C.H. Robinson (NASDAQ: CHRW), the largest North American third-party logistics provider, announced its financial and operational results for the fourth quarter of 2020 after markets closed on Tuesday.

Robinson grew earnings per share to $1.08, up 47.9% from 2019’s dismal fourth quarter and enough to beat Wall Street’s consensus estimate of 94 cents per share.

Higher prices to customers and higher volumes across most modes offered by Robinson led to fourth-quarter revenue of $4.5 billion, up 19.9% year-over-year, but even more impressive, up 7.5% compared to the prior quarter.

Robinson’s disciplined sales force eschewed truckload volume growth to take price from shippers in an extraordinarily tight trucking market, growing revenue by 10.8% year-over-year and holding the line on gross margins. Meanwhile, international freight revenue exploded: Global Forwarding blew out the quarter with 71.7% year-over-year revenue growth and nearly quadrupled income from operations on tighter margins.

At North American Surface Transportation (NAST), Robinson’s brokerage division that includes truckload, less-than-truckload and intermodal freight services, gross margins fell from 14% in the fourth quarter of 2019 to 12.8% in the fourth quarter of 2020, but were actually 20 basis points wider than the third quarter of 2020. In other words, while Robinson’s brokerage gross margins compressed year-over-year, they were stable to slightly wider sequentially, signaling that Robinson’s customer sales representatives were able to keep up with a vertiginous spike in the cost of purchased transportation and average routing guide depth increased to 1.8.

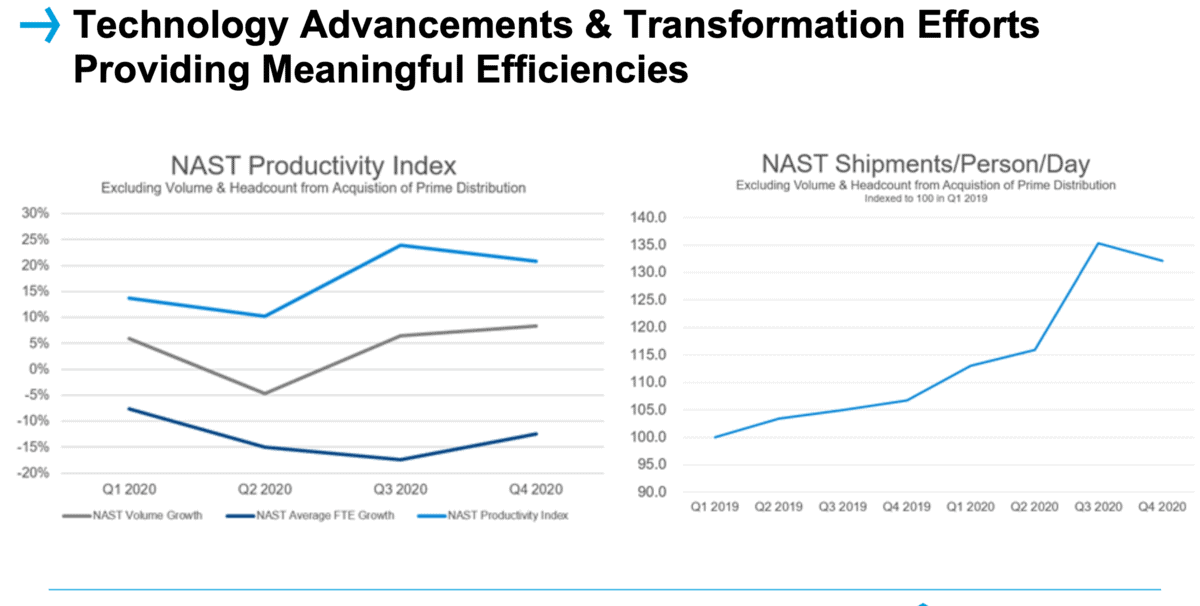

Average headcount at NAST was down 8.4% to 6,555 employees, highlighting continued improvements in productivity that Robinson management says is a direct result of the company’s massive investments in information technology. Notably, in this quarter’s release, Robinson published productivity metrics that compare NAST volume and headcount trends:

This newfound transparency will be welcomed by analysts who will applaud the impact of Robinson’s technology investments to its income statements. However, these metrics start in the very weak freight environment of 2019, when demand for outsourced logistics services fell faster than Robinson could trim headcount, resulting in fairly low productivity. One wonders what the NAST shipments/person/day chart would look like if 2018, when NAST enjoyed high productivity in a tight trucking market, was included.

Gross profits in truckload fell 2.1% year-over-year, while LTL gross profits rose 4% and “other” (including intermodal) grew 51.5%.

In Robinson’s Global Forwarding unit, which includes ocean, air and customs, gross profit margins compressed by 400 basis points to 17.5% compared to the fourth quarter of 2019, reflecting tight capacity markets on the oceans and in the sky. But gross revenue spiked 71.7% year-over-year and income from operations surged 289.1% to $58.4 million from $15 million the year prior. Meanwhile, Global Forwarding trimmed headcount by 4.1% to an average of 4,626 average full-time employees.

Ocean gross profits jumped 53.1% year-over-year, air gross profits grew by 38.3% compared to the prior year and customs gross profits grew 4.5% year-over-year.