% in 2025.

One standout issue at the event was whether we’re in a recession of freight or rates. Eric Starks, chairman at FTR Transportation Intelligence, believes the latter. James Menzies wrote at TruckNews.com that Starks preferred to call it a rate recession, as trucking rates are being impacted not due to falling freight demand, but from excess truckload capacity that continues to exit the market at a slow rate. Additionally, analysts believe it will require both more freight volumes and less truckload capacity, with the current rate of capacity decline not sufficient enough to move the needle.

In the meantime, absent a sustained market upswing, fleet strategies involve doing more with less and optimizing existing operations. For shippers, stability in the truckload space allows them to focus on the less-than-truckload segment, which is still in flux after the demise of LTL carrier Yellow. Yellow’s approximately 150 former terminals, 12,700 tractors and 42,000 trailers found new owners following a court-ordered auction. The Home Depot was noted at the conference to have paused bidding on its next annual contract as it waits for the dust from Yellow’s demise to settle. Part of that stems from Yellow formerly being the No. 2-ranked carrier for Home Depot.

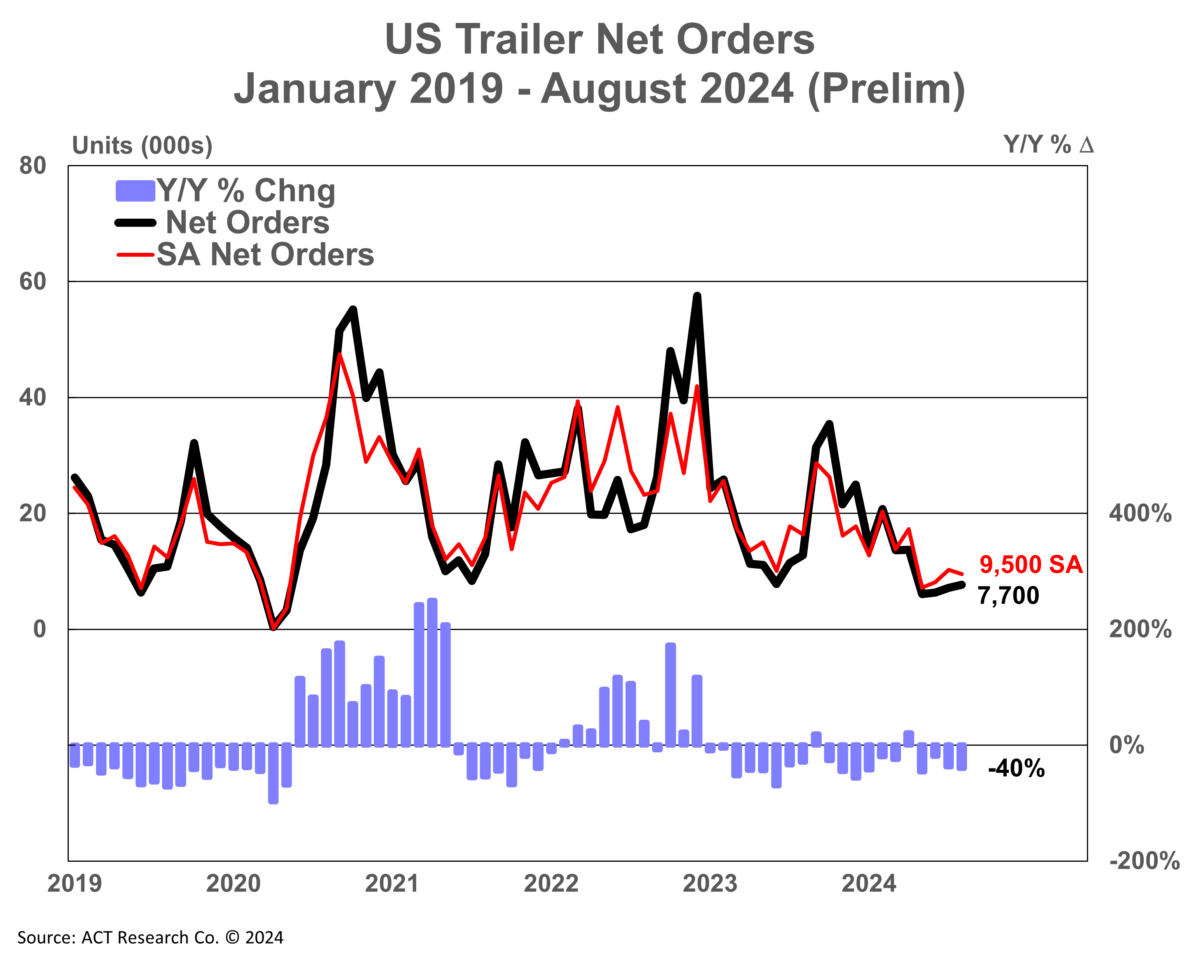

August preliminary net trailer orders fall 40% year over year

Following seasonally weak order numbers in the Class 8 space, trailer orders in August also saw large year-over-year declines as cash-strapped fleets hit the pause button on new equipment orders. Recent data from ACT Research shows preliminary net trailer orders increased 500 units from July to 7,700 units, an improvement, but 40% lower y/y than August 2023. August’s data brings year-to-date U.S. trailer net orders to 89,400 units, down 27% compared to the first eight months of 2023.

Jennifer McNealy, director of CV market research and publications at ACT Research, said, “Despite the sequential order improvement, August data continue to bear witness to our expectations of weaker demand against the backdrop of elevated order velocity the past few years, continuing weak for-hire truck market fundamentals, and already-filled dealer inventories. That said, it is important to remember that for orders, we remain in the weakest months of the annual cycle, suggesting stronger orders weren’t expected in August. An order uptick showcasing demand, or the lack thereof, depends on the next few months as OEMs open, or more fully open, their 2025 books.”

McNealy added that based on anecdotal industry conversations, this “pause button” is expected to remain throughout 2024, with growing concerns over the size of 2025 orders, when order books open up beginning in September. She adds the timing and size of 2025 order bookings remain a wildcard, with the current levels of elevated cancellations and lower backlogs not seen since late 2013.

Market update: Cass Freight Index and the ‘Dog Days’ of August

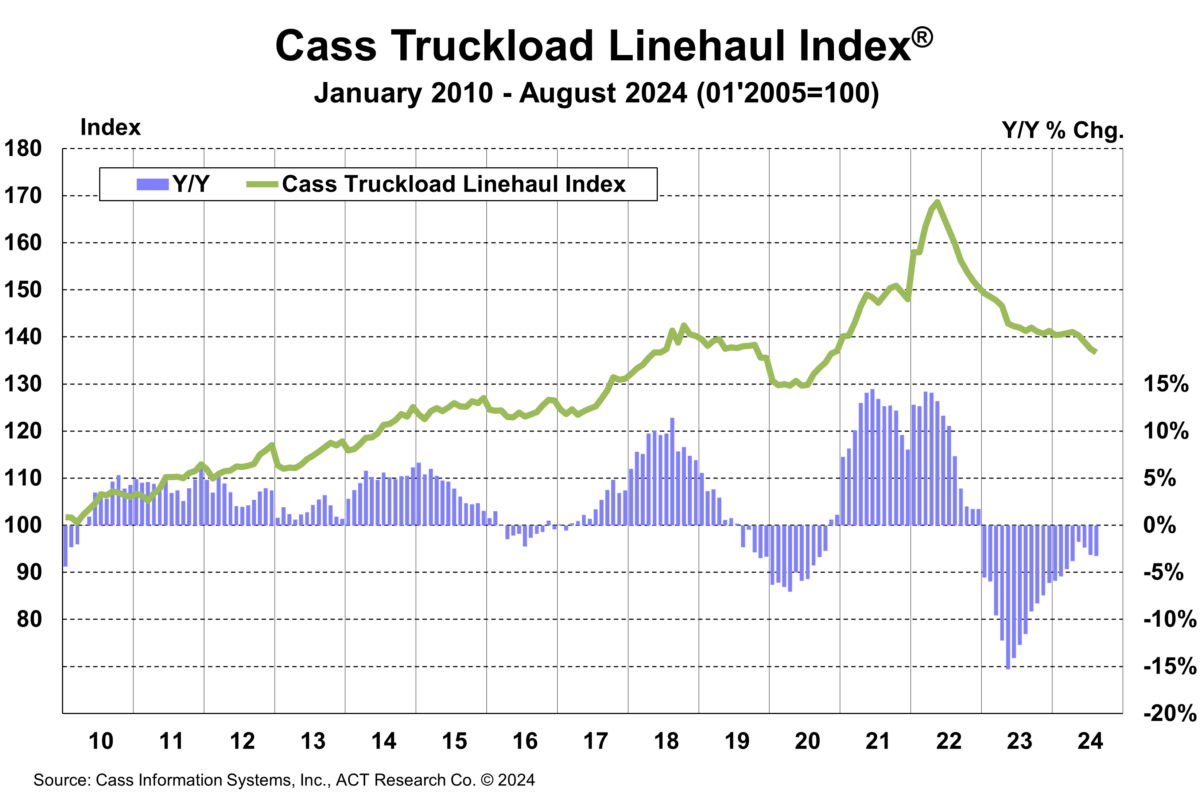

Freight audit and payment provider Cass Information Systems’ recently released August Cass Freight Index showed an uptick in shipments but declines in freight expenditures, inferred freight rates and its truckload linehaul index. The report, titled “Dog Days” saw its shipment index increase 1% m/m in August compared to a 3% m/m gain in July.

Tim Denoyer, vice president and senior analyst at ACT Research, wrote in the report, “These were the smallest declines in 18 months as goods demand continues to grow slowly, and slowing capacity additions reduce the pressure on for-hire shipments.”

Another standout came from the Expenditures Index, which fell 2% m/m in August, down 9% y/y versus a 6.2% y/y drop in July. The Cass Truckload Linehaul Index, which includes both spot and contracted freight, saw its fourth straight month of declines, falling 3.3% in August versus 3.2% m/m in July. Denoyer added, “With spot rates steady over the past year, downward pressure on the larger contract market is lessening, but recent slight increases in spot rates are not yet enough to turn contract rates higher.”

Providing context, FreightWaves’ Todd Maiden writes: “The update from Cass appears to be in line with comments from trucking heads at an investor conference held last week. Some of the nation’s largest truckload carriers like Schneider National and Werner Enterprises said the industry is still coming out of a protracted recession and that there has been no market inflection, just normal seasonal demand trends.”

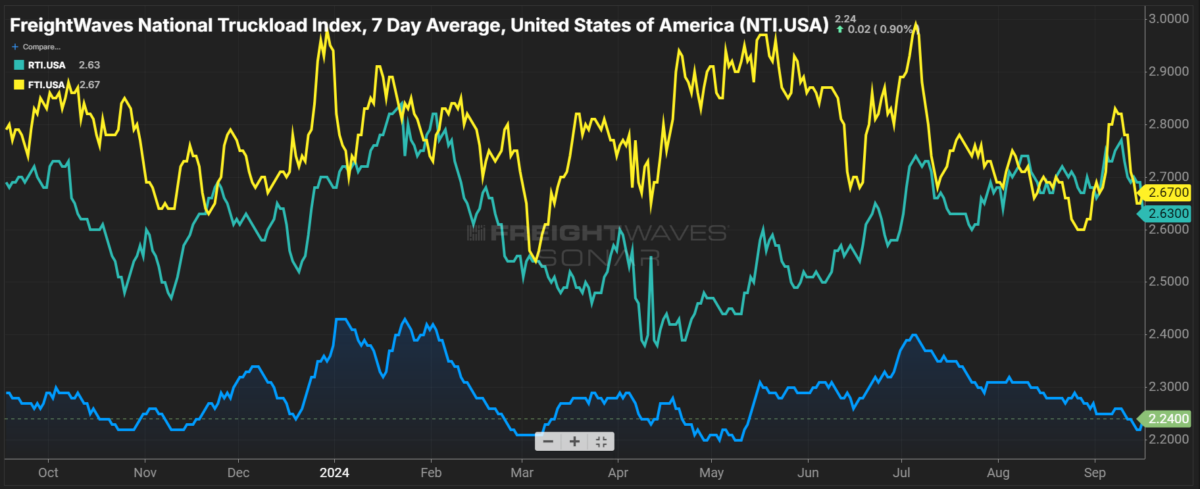

FreightWaves SONAR spotlight: Reefer and flatbed spot rates cross streams

Summary: Following months of separation, reefer and flatbed spot market rates appear to have crossed streams, erasing a divergence as the impacts of produce season buoy reefer spot rates. Luckily for the freight market, the “Ghostbusters” rule – laid out when Harold Ramis tells Bill Murray “It would be bad” to cross the streams – does not apply. Unfortunately for the freight market, it could use a total protonic reversal as the glut of truckload capacity continues to drag out a yearslong down cycle.

Looking at reefer and flatbed in the context of the dry van segment, Labor Day brought about much-needed seasonal volatility versus continued degradation for dry van spot rates. Despite the Labor Day bounce, though, the return of capacity across all equipment types to the market sent spot rates lower compared to this time last week.

The largest weekly decline came from the flatbed segment, with FTI falling 15 cents per mile all-in from $2.82 on Sept. 9 to $2.67. Contracted outbound tender rejection rates remain depressed, down 6 basis points w/w from 5.6% to 5.54%.

The reefer segment was the second-largest decline. RTI fell 14 cents per mile all-in w/w from $2.77 on Sept. 9 to $2.63. Despite the spot market loosening, capacity on the contracted side appeared to tighten in the past week, with reefer outbound tender rejection rates climbing 139 bps w/w from 9.64% to 11.03%.

Lastly, for the dry van segment, the final weeks of summer bring continued doldrums but fewer declines, with NTI spot rates falling 2 cents per mile all-in w/w from $2.26 to $2.24 per mile. Not to be outdone, the van contracted space also saw a slight decline. VOTRI was down 6 bps w/w from 4.31% to 4.25%.

The Routing Guide: Links from around the web

RXO completes $1B acquisition of Coyote Logistics (FreightWaves)

Survey finds top truck stop amenities ensuring safety for female truck drivers (Land Line)

Report: Biden won’t block dock strike (FreightWaves)

What would a Fed rate cut mean for trucking? (Fleet Owner)

A Trucking Recovery Is Slipping Further Into the Future (Bloomberg)

How Aifleet is Growing with its AI-Driven Approach to Trucking (Heavy Duty Trucking)

Stephen Webster

In Canada we are seeing companies drop long time higher paid drivers in larger fleets that self insure often through a captive. They are being replaced with foreign students that become truck drivers and dispatch is being sent overseas to lower wage countries.. Large numbers of small trucking companies are shutting down

.I am seeing record high numbers of people loosing their housing in the transport field

I also seeing truck and trailer maintenance not being done .We do not want to become a Cuba but we need to request all foreign truck drivers in Canada pass a level 5 English or French test except those that come for a 8 month term of April to Nov to haul agr goods no hazmat under 500 km no cross border and not into Toronto or Vancouver in my opinion