In the trucking industry, it’s a commonly repeated adage that “the shippers are the last to know” when it comes to freight market conditions. According to brokers we spoke to this week, shippers have finally realized how to take advantage of unusually loose trucking capacity, and they’re trying to crash rates.

The capacity-constrained environment of the past eighteen months is over. Double-digit driver wage hikes and record-breaking month after record-breaking month of new truck orders have substantially increased the number of available trucks.

In the new year, the national market is in the process of rolling over.

The spread between contract and spot rates continues to widen. According to DAT’s RateView tool, the national average spot rate for dry vans, net of fuel, was $1.76/mile in December and fell to $1.75/mile in January; meanwhile contract rates rose from $2.01/mile in December to $2.02/mile in January, widening the spread to 27 cts/mile.

Brokerages and 3PLs see opportunity in volatile, confusing markets, and have enjoyed an unusual phenomenon: robust spot market activity driven by shippers deliberately seeking plentiful, cheap capacity rather than by shippers resorting to expensive spot freight out of desperation. Because this dynamic is playing out in January, a time when most carriers are in asset-utilization mode and do not expect to make strong profits, brokerages have been able to widen their margins considerably.

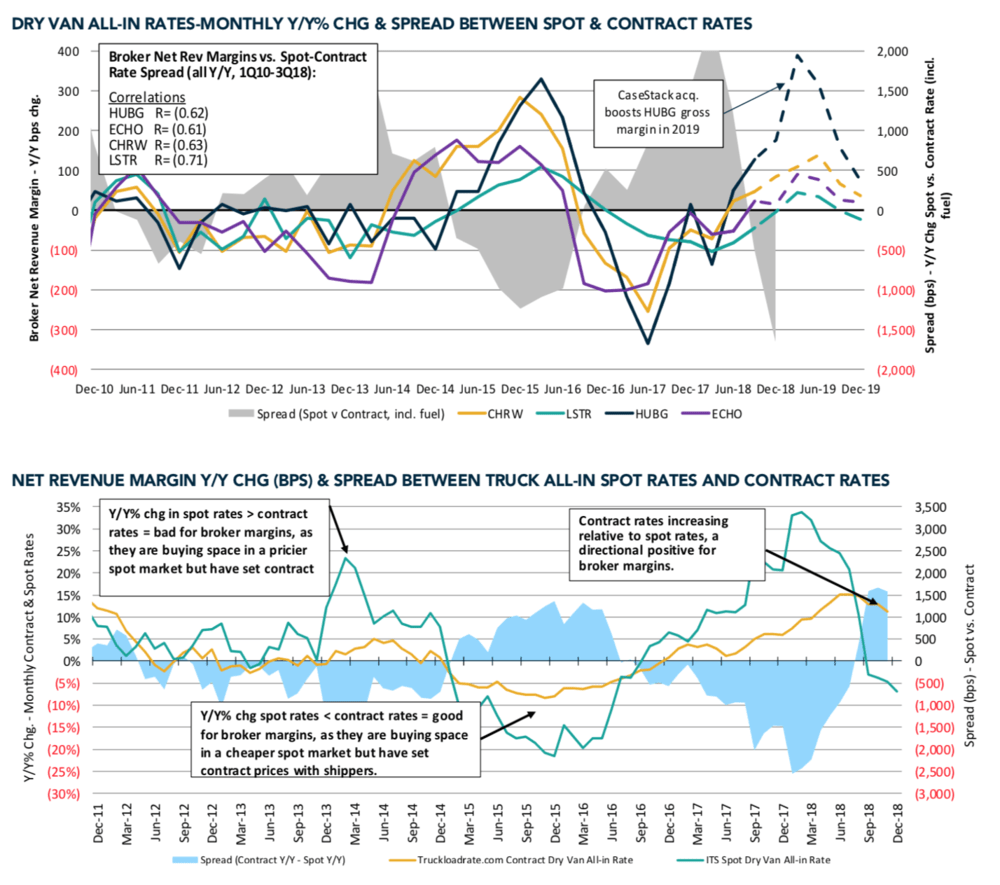

The chart below, from Susquehanna equities analyst Bascome Majors, shows how brokerage margins expand when spot rates fall below contract rates.

Carter Garrett, VP of Sales at Trident Transport, a Chattanooga-based brokerage with heavy exposure to spot freight, said that last week was one of the best in the five year old company’s history on both a revenue and margin basis.

“It’s the loosest market I’ve seen in six or seven years,” Garrett said, pointing out that “shippers have started catching on this month. What we’re doing as a smaller brokerage is focusing on well-established lanes we have experience in and not taking on much risk.”

“We’re seeing the spread widening between contract and spot,” said Patrick Draut, VP of Business Intelligence at K & L Freight, a Chicago-based transportation provider with a large brokerage operation.

“The market thinks rates have to go lower from where they are now,” added Kyle Lintner, Director of Markets at K-Ratio, K & L’s freight futures division.

Shippers appear to be putting freight directly into the spot market if the load is rejected by their primary carrier instead of working down their routing guides. That’s one reason why national tender rejections have continued to reach new lows. Many shippers have begun their RFP negotiations with aggressive counter-offers 25% below carriers’ first round bids.

When shippers wise up to market conditions and ask for rate decreases, there’s a knock-on effect with brokerages, who beat up the carriers to protect their margins.

“You have some brokers trying to dictate the market, posting $1,500 from Chicago to Atlanta, hundreds of dollars below DAT’s seven day average,” Draut explained. Brokers are still searching for the bottom in this market, some offering trucks $1.60-1.65/mile to go into the East Coast, and just $1.20 to come out.

Some of these rates are not sustainable based on the per-mile cost of operating a truck, and rates should stabilize at some point in the next six to eight weeks, according to K & L.

“Sometime in advance of produce season they’re going to stop accepting cheap loads, whether that’s in late February or into March, and that will set the bottom,” Lintner said.