A year ago, fear was a big driver of the supply chain crunch: fear that goods wouldn’t arrive on time, stoked by headlines warning that shipping delays could “cancel Christmas.” It became a vicious cycle. The threat of delays caused importers to max out orders and bring them forward, causing more delays.

Importers ordered too much in late 2021, and to avoid another holiday scramble, they shipped in seasonal goods early in 2022. This front-loading alleviated pressure on the supply chain in the second half of the year.

Container shipping schedules have become more reliable in light of lower volumes, so importers have less to fear from ocean shipping delays. But despite progress, the supply chain is still not back to where it was pre-COVID.

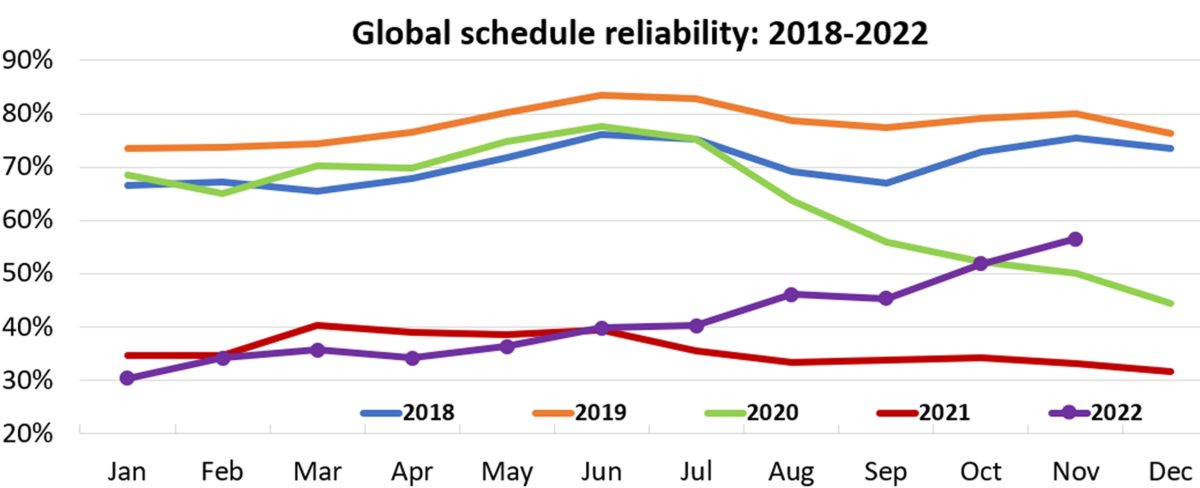

Schedule reliability back to 2020 levels

Sea-Intelligence’s “Global Liner Performance” report tracks reliability across 34 trade lanes covered by over 60 container lines.

Sea-Intelligence found that 56.6% of services arrived on time in November — the highest reliability percentage since August 2020. It’s a big improvement from January, when reliability cratered at just 30.4%. Yet the on-time rate is still just above a coin toss and remains well below the 2018-2019 average of 74%.

The November data revealed a significant disparity in on-time performance among container lines, with MSC scoring best at 63.4% and Yang Ming the worst at 42.5%.

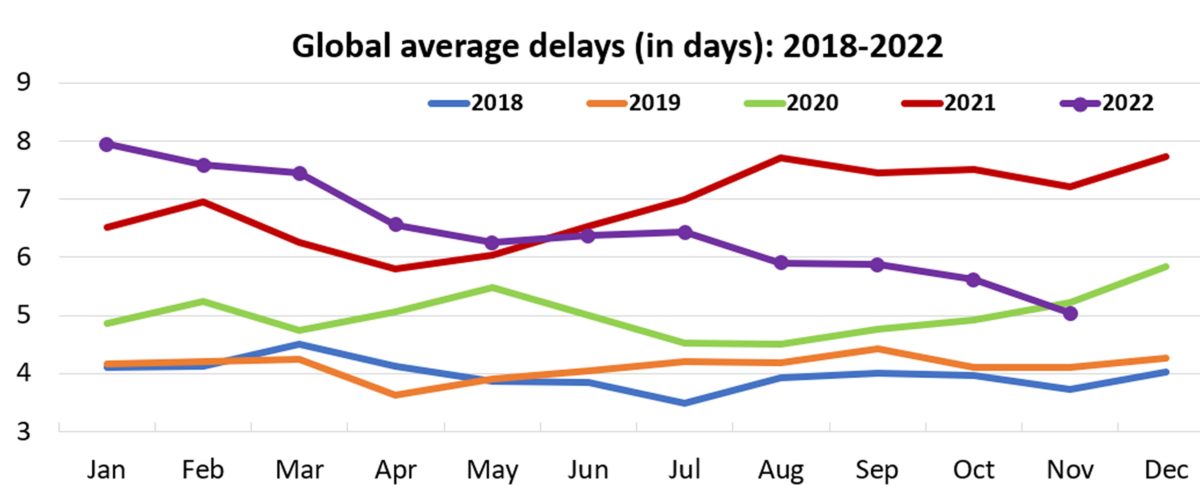

Sea-Intelligence also tracks average delays for late vessel arrivals, which likewise show large improvements in 2022.

Average global delays fell to 5.04 days in November, down 37% from the peak of 7.95 days in January. November marked the lowest average since October 2020. Nevertheless, it was still 24% higher than the 2018-2019 average of 4.05 days.

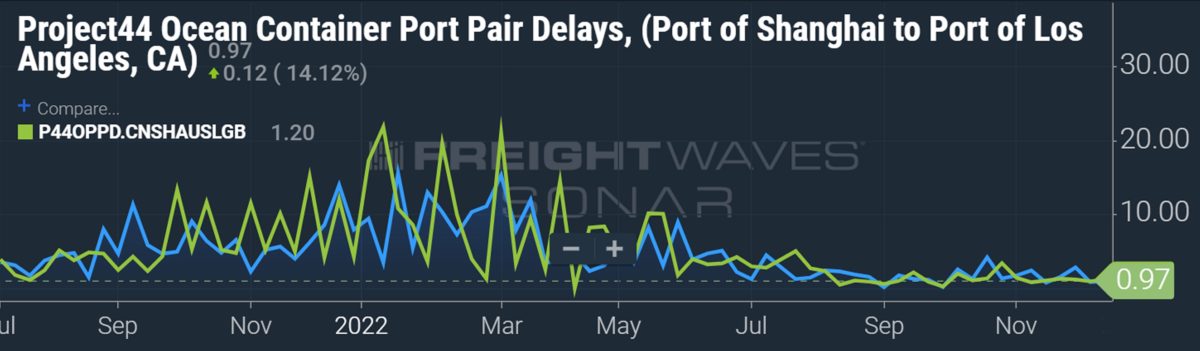

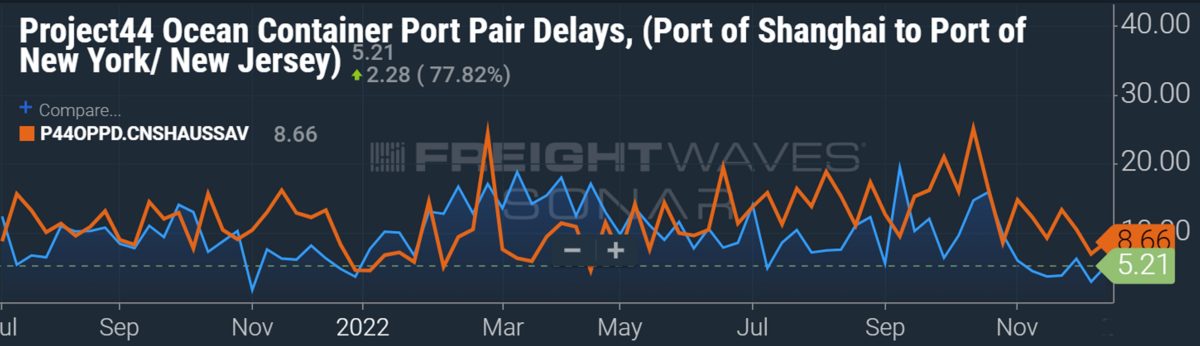

West Coast delays largely gone, East Coast delays lessen

In the U.S. import market, schedule reliability varies by coast. West Coast port congestion cleared in the first half of this year. East Coast port congestion eased more recently.

Data on FreightWaves SONAR from project44 on the average delays between the port of lading and port of departure highlight the coastal disparity.

Delays between Shanghai and the ports of Los Angeles and Long Beach, California, spiked in the first quarter of 2022. Since August, delays have largely disappeared, at around one day.

In contrast, delays between Shanghai and the ports of Savannah, Georgia, and New York/New Jersey remained persistently elevated through mid-October.

East Coast delays have declined since then but remain much higher than those at West Coast ports. Container services from Shanghai to New York/New Jersey averaged delays of 5.2 days in the third week of December, and services from Shanghai to Savannah averaged 8.7 days, according to project44 data.

Flexport indicator also improving

Other indicators also show a reduction — but not yet a resolution — of supply chain issues.

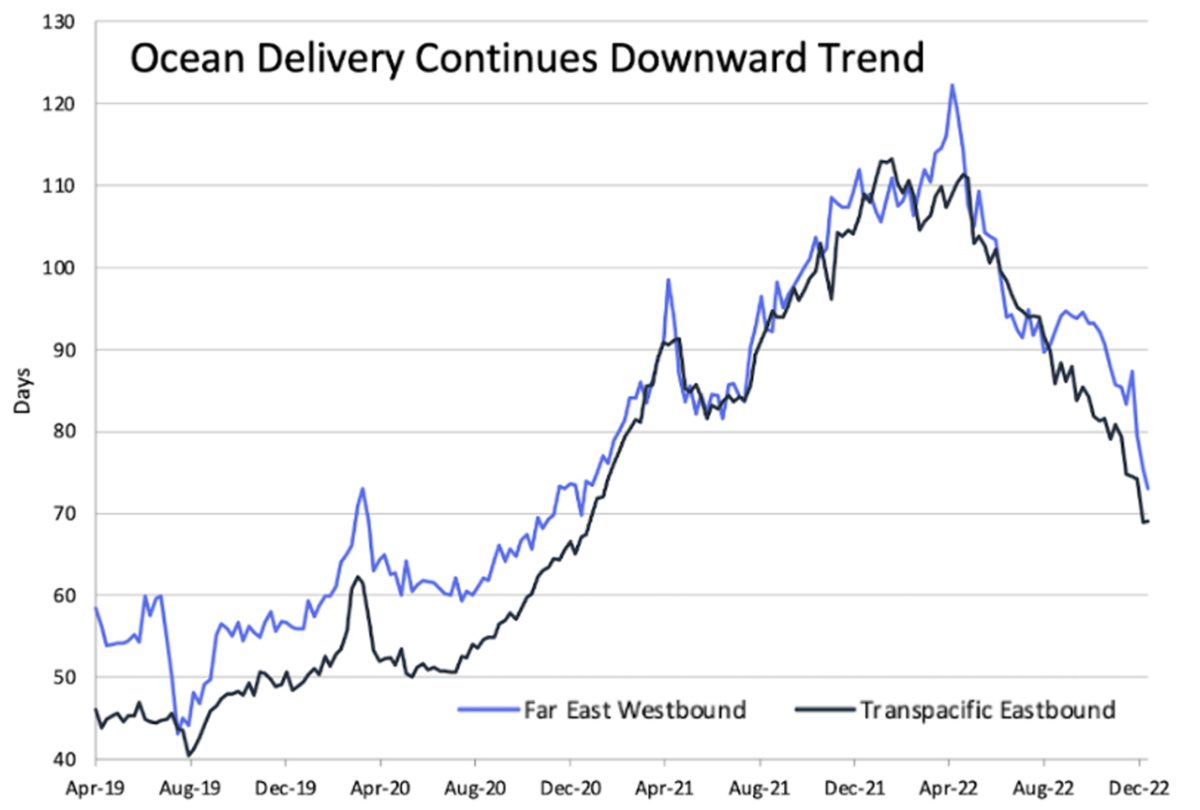

Flexport launched the Ocean Timeliness Indicator (OTI) in December 2021. The OTI measures the time from the cargo-ready date at the exporters’ gate to the date when products leave the destination port (i.e., the landside transport time from the factory to the port in Asia, plus the Asian port wait, the ocean journey time and the North American port wait).

The OTI for the Far East-U.S. route (covering all three U.S. coasts) peaked at 113 days in January, the same month Sea-Intelligence found liner schedule reliability to be at its worst.

The OTI was down to 69 days in the third week of December, 39% below the all-time high, but still 50% above the 2019 average of 46 days.

According to Flexport, the OTI shows that “while the worst of late-2021 buildup in congestion may be over, levels are still well above pre-pandemic levels.”

Click for more articles by Greg Miller

Related articles:

- Container shipping’s ‘big unwind’: Spot rates near pre-COVID levels

- 2022’s top shipping stories: Container boom ends, war fuels tankers

- LA/LB imports drop double digits; slump predicted through spring

- Plunge in US imports accelerates; volumes near pre-COVID levels

- Plunging spot rates drag down container shipping contract rates

- Zero ships waiting off Southern California for first time since 2020