Cathay Pacific has fully rebuilt its freighter schedule in time for the peak shipping season, but executives signaled Thursday that demand will be softer this year because of inflation and ongoing supply chain disruptions.

The prediction came as an unprecedented heat wave and another round of COVID lockdowns in a major city further constrained production at Chinese factories.

The busy period for air shipments traditionally runs from late September until early December as stores bring in orders for the holidays. Cathay Pacific’s cargo unit is projecting slower growth compared to record-setting 2021. And companies that manage airfreight shipments for clients concur that the supply of airlift is exceeding demand in China, although bookings are picking up in places such as Korea, Taiwan, India and Indonesia.

There are so many economic crosswinds that it is difficult to say, with certainty, where the market is headed. But there are indications air cargo shipments are starting to pick up.

In a monthly email to customers, Frosti Lau, general manager for cargo service delivery, said inflation appears to be dampening consumer purchases while supply chain disruptions are curbing manufacturing output.

He didn’t mention specific examples, but China’s no tolerance policy toward COVID forced factories months ago to close or scale back work. Many workers have not returned to jobs even when allowed and the country has yet to fully reopen. China and Hong Kong also had to cope with several typhoons this summer, which temporarily upset Cathay Pacific Cargo’s carefully synchronized crew rotations for China flights. That setback followed months of sharply reduced freighter operations because of strict Hong Kong rules for returning pilots to stay in a seven-day quarantine.

“While high-tech is one of those sectors that may be adversely affected, there are also rumors of consumer product launches later this year that may yet stimulate demand,” Lau wrote.

Cathay Pacific’s freight volume in July dropped 17.2% year over year and 41% from 2019. Cargo capacity was down 16.4% and by nearly half versus the pre-pandemic period.

The airline continues to slowly add passenger capacity, which has been stunted much longer than at other airlines because of COVID restrictions, and some passenger aircraft continue to operate as auxiliary freighters on intra-Asia routes. Officials have said passenger capacity could reach a quarter of the 2019 amount by the end of the year.

“This extra capacity will help as we prepare for a busy peak, although we are anticipating it may not be as sustained and pronounced as last year’s,” said Lau.

Hong Kong’s export and import volumes decreased in August by 7.5% and 6.8%, respectively, affecting space and rate, said Taiwan-based freight forwarder Dimerco Express in an update to customers. Several factors besides the pandemic weighed on air cargo activity, including ongoing COVID restrictions on cross-border trucking between mainland China, weaker global demand and the Russia-Ukraine war.

One drag on Cathay’s business that Lau didn’t mention was widespread flight cancellations in August by mostly Chinese and Hong Kong airlines because of China’s military exercises around Taiwan to protest U.S. House Speaker Nancy Pelosi’s visit to the island nation, which China claims as its own territory. The reduced passenger and freighter flights created a temporary capacity shortage.

The Baltic Air Freight Index dipped 1.1% for the week ended Wednesday, punctuating a steady decline in air cargo rates that now has average global spot rates lower than a year ago for the first time in many months. Prices do not appear to be firming up as the peak season approaches, said the TAC Index, which calculates the Baltic index.

Logistics companies that ship by air also say demand is soft in many parts of the world, including Europe and South China.

China manufacturing holdups

Meanwhile, events in China are playing into Cathay’s assessment.

The city of Chengdu, with more than 20 million residents, announced a COVID lockdown beginning Thursday evening and mass testing until at least Sunday following a resurgence of infections.

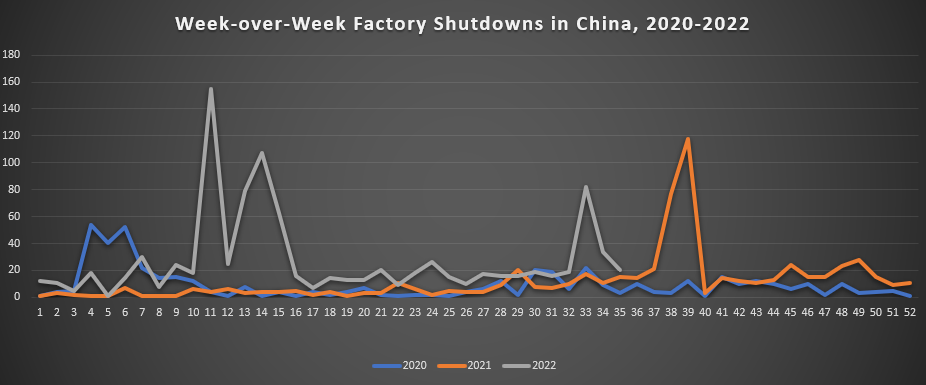

The city, located in Sichuan province, just emerged from a power crisis due to a record heat wave that led authorities to ration power, forcing hundreds of factories to shut down to prioritize energy availability for households. A historic drought reduced electricity generation at power plants at the same time demand spiked.

Chengdu is the largest Chinese city to be locked down since Shanghai in early April. Other manufacturing centers, such as Shenzhen and Guangzhou, have also recently tightened COVID restrictions.

The extreme heat likely made it easier to transmit the virus as people gathered indoors in air-conditioned settings, Everstream Analytics said in a briefing memo shared with American Shipper.

The COVID sequestration after a two-week shutdown for the power shortage will complicate efforts to restore full production capacity, the cloud-based supply chain risk management firm said. Larger companies may be able to keep functioning under closed-loop systems with employees living 24/7 within the factory campus or transported back and forth to a dedicated dormitory. Midsized and smaller companies will be forced to close down again, “which will further reduce inventories and likely lead to supply delays if the lockdown is protracted.”

Multinational companies with factories in Chengdu include Toyota, Volkswagen and automotive supplier Bosch, according to Everstream Analytics.

Mirko Woitzik, Everstream’s global head of intelligence, said in an email that Foxconn’s Hon Hai Precision Industry entered closed-loop production on Thursday and is expected to maintain normal operations. Semiconductor manufacturers Chengdu Yaguang Electronics and Chengdu Shizheng Technology shut down.

Sweden-based Volvo Cars also halted production at its Chengdu plant due to the lockdown measures, according to Reuters.

Other areas, including Chongqing, a large city in southwestern China, also experienced power cuts in late August. Manufacturing facilities in Zhejiang, Jiangsu and Anhui provinces also were ordered to temporarily shut down or reduce operations.

Steel and copper facilities, which are heavy energy users, felt the brunt of the cutbacks, Everstream reported. It said a supplier of packaging for Apple computer chips shut down for several days, as did Sichuan Yahua Industrial Group, a top producer of lithium used in electric vehicle batteries.

The National Bureau of Statistics this week said China’s factory production in August shrank for the second consecutive month as the power crisis, COVID outbreaks and other factors took a toll on work and consumption.

Despite headwinds, air cargo demand and sales are expected to be good compared to an average pre-pandemic year. Few realistically expected the industry to sustain 2021’s record volumes. And there are signs volumes are picking up as the traditionally slow summer season comes to an end.

Export volumes out of China continue to decline, but with the heat waves in China subsiding and new tech products such as the iPhone set for release within weeks, the peak season could begin about the third week of September, Dimerco Express said. As production resumes, capacity is expected to tighten and rates will increase, it added.

Data service World ACD reported global airfreight tonnage increased in the last week of August after declines in each of the previous three weeks. A similar pattern occurred as last year in August, although this year’s decline was deeper, it said.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

RECOMMENDED READING:

Cathay Pacific freighter fleet overcomes ‘double hell’ of July typhoons