DHL Supply Chain Pricing Power Index shows continued leverage for carriers, but falls from last week’s high

The weekly DHL Supply Chain Pricing Power Index continues to favor carriers, but the index has fallen from last week’s high as freight volumes start dropping off.

The index, which uses analytics and data contained in FreightWaves SONAR to analyze the market and estimate the negotiating power for rates between shippers and carriers, has dropped to a reading of 60. Last week the index reached a reading of 65. Any reading above 50 indicates carriers have an advantage in rate negotiations.

An analysis of the index shows that both freight volumes and tender rejections are falling as fast as they rose. While both remain elevated above what we would expect for this time of the year, the indices are poised to plummet further in April. Economic data is abysmal – initial weekly jobless claims came in 10 times the Great Recession peak of 665,000. Most of the economy is sputtering to a halt, including most truckload freight.

Load volumes: Absolute levels positive for carriers, momentum neutral

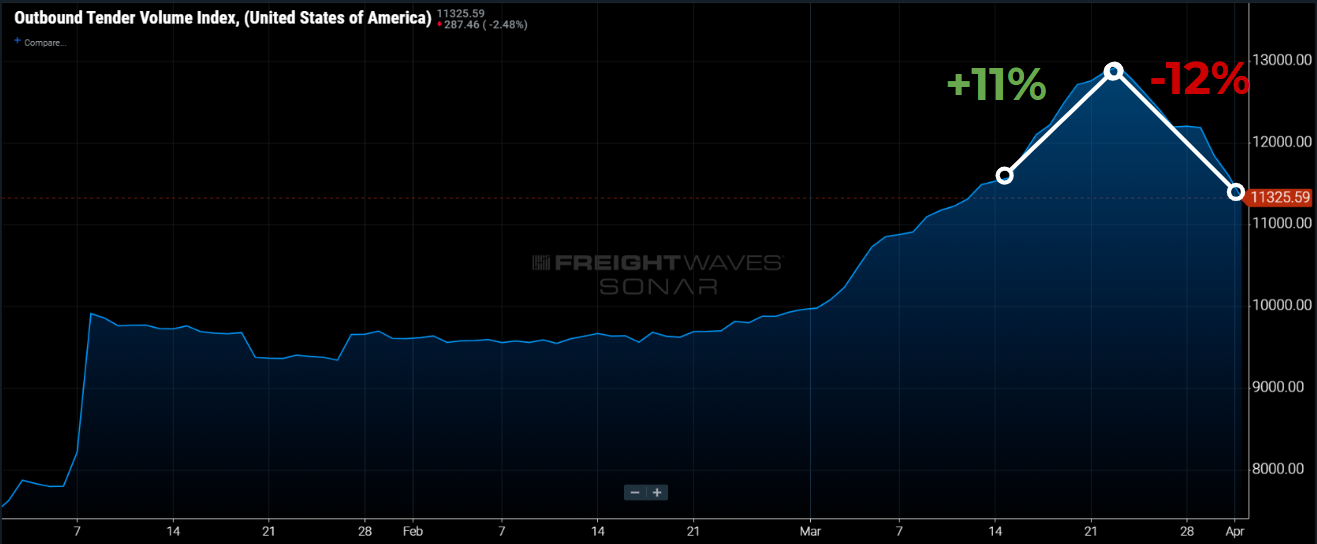

Since the peak nine days ago, national outbound freight volumes (SONAR: OTVI.USA) has shed 12.5% to a current 11,325,6. In the same period preceding the peak, outbound tendered volumes rose nearly 11%. It is safe to say this peak is behind us. The panic-buying pull forward of demand for groceries and consumer packaged goods (CPG) is over.

Data from Placer.ai, a retail intelligence provider, shows that foot traffic to the nation’s largest packaged retailers (Walmart, Costco and Target) fell off considerably towards the end of March, on a year-over-year basis. Walmart fell from an increase of 18.4% in the second week of March to a decline of 6.7% in the third week. Costco’s traffic dropped 8.7% after a 34.7% rise the week before and Target was off 20.5% after a 19.2% increase in the second week.

As we have noted over the past two weeks, we believe only 40% of truckload freight is safe from a lockdown environment including food, medical supplies and some CPG. It is possible the drop in foot traffic could be a lull in between grocery demand spikes. We believe some of the demand for CPG will be weaker due to the pull forward, but overall demand for grocery and packaged goods will be strong through the next few weeks.

If OTVI continues its descent at this pace, we would expect volumes to fall another 6% before our next publication. Volumes are still elevated above historical comparisons, but with consumer spending down 30%, we expect volumes to tumble for the month of April.

Tender rejections: Absolute levels positive for carriers, momentum positive for shippers

Much like OTVI, the outbound tender reject index (SONAR: OTRI.USA) has also peaked and is rapidly slipping to the downside. OTRI is only four days off its peak, but it is exhibiting the same trend as OTVI – rejections have fallen 16.3% off the peak, and in the four days prior to the peak OTRI rose only 5%.

Capacity is still quite tight around the country, and OTRI remains higher than at any point in 2019. However, much like volumes, tender rejections will continue to plummet in April. With a majority of the country on lockdown and many industries at near cancellation, there simply isn’t enough freight to keep capacity this tight for long.

Spot rates: Momentum positive for shippers

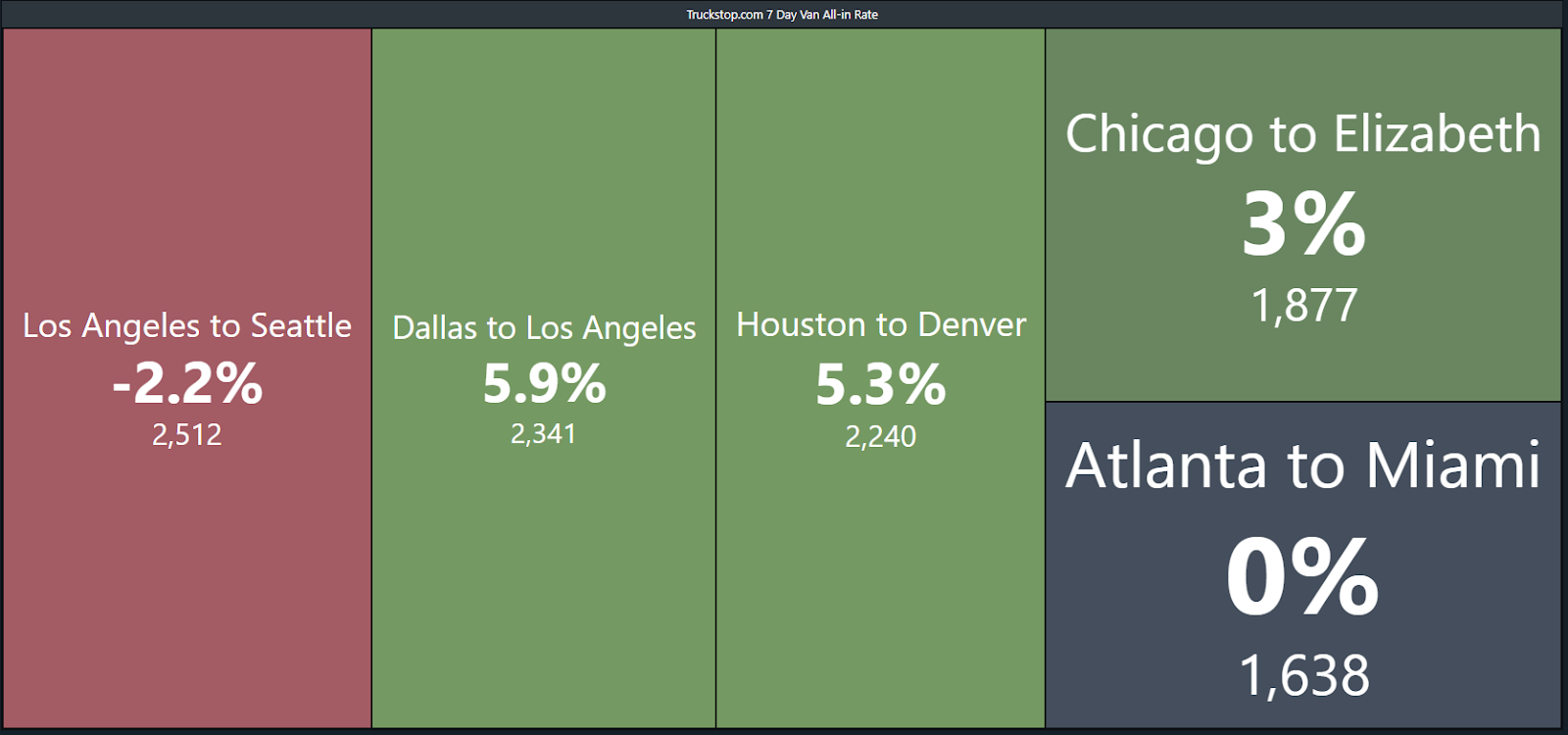

Spot rates climbed significantly through the back half of March as shippers rushed to replenish depleted grocery storefronts. Both national volumes and tender rejections are plummeting but remain far above where we would expect for this time of the year. Spot rates will remain elevated for the next few weeks as the freight market stabilizes. Depending on the infection rate, linehaul rates will vary wildly by region. For the past three weeks, more than two-thirds of the 100 lanes of spot rate data in SONAR have been growing week-over-week (w/w). As of Thursday, more than half are negative w/w. Spot rates will track volumes through the month of April.

Economic stats: Momentum and absolute level positive for shippers

Backward-looking economic data is relatively useless at this point. Nonetheless, several economic data releases this past week are worth examining.

By far the most widely watched blockbuster economic data point this week was initial jobless claims, which came out today. Given its frequency, this is one of the best real-time indicators we have.

The second-to-last week of March 2020’s jobless claims spiked to 3.3 million. Many thought that was an unfathomable number. However, we just received the jobless claims for the last week of March and they were 6.6 million. To put into context just how high that number is, 4% of the American workforce lost their jobs in one week and the 6.6 million initial claims are about 10 times the peak of 665,000 in the 2008-09 recession and the all-time record of 695,000 in October 1982. It is also 32 times more than the 210,000 initial claims a month ago. After two week cumulative job losses of 10 million, the unemployment rate now sits at 6.3%, nearly doubling off the 50-year low of 3.5% from just three weeks ago.

Credit card spending drops

Bank of America Merrill Lynch (BAML) published daily credit card spending data through March 24, 2020, and it is not looking good in terms of an early read on GDP for the end of Q1 and the beginning of Q2. Overall spending inflected negative starting on March 14 and most recently has been running down more than 30% year-over-year. With consumer spending accounting for two-thirds of GDP, this is consistent with many projections for Q2 GDP to fall 30%. Eventually, we will undoubtedly see this weakness spill over into transportation and load volumes are likely to turn significantly negative year-over-year, potentially in a matter of weeks.

BAML also broke down the credit card spending data by category and the best and worst performers are striking. For the last week, airlines, lodging, cruises and entertainment have all seen 100% (or more) year-over-year declines (with the difference due to refunds); on the positive side, online electronics have been running up about 40% year-over-year while groceries were up over 100% year-over-year but have faded to 20% year-over-year. Restaurant spending has been running down about 60% year-over-year. We would expect grocery sales to reaccelerate in the coming days and weeks as consumers deplete their initial panic runs from mid-March and trends to continue to mirror those of restaurants, only inversely.

Transportation stock indices: Momentum positive for carriers

Transportation stocks mostly had a rough week after a stellar week last week. LTL led the way to the downside (-6.7%) with all four stocks down significantly. Parcel was second worst (-4.7%) driven by declines at FedEx and UPS. Truckload was only down 1.3%, likely due to the fact that the industry is still seeing strong y/y load volume gains (though they are decelerating). On the other hand, logistics was up 0.5% and the lone positive performer this week was driven by strong performance for C.H. Robinson.

For more information on the FreightWaves Freight Intel Group, please contact Kevin Hill at khill@freightwaves.com, Seth Holm at sholm@freightwaves.com or Andrew Cox at acox@freightwaves.com. Check out the newest episodes of our podcast “Great Quarter, Guys” here.