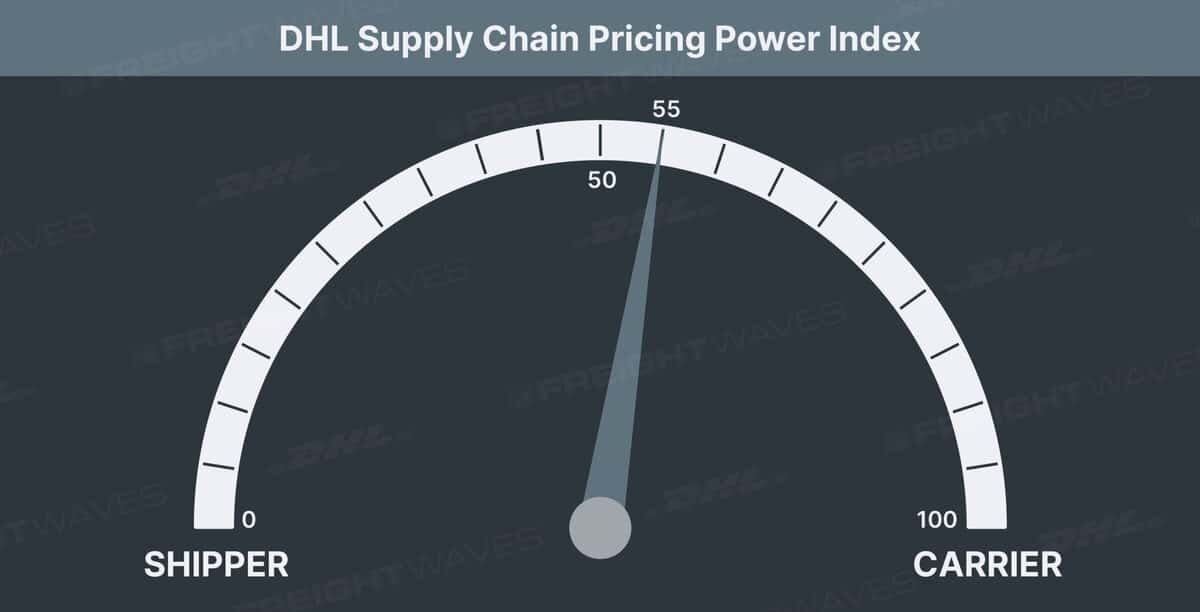

Weekly DHL Supply Chain Pricing Power Index rises to highest level in recorded history

The DHL Supply Chain Pricing Power Index has swung dramatically in favor of carriers. The Index uses the analytics and data contained in FreightWaves SONAR to analyze the market and estimate the negotiating power for rates between shippers and carriers.

The impact of COVID-19 on the current freight environment has significantly moved the needle in pricing power, shifting from a reading of 40 last week to 55 this week. Anything over 50 indicates carriers have leverage in negotiations while anything below 50 suggests shippers have the advantage.

The DHL Supply Chain Pricing Power Index is based on load volumes, tender rejections, spot rates, and economic statistics.

Why carriers have an edge

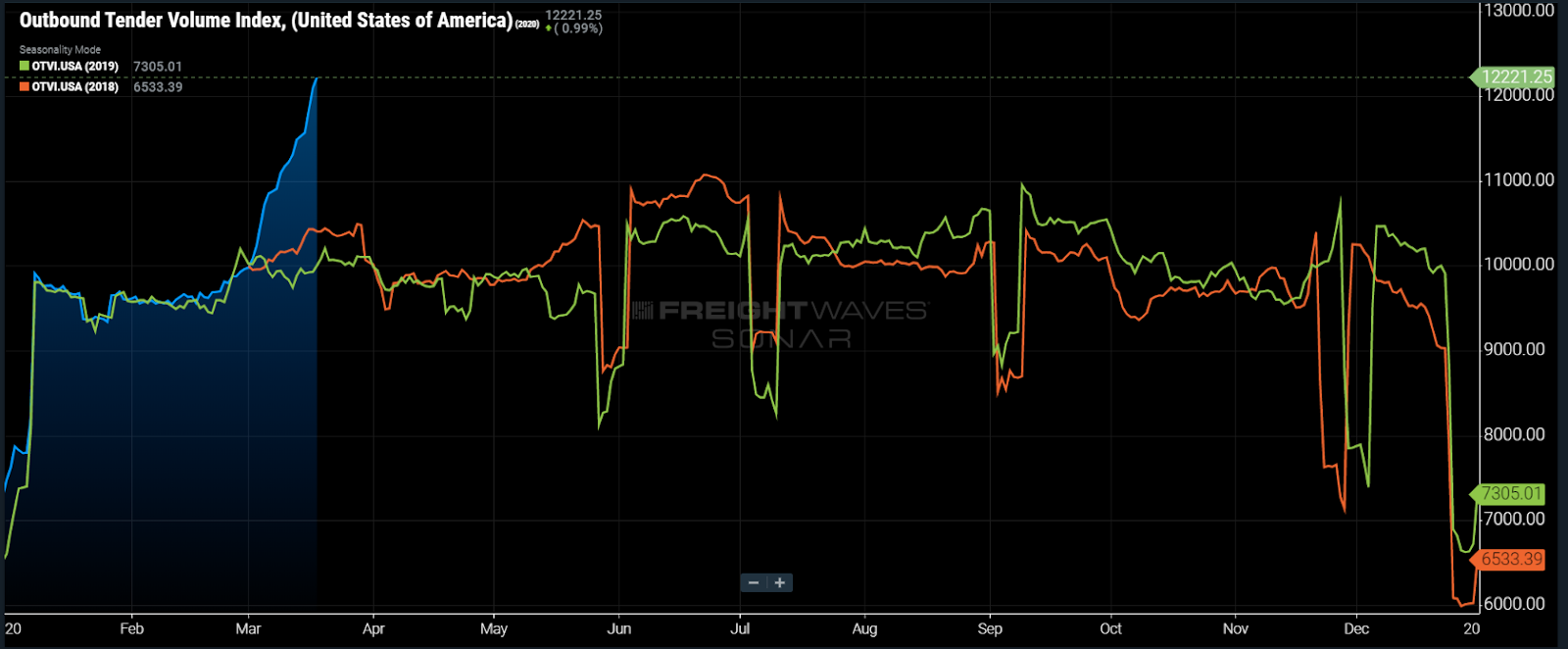

Domestic freight volumes are more than 10% higher than the 2018 summer peak, and capacity is near Christmas holiday levels. Spot rates are flying to the upside and carriers have entered a dominant pricing power position for the first time since the first publication of the Index in September 2019.

Panic-buying is continuing to create an unprecedented surge in domestic freight volumes. The outbound tender volume index is now at 12,221.25, which is over 8% higher than last week. This is by far the highest point in the three-year history of OTVI. Not only are volumes spiking higher, but they are spiking higher at a faster rate. In the past three weeks we have seen volumes increase 6% then 7% and now 8% this week. Year-over-year comparisons are almost becoming meaningless — OTVI is up nearly 20% since this time last year.

This demand spike is almost solely from panic-buying and restocking of shelves. Outbound volumes are above the 2018 peak (one of the best years in recent freight history) by nearly 10%. Shippers, especially those moving consumer packaged goods (CPG) are at the mercy of their carriers. At this time, shippers feel they cannot move freight fast enough, and for many of them the high spot rate markets are the only option. As more restaurants and businesses close, OTVI will flatten and begin returning to normal levels in the coming weeks.

Outbound tender rejections have risen strikingly over the past week. OTRI currently sits at 13.74%, which is just under Christmas Day highs of 14.25%. A value this high is indicative of two happenings: Drivers are rejecting contract loads in favor of higher spot market rates, and some drivers have left the market altogether (for now).

Last week OTRI was just over 8% and we believed then carriers were in a strong pricing power position. That number has nearly doubled and is likely to go higher as the virus persists over the coming weeks.

Time will tell whether the coronavirus impacts capacity disproportionately. Poor health, diet and lifestyles of drivers are well-known in the U.S. It is possible that drivers will be disproportionately affected by the virus. COVID-19 has the potential to wipe out a sizable portion of trucking capacity before it is contained.

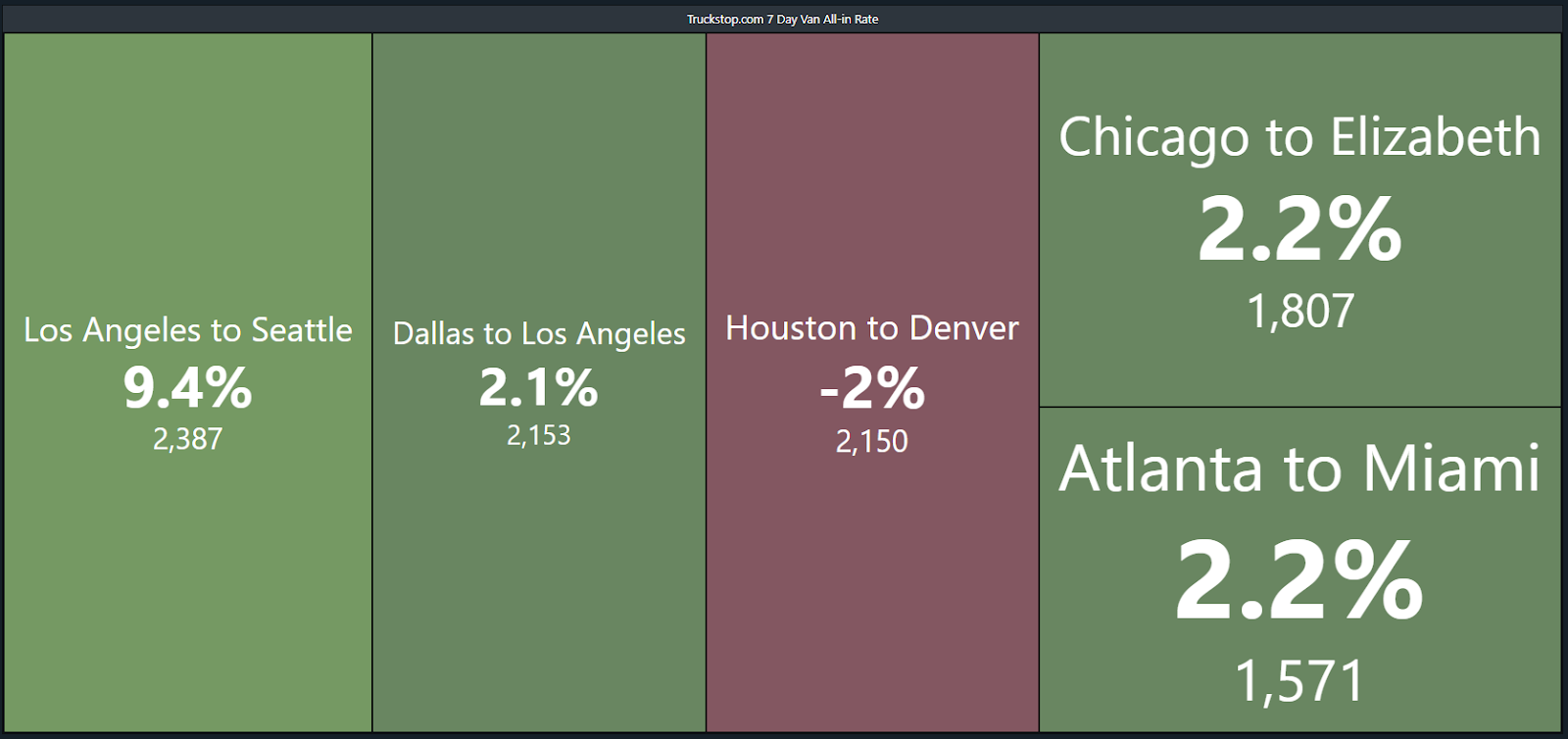

The changing supply-and-demand dynamics are beginning to show in the Truckstop.com data in SONAR. More than two-thirds of the 100 lanes provided to us by Truckstop.com have increased over the past week with almost 10% of markets up by double digits. Volumes continue to flow at an unprecedented rate and carriers and brokers are taking advantage by bidding up spot market rates. Rates will continue to rise until volumes level off and drivers get back on the road. This is likely a trend that will continue into April.

Economic stats: Momentum and absolute level positive for shippers

Backward-looking economic data is relatively useless at this point. Nonetheless, several economic data releases this past week are worth examining.

The most real-time indicator is weekly claims for jobless benefits, which came out Thursday. The initial feedback is not looking good. Initial jobless claims spiked 33% last week to 281,000 from 211,000 a week earlier. Many economists now expect the unemployment rate (SONAR: UEMP.USA) to double or more from the recent 50-year low of 3.5%. Last week’s 33% jump in initial jobless claims was greater than any weekly jump seen even during the financial crisis of 2008-2009. One notable economist is calling for jobless claims to jump tenfold to 2 million next week, which would be unprecedented.

Retail sales are beginning to show cracks as well. In February, retail sales fell 0.5% month-over-month, and this was before COVID-19 was a global pandemic and many Americans were forced to work from home while many retailers shut their doors. The decline was led by autos, which fell 0.9%.

Also, the Federal Reserve announced an immediate, emergency rate cut to 0% on Monday along with a $700 billion quantitative easing program (in which the Fed will purchase Treasuries and mortgage-backed securities). However, the Fed denied the possibility of negative rates in the U.S. as an appropriate policy measure.

The White House has also proposed a $1 trillion stimulus package that is likely to pass in some form would aid individuals and small businesses during a time when many public places, including restaurants, bars, movie theaters, retailers and more, are closed.

Transportation stock indices

Transportation stock performance improved this week after a horrific decline last week. However, two of the four indexes still saw a decline. Logistics led the way on the downside at -8.8% driven by a significant decline in XPO. LTL was the second-worst performer at -5.9% as ODFL fell 8.44%.

On the positive side, truckload fell only 0.6% as the larger market capitalization names were down to up while several of the small cap trucking stocks saw large declines.

Lastly, parcel led the way on the upside, increasing 3% as UPS and FDX saw nice gains. In our view, this was likely driven by the benefit of their exposure to increased e-commerce spending as Americans are quarantined at home and air rates are increasing for expedited cargo.

For more information on the FreightWaves Freight Intel Group, please contact Kevin Hill at khill@freightwaves.com, Seth Holm at sholm@freightwaves.com or Andrew Cox at acox@freightwaves.com.