Hot Take

Getting useful metrics that actually help provide an accurate picture of what is happening can be challenging. Metrics can simply be on-time rates, bounce percentages and visibility. Or they can get more in-depth with margin, revenue and service per carrier/shipper.

Scorecards for carriers, shippers and brokers aren’t going anywhere. They’re here to stay and through some proper planning and development, you can make them work for you.

Using the data collected from shipments as well as feedback from shippers can be crucial in making sure your carriers and shippers are adequately matched. Shippers are particular in what they want and need out of their carriers and having that data available quickly reduces the amount of time reps spend on their shipments.

Carrier scorecards are a great tool to measure a carrier’s reliability, performance and days to receive payment. Shipper scorecards are also vital to know the type of equipment they need, their requirements on appointments or anything else that could slow down a pickup at their facilities.

Scorecards aren’t just for shippers and carriers anymore. Employers have started leveraging internal scorecards as a valuable tool that measures employee engagement and satisfaction. Having specific goals to present to your employees gives one snapshot of how things are going.

Internal surveys don’t have to be a quarterly thing. Having metrics posted and reviewed regularly with employees keeps a high level of engagement, especially if those metrics tie into a compensation package.

We live in a world surrounded by data. It’s no longer a valid excuse to say, “We don’t have data points for that.” It’s a matter now of making your data work for you.

Quick Hits

Daimler Trucks is halting production of the Western Star 5700XE at the end of the year and current customers orders are being canceled, either by Daimler or the dealerships. Daimler is saying the shortage of semiconductors and other difficult-to-get parts has it swimming in orders it cannot fill. Daimler has most of the trucks done, aside from the parts that are on back order.

As of right now, there is no truck announced as a replacement for the Western Star 5700XE. Smaller trucking companies have large hurdles to even get a truck at an absurd used price. These cancellations and current truck orders are optimistically expected to be complete in Q4 of 2022. The used market rates will continue to be at record heights. It’s with a hope and a prayer that new trucks are coming to the market to help relieve capacity, driver breakdown frequency and a slew of other issues.

What can Brown do for you? – I’ve found the answer to the age-old question: “What can Brown do for you?” It can make you pay a lot more for your fuel and rates. Effective Nov. 15, UPS is imposing an extra 1% on its fuel surcharge. An additional 1% typically isn’t that much of a cause for concern, but when it’s hot on the heels of a 75 basis-point fuel surcharge increase that came over the summer — that’s gonna be a hard one to explain to the shipper.

UPS has also announced that it is imposing a general rate increase of 5.9% for 2022 to non contract customers effective Dec. 26. Most small parcel shippers utilize UPS and will continue to do so throughout the peak season. Now is the time to start coming up with a plan as to how to mitigate these increases. Some 3PLs that are hesitant about approaching customers for an increase in their rates will take the greatest hit in their margins.

At the same time, implementing the same 6% pass-through will hopefully balance out the cost of those noncontract loads.

Market Check

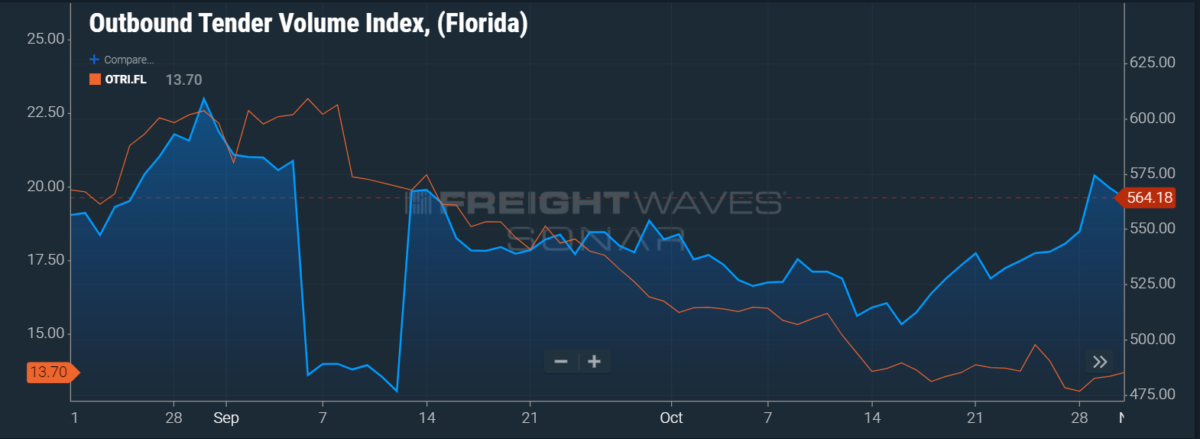

Florida is proving to be an interesting place to be lately — volumes are up and rejections are down. The current volumes are reflecting those back in late July to early September, but the rejection index is significantly lower than that of July and September. You can confidently get some freight out of Florida now and maybe not pay out the nose.

Some transportation providers are saying there are more driver jobs than applications to fill them. That being said, if you have freight heading into Florida, specifically central Florida, you can definitely get a better deal as there is a plethora of freight waiting to be picked up there.

How’d the Lemonade Stand Do?

Q3 for most publicly traded companies ended in September, meaning the last few weeks have been full of nothing but earnings calls. It’s a nice change of pace to take a step back from mergers and acquisitions to see how the quarters rounded out for a lot of companies. FreightWaves’ coverage of earnings and finance topics is here.

There was tight capacity, strong demand and “record” years for many carriers in the third quarter and likely through the end of the year. Hub Group, Schneider and C.H. Robinson have all called out the strong demand for drivers and inventory levels at all-time lows. All predicted the current market to be maintained into at least Q2 of next year.

Intermodal freight continued to be the big winner at Hub Group, while C.H. Robinson highlighted its tech investment for getting gross earnings above $6.3 billion. Schneider may have had high startup costs for its five new driver apprenticeship academies started this year, but it still is on track to post $5 billion in revenue for the year.

The more you know

Biden calls for international action on supply chain crisis

CP and KCS file merger application, CN adds board member

Can restaurant leftovers be carried across the US-Mexico border?

Direct-to-consumer brands are losing their cookies, and maybe their sales