C.H. Robinson released financial results for the second quarter Wednesday, and North America’s largest pure play 3PL blew past Wall Street’s expectations for profitability.

The company reported diluted earnings per share of $2.67 compared to consensus estimates of $1.99, good for an 85.4% increase on a year-over-year (y/y) basis.

C.H. Robinson’s total revenue came in at $6.8 billion, in line with market expectations and an increase of 22.9% compared to the year-ago period. The company’s adjusted gross profit increased by 37.7% y/y, citing higher adjusted gross profits across all of its segments.

The company’s profitability benefited from its ability to purchase capacity both domestically and internationally, combined with a complex and volatile freight environment.

“Our second quarter was another quarter of record profits, as our business model performed as we would expect it to in this part of the cycle,” Bob Biesterfeld, president and CEO of C.H. Robinson, said in the news release.

The company’s North American Surface Transportation (NAST) segment reported revenue growth of 15.7% compared to a year ago, up to $4.1 billion. The company cited higher pricing for both truckload and less-than-truckload customers as well as an increase in truckload volumes. NAST revenues accounted for 61% of C.H. Robinson’s total revenue, down nearly 4 percentage points from last year.

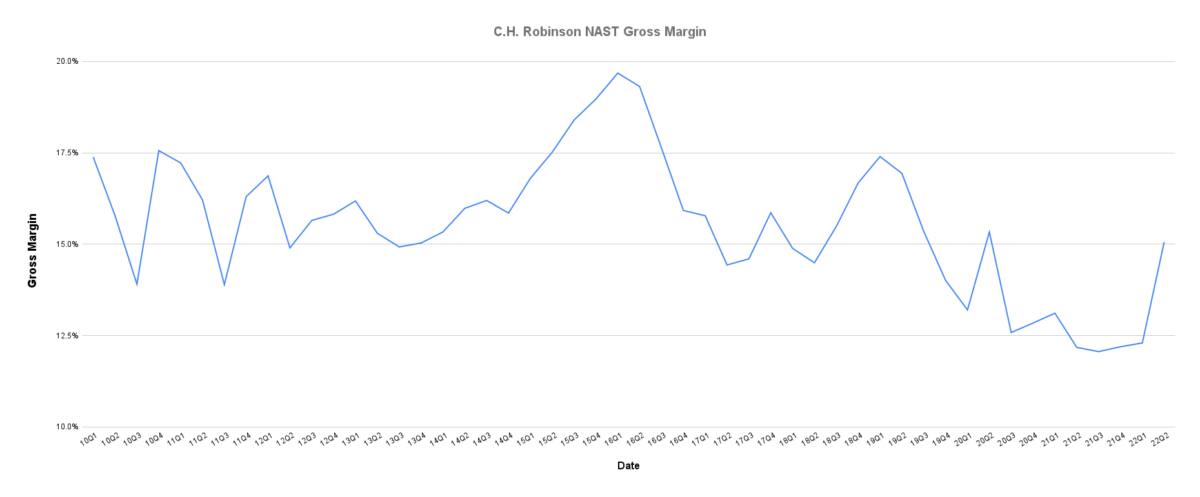

NAST’s adjusted gross profit increased by 43.1% y/y to $624.6 million, the highest level on record, surpassing even the fourth quarter of 2018. Adjusted gross profit for the truckload segment of NAST increased by 50.8% y/y due to a 48% rise in adjusted gross profit per shipment and a 2% increase in truckload volumes.

“Our strong results were again driven by significant operating margin expansion in our North American Surface Transportation business, as we further improved the profitability of our truckload and less-than truckload businesses and grew our truckload volume in a declining market,” Biesterfeld said.

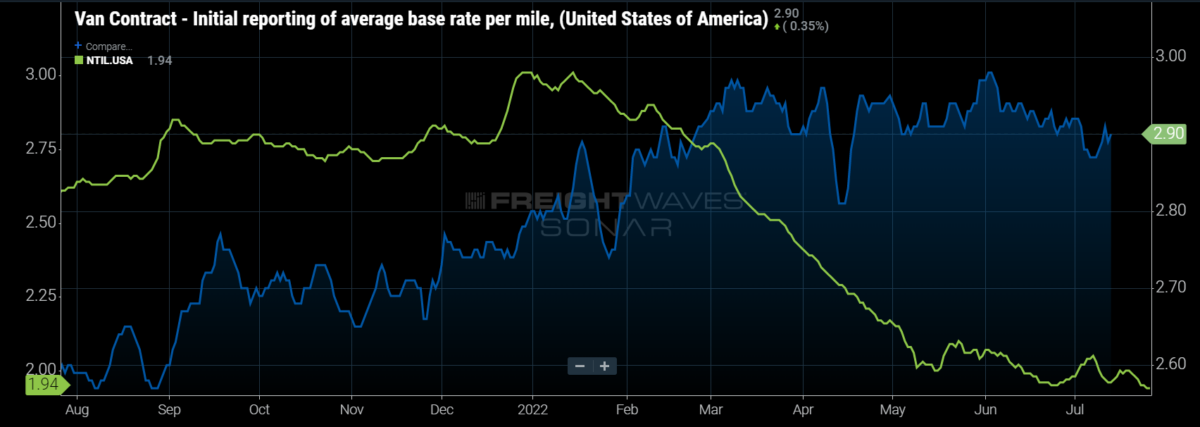

SONAR: VCRPM1.USA (blue, right axis) and NTIL.USA (green, left axis)

To learn more about FreightWaves SONAR, click here.

The company’s average truckload rate per mile, excluding fuel surcharge, increased by 1.5% compared to the same period a year ago. Conversely, the truckload linehaul costs, or the company’s buy rate, declined by 5%, resulting in a 46.5% increase in adjusted gross profit per mile.

LTL adjusted gross profit increased by 30.2% y/y despite a 5% decline in LTL volumes during Q2.

The segment also experienced inflationary pressures as operating expenses — increased salaries, incentive compensation and technology — increased by 21.9% y/y, according to C.H. Robinson. The company increased NAST headcount by 14.8% y/y during the quarter.

Source: Company earnings, FreightWaves analysis

The segment’s adjusted gross margin percentage did expand by 290 basis points y/y to 15.1%, a 280 bps increase sequentially.

Global Forwarding, another segment of C.H. Robinson, took a slight breather in Q2 as revenues increased by 44.3% y/y, compared to the 89.8% growth in Q2, to $2.1 billion. Sequentially, Global Forwarding revenue declined by 4.6%. The segment’s adjusted gross profit increased by 35.9% to $324.4 million.

The company expanded adjusted gross profit on the ocean and in the air. Ocean adjusted gross profit increased by 51.1%, thanks to a 47.5% increase in adjusted gross profit per shipment and a 2.5% rise in shipments. Adjusted gross profit in the air increased by 7.5%, benefiting from a 14% jump in adjusted gross profit per metric ton shipped, offsetting the 6% decline in metric tons shipped.

Global Forwarding followed a similar pattern to NAST when it came to operating expenses. The segment’s operating expense increased by 20.2%, driven by the most of the same factors: increased salaries, incentive compensation, technology and travel expenses. The company continues to hire, growing the Global Forwarding headcount by 17.3% in the quarter.

All other corporate results, which include Robinson Fresh, Managed Services and Other Surface Transportation, experienced revenue growth of 12.4% to $558.2 million. Adjusted gross profit for Robinson Fresh increased 16.8% to $35 million; Managed Services rose 5.3% to $27.6 million, a sequential decline of $500,000; and Other Surface Transportation jumped 13.4% to $20 million.

Biesterfeld noted that amid lingering questions about the global economy, inflationary pressures and consumer spending, C.H. Robinson’s business model puts the company in position to provide continued strong financial results.

Derek Morris

“Global Forwarding, another segment of C.H. Robinson, took a slight breather in Q2 as revenues increased by 44.3% y/y, compared to the 89.8% growth in Q2, to $2.1 billion. Sequentially, Global Forwarding revenue declined by 4.6%. The segment’s adjusted gross profit increased by 35.9% to $324.4 million.” How is there a decline of 4.6% (sequentially) when there was an increase of 44.3% y/y? Additionally, “compared to 89.8% growth in Q2…”?

Derek Morris

“Global Forwarding, another segment of C.H. Robinson, took a slight breather in Q2 as revenues increased by 44.3% y/y, compared to the 89.8% growth in Q2, to $2.1 billion. Sequentially, Global Forwarding revenue declined by 4.6%. The segment’s adjusted gross profit increased by 35.9% to $324.4 million.”