This morning, Celadon Group (OTC: CGIP) executives told its employees that the company filed for bankruptcy protection under Chapter 11 and will shut down the operations of its over-the-road fleet. The official announcement came after a chaotic weekend of credit, customer, and driver issues when word got out about Celadon’s impending Chapter 11 bankruptcy filing.

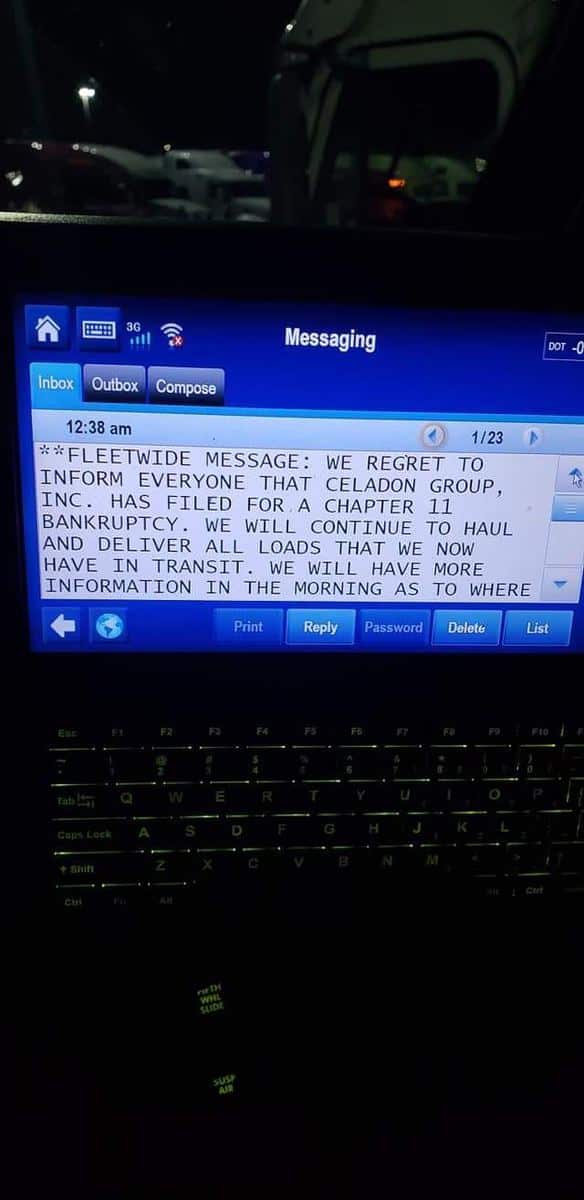

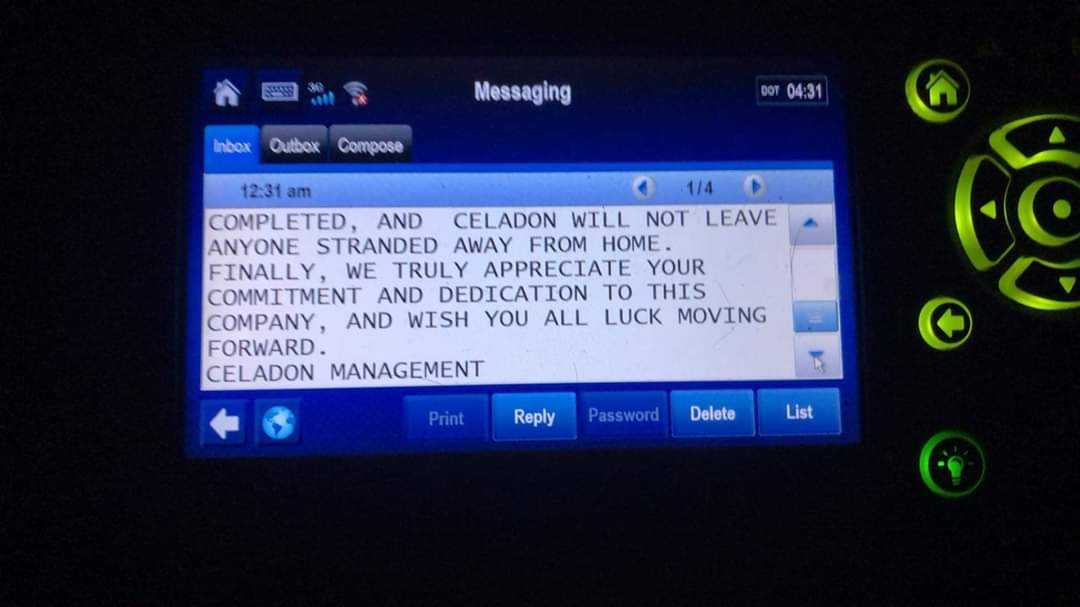

Employees were instructed to come to a meeting at the corporate headquarters in Indianapolis to be held this morning. But then in the middle of the night, fleet-wide messages went out to drivers’ telematics devices:

Competitors of the troubled carriers started aggressively posting offers for assistance and interest in hiring as news broke over the weekend. For many, a new career will start off on a sad note, but many were optimistic about the opportunities and new beginnings.

For office and professional staff at company headquarters, the struggle will be bigger to find equivalent opportunities. Many of the employees had spent decades working at the company and will be forced to look in other industries. Celadon was the largest trucking company based in Indiana, with no equivalent competitor in the area. As such, finding an employer or group of employers that can absorb the size of the truckload administrative workforce will be difficult.

While Celadon’s demise took many years to play out, its final stages could be described as chaotic.

Last Thursday, December 5, rumors swirled as lenders began repossessing equipment from Celadon. The next day, internal sources at Celadon told FreightWaves about the planned filing. On Friday Celadon also began advising its largest customers to find other transportation providers, but did not inform its own employees about the expected bankruptcy or shutdown. Customer service and driver managers found out from customers and drivers that the company was in trouble on Friday night, but lacked context. While management had informed shipper customers, they failed to inform internal staff.

FreightWaves received notice late Friday from a person not affiliated with the company that FedEx and other accounts had cut the company off. Other shippers, including Walmart, MillerCoors and Conagra also started to cancel pre-planned loads. In some cases, Celadon drop trailers with freight pre-loaded at shipper locations were unloaded and the freight given to other carriers.

When shippers started to cancel loads that were pre-booked late Friday, the jig was up. It became apparent inside of headquarters that the rumors had some teeth to them and questions started to be asked.

Over the weekend, Comdata shut off fuel cards, briefly re-activated them and then cut them again. FreightWaves heard reports from other carriers’ drivers who witnessed Celadon trucks being repossessed and towed away from truck stops.

The lack of communication from company leadership contributed to the confusion over the weekend. Some drivers were apparently told to get out of their trucks; others were told to finish their loads. Meanwhile, rival carriers offered jobs, transportation, and legal advice to stranded Celadon drivers.

Drivers, dispatchers, and office workers traded rumors, expressed their feelings, and asked for help on social media during the weekend.

One Celadon driver who was stuck in Laredo spoke to FreightWaves about his plan to leave the company but preferred not to be identified.

“I loved working for Celadon,” the driver said. “They treated me with respect. I wanted to stick around with Celadon, but I have a wife and kid back in Florida and I got to do what is best for my family.”

This is a developing story. FreightWaves will have more news on the Celadon shutdown on FreightWaves.com and FreightWaves TV. Download the FreightWaves TV app for iPhones or Android. FreightWaves TV is also streaming on AppleTV and Roku.

Jeromy

I retired from Celadon and trucking (I didn’t wish to drive for anyone else at this point) about 3 years ago after 11 years with Celadon mainly because I has a sneaky suspicion that something was going seriously wrong. My feeling has been shown to be right. I’m only surprised it took this long.

Rudolph James Robert Wratten

Celadon has had it.

Drivers are somewhat mobile.

But, can you imagine the office people?

This has a level of harm that is in unbelievable.

The results will not be felt for months.

brenda oles

S&R Trans in Grand Rapids Michigan has openings for Owner Operators and Company drivers. Call Brenda at (616)260-2903 .