Hot Take

It’s a word that can send fear into anyone, specifically accounting departments: audit. It’s the last thing you want, as it’s an arduous process that no one has time for. While an audit by the IRS is painful and tedious, that doesn’t mean you can’t make time to audit other things internally and less painfully.

For example, freight invoices. Everyone has to deal with freight invoices and you can always trust carriers to bill invoices correctly every single time (note sarcasm), so why would you have to go back and double check their work? Carriers make mistakes. They might bill an invoice to your blanket pricing instead of customer-specific pricing, for instance.

It may seem annoying to have a team of people double check that invoices are correct. So if you don’t have the ability to get a whole team right off the bat, then start with one person dealing with one customer. I guarantee any billing department can tell you who the biggest offenders are of invoices not matching what was quoted in the system.

If you get one person to research and contest the errors with one customer, track those audit savings. It might only be $50 here and there, but I’ve caught a $4,000 mistake. A carrier billed an LTL shipment at volume pricing instead of the quote we received. All I had to do was send the shipment and the quote number saying, “Hey, this is what you quoted us. Please correct the invoice.” It took less than five minutes of research to save $4,000.

Obviously that isn’t going to happen every time but those are the times you’re glad you have someone double checking carriers’ work. When you fold auditing into your billing process, the positives overwhelmingly outweigh the negatives.

You can reduce administrative expenses on invoice management, you get an almost immediate return on your investment in the people you hire for these positions, you get more accurate and clear data for reporting, you get another point to use in negotiations for better rates with carriers, and you can truly make a more cost-efficient supply chain for your customers.

Customers won’t have to double pay shipments or pay way too much for a shipment because no one caught an overcharge. It’s another value add to what you can offer customers: We can guarantee that your shipments are billing correctly and your costs will be more accurate.

As an experiment, pick a customer and a month’s worth of invoices, specifically right after a new pricing agreement goes into effect. See how many invoices were paid that didn’t match a contract. Sure, there are some legitimate extra charges, but are there really THAT many?

Quick Hits

We love a good border story. Seems like that’s all anyone can talk about these days. But this time we aren’t talking about Canada. Let’s take a trip to the southern border and see how Mexico is handling the new vaccine mandate. The drayage capacity (trucks that travel short distances into the U.S. from Mexico) has taken a hit as an already strained market is exacerbating problems.

The first three days after the vaccine requirement went into effect, 111 noncompliant drivers were stopped at the border, forcing those drivers to return to Mexico and the shipment of goods to be temporarily held in a cargo import facility until the load could be handled by a vaccinated driver. As of right now, the wait times haven’t increased drastically at the border as a result of the new vaccine mandate.

As always when dealing with cross-border shipments, it’s important to make sure that all the proper rules and regulations are followed to minimize delays for everyone involved.

Remember that one time we were all like, “Oh no! Central Freight Lines is done!” and “Well, at least they’re not leaving drivers stranded like Celadon”? Well turns out Central Freight wasn’t quite as on top of things as we thought. Owner-operators and contractors have said they still haven’t been refunded their money in escrow or maintenance account funds that were withheld from their paychecks, plus their quarterly safety bonuses.

Loyal drivers of 20-30 years are saying they stayed with the company despite the red flags of financial difficulties and are now being shorted money as a result of their loyalty. Drivers have followed every request — turn in plates, fuel cards, permit books, etc. — and still have no date when they will get their money or even if they will at this point.

As former Central drivers start showing up at new carriers, be gentle with them and make sure they get paid and don’t get the runaround. A little bit of love can go a long way here.

Market Check

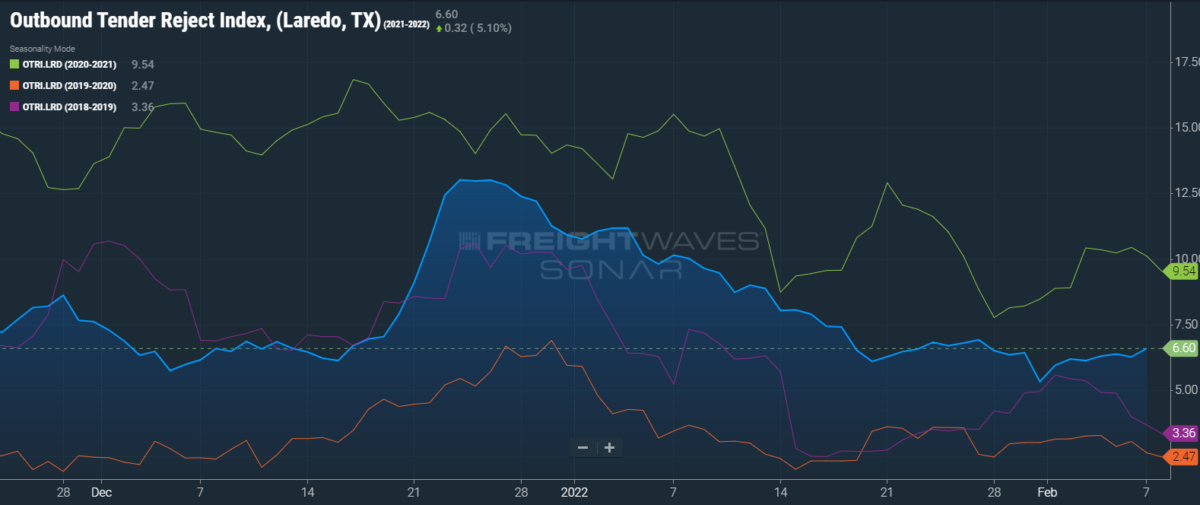

Outbound tender rejection rates in Laredo, Texas, are quite possibly some of the lowest in the country at the moment. Rejection rates of 6.6 are crazy low, meaning that contracted rates are faring better than the spot market. Not only is it low compared to the national outbound tender rejection average, it’s low compared to last year. It looks like Laredo always takes a dive after January but this is quite the dive.

That said, if you have a load that you want to move out of Laredo, now is the time to do it. Get those loads moving at good rates before everything inevitably spikes.

How’d the lemonade stand do?

Slow and steady, or at least in this case consistent, wins the race. Werner Enterprises is projecting to grow revenue 10% on average over the next five years by focusing on organic growth versus acquisitions. Werner reported Q4 adjusted earnings per share of $1.13, as well as revenue of $563 million (truckload) and $185 million (logistics). Operating ratio for the truckload division was 81.8%, remaining flat year-over-year.

At the other end of the spectrum we have USA Truck taking a slightly more aggressive approach to growing revenues. Its goal is to increase revenue 40% by 2024, hitting that elusive $1 billion mark. Q4 of 2021 put USA Truck in a good spot to start that climb. Adjusted earnings per share came in at $1.38, with reported revenue of $710.3 million for 2021. The majority of the growth was attributed to expanding the asset business network, doubling the logistics side of the business and reducing the age of the fleet. Here’s hoping that extra $290 million comes quickly for them.

The more you know

Freedom Convoy truckers say some supporters embarrassing them

CN expects to benefit from vaccine mandate for cross-border truckers

Ascend acquires South Carolina-based Dedicated Transportation Solutions

Jobs report: Lots of them, but more in warehousing than in trucking