Both freight shipments and costs stepped higher year over year (y/y) in September, according to Cass Information Systems. However, the comps become more formidable moving forward as the freight economy distances from record levels.

Shipments increased 4.8% y/y in September but were 2.9% lower than August levels. The shipments component of the Cass Freight Index reached a more than four-year high in August.

“U.S. freight volumes continued to exceed low expectations in September with more buoyant demand than feared in the start of peak shipping season,” ACT Research’s Tim Denoyer commented in the report.

| September 2022 | y/y | 2-year | m/m | m/m (SA) |

| Shipments | 4.8% | 5.4% | -2.9% | -2.9% |

| Expenditures | 21.2% | 60.2% | 0.3% | -1.9% |

| TL Linehaul Index | 3.9% | 17.1% | -2.2% | NM |

However, Denoyer cautioned against the likelihood of continuation in the trend — up y/y in the last three months — pointing to an easy prior-year comp during the month. He also believes retailers discounting excess inventories, preholiday inventory build and improved fluidity in the automotive supply chain were supportive of volumes.

If normal seasonal trends hold for the rest of the year, the report said shipments will be up y/y between 2% and 3% in October and down slightly for the fourth quarter. “Tougher comps in November and December also suggest the recent increases are temporary.”

Denoyer continued, “It sure doesn’t feel like freight volumes were up nearly 5% y/y in September, does it? Our analysis suggests this will not repeat for quite some time, and it took the right combination of easy comps and temporary factors to make happen.”

Supply chain data provided earlier this month showed a notable slowdown in the back half of September compared to the first 15 days of the month. Sentiment around transportation capacity indicated incremental loosening with a material step down in pricing. Weakening freight fundamentals and growing concerns of a muted peak shipping season had analysts reeling in earnings estimates ahead of third-quarter reports.

The expenditures subindex was 21.2% higher y/y during September, which was a slight acceleration from August’s y/y growth rate (up 20.4%). On a sequential comparison the index was 0.3% higher in the month.

The expenditures data set looks at the total amount of money spent moving freight, including fuel expense. Average weekly retail diesel fuel prices were more than 45% higher y/y in September but close to flat when compared to August. When backing out the decline in shipments, rates were 3.3% higher sequentially. Seasonality and a mix shift toward higher-cost modes were cited as reasons for the increase.

The cost index is expected to log a full-year increase of 23% y/y, turning negative in February.

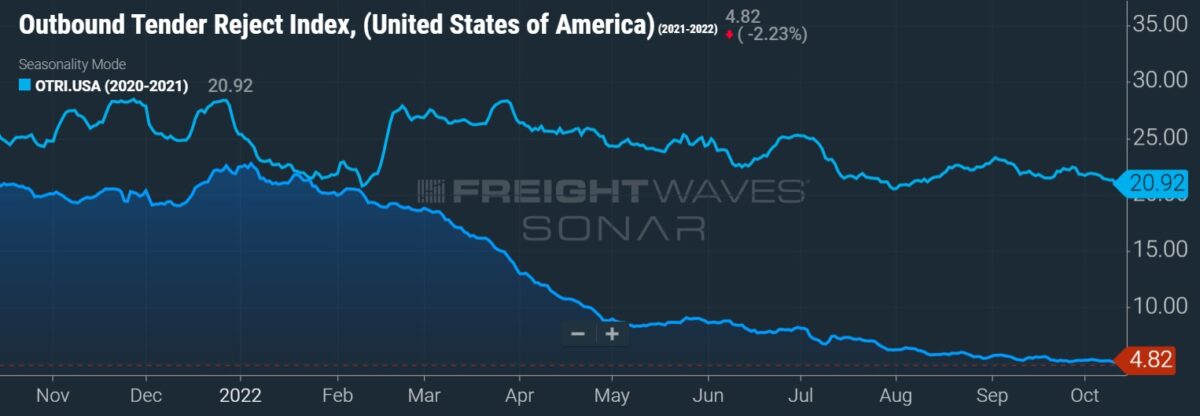

“The supply/demand balance in U.S. trucking markets has loosened significantly this year, and as a result freight rates are leveling off and set to slow sharply in the months to come,” Denoyer said. “While shippers aren’t seeing any real savings yet, considerable cost relief is now highly probable for 2023, which we think will be welcome news for the broader inflation picture.”

The Cass Truckload Linehaul index, which excludes fuel and accessorials, increased 3.9% y/y but was 2.2% lower than in August. The index value was the lowest of the year, with September marking the fourth sequential decline. The data includes both spot and contracted freight and is forecast to turn negative y/y in January.

“There is little real questioning of the consensus that the freight economy is in a soft patch that could be with us for a while,” Denoyer said. “While demand is still looking about flat this year, the supply side recovery has turned the market from tight to loose. Thus, the reason market dynamics are much different this year — it is not that there is less freight. It’s more capacity.”

More FreightWaves articles by Todd Maiden

- Transfix pulls IPO, new private funding round planned

- September weakness pushes analysts to lower estimates ahead of Q3 reports

- KAG Logistics expands 3PL platform through Connectrans deal

Sarah Elizabeth

I am making $90 an hour working from home. I never imagined that it was honest to goodness yet my closest companion is earning $16,000 a month by working on a laptop, that was truly astounding for me, she prescribed for me to attempt it simply.

Everybody must try this job now by just using this website… 𝐰𝐰𝐰.𝐏𝐫𝐨𝐟𝐢𝐭𝟗𝟕.𝐜𝐨𝐦

Helen Lynch

Everyone can make money now a days very easily…dd…..I am a full time college student and just w0rking for 3 to 4 hrs a day. Everybody must try this home online job now by just use… This Following Website.—–>>> salaryapp1.blogspot.com

Gloriohnson

Everyone can make money now a days very easily…dd…..I am a full time college student and just w0rking for 3 to 4 hrs a day. Everybody must try this home online job now by just use… This Following Website.—–>>> 𝐨𝐧𝐥𝐢𝐧𝐞𝐜𝐚𝐬𝐡𝟗𝟐.𝐛𝐥𝐨𝐠𝐬𝐩𝐨𝐭.𝐜𝐨𝐦

Pamela Daniel

I’ve made 💰$64,000💰 so far this year working online and I’m a full time student. Im using an online business opportunity I heard about and I’ve made such great money. It’s really user friendly and I’m just so happy that I found out about it. Heres what I do.

🙂 AND GOOD LUCK.:)

HERE====)> 𝐰𝐰𝐰.𝐖𝐨𝐫𝐤𝐬𝐟𝐮𝐥.𝐜𝐨𝐦

Ramon Moore

our neighbor’s sister-in-law gets 77 an hour on the internet.. she has been fired from a job for three months… the previous month her revenue was 16199 just working on the internet for a few hours every day.

check this ….. http://salaryapp1.blogspot.com

PeggBriggs

[ JOIN US ] My last pay test was 💵$2500 operating 12 hours per week on line. my sisters buddy has been averaging $15000💵 for months now and she works approximately 20 hours every week. i can not accept as true with how easy it become as soon as i tried it out.

copy and open this site .…………>> 𝐖𝐰𝐰.𝐇𝐨𝐦𝐞𝐜𝐚𝐬𝐡𝟏.𝐜𝐨𝐦