Demand headwinds for agricultural equipment in western Canada and weakening in the transportation industry were the factors behind Cervus Equipment’s (TSX: CERV) C$2.1 million loss in the third quarter of 2019. The adjusted loss was well below the company’s adjusted earnings before income taxes of C$15 million in the same period of 2018.

A Canadian dollar equals US$0.76.

“The most significant factor underlying our third-quarter results was the continuing headwinds facing our Western Canadian Agriculture operations, said Cervus President and CEO Angela Lekatsas.

The Calgary-based equipment dealer reported that a meaningful imbalance in used agricultural equipment was behind the diminished results, which included margin concessions and write-downs as the company looked to jettison inventory to rebalance its distribution network.

“Consistent with our priority to rebalance used equipment inventory during a period of sustained and unusual market conditions, we experienced a decline in equipment gross profit. Our priority to strengthen the balance sheet reduces near-term risk of continued inventory obsolescence and related carrying charges, while providing the opportunity for improved profitability longer-term,” Lekatsas said.

In the third quarter, Cervus lowered its used agriculture inventory by C$33 million sequentially from the second quarter.

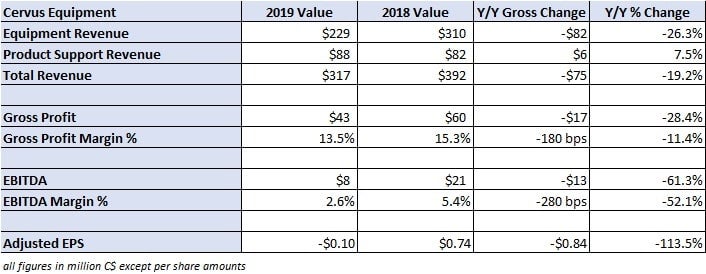

Total revenue for Cervus topped out at C$317 million in the quarter, a 19% year-over-year decline. Product support revenue, mainly parts and service revenue, increased 8%. However, a 26% dip in the sale and lease of equipment drove the decline. While a drop in demand for new agricultural equipment was the primary reason for lower revenue in the period, “a decline in truck sales in [the] Transportation segment relative to strong sales of 2018” was another factor.

Canada, similar to the U.S., is experiencing a general malaise in demand for trucking services. The company’s transportation segment reported a 22% year-over-year decline in revenue compared to more robust transportation equipment sales amid the backdrop of a stronger freight market in 2018. Increased competition at the dealer level, notably in the fleet market, was the primary reason for the reduction.

Class 8 truck orders remain depressed on the heels of carriers buying too much equipment in 2018. Preliminary truck orders for October came in at 22,100 units, according to ACT Research and FTR Transportation Intelligence. That is half of 2018’s order activity and the weakest October since 2016. While original equipment manufacturers welcomed the highest level of orders in nearly a year during October, the industry remains on the downside of the demand cycle.

Cervus’ management noted several factors weighing on demand for agricultural equipment.

“The Western Canadian Agriculture industry continues to face headwinds, including reduced farm income in 2018 compounded by increased input costs, reduced commodity prices, trade disputes and poor weather conditions,” read the earnings press release. The commentary went on to note that these factors are causing farmers to hold on to existing equipment longer, postponing new equipment decisions. Harvest-related parts and service demand only partially offset the declines in equipment revenue.

The company reported gross margin erosion of 180 basis points (bps) to 13.5% with its earnings before interest, taxes depreciation and amortization (EBITDA) margin falling 280 bps to 2.6%.

Cervus will host a call to discuss its third-quarter results with analysts on Nov. 8 at 11 a.m. EST.

Cervus is a network of 63 agricultural and transportation equipment dealerships in Canada, New Zealand and Australia representing brands like John Deere, Peterbilt, Clark, Sellick, Doosan, JLG and Baumann.