Welcome back to Check Call. Conference season is upon us, and wrapping up conference season is the one and only FreightWaves Future of Supply Chain. If you haven’t yet decided on going or you want to go but are looking for the best deal on tickets, then you’re in luck. Check Call subscribers get a discount. Go here to buy tickets or use CheckCallFSC24 at checkout to get the best deal around. It’s in Atlanta so flights are going to be cheap and plentiful, and all the coolest people are coming so you better too.

In this edition: East Coast ports take center stage, demurrage charges get a hike, and another acquisition is complete.

2023 brought the potential for the International Longshore and Warehouse Union strike at the West Coast ports. It’s only fitting that 2024 brings the potential for the same to happen on the East and Gulf coasts with the International Longshoremen’s Association.

The labor contract between the International Longshoremen’s Association and the United States Maritime Alliance (USMX) is set to expire at the end of September. The ILA represents some 70,000 dockworkers, while the USMX represents employers at 36 coastal ports — including three of the U.S.’s five busiest ports: the Port of New York and New Jersey, the Port of Savannah, Georgia, and the Port of Houston.

Talks for the contract began this time last year, but in a surprise to no one, negotiations couldn’t get past the issue of wage increases.

While both sides are still trying to come to an agreement, it seems as though nothing significant will happen till October 2024. That is when the ILA warned members of a possible coastwide strike, essentially crippling the East Coast and massively hindering the Gulf Coast as well.

The threat of a strike can sometimes be more powerful than the strike itself. Most recently that tactic paid off for UPS workers in 2023, with a new agreement between UPS and the Teamsters. A significant part of the cargo that switched to the East Coast from the tumultuous past two years at the West Coast has already returned to the West Coast, and more could be heading back.

It’s too early to tell if it’s likely that an agreement will be reached before the Oct. 1 deadline, but if East Coast imports or exports are a significant part of your business, that leaves about seven months to come up with a backup plan should the worst happen.

Everyone’s favorite charge to ignore just got harder to, well … ignore. The Federal Maritime Commission has imposed new billing standards on ocean carriers and terminal operators to crack down on late-container fees. These increased demurrage fees will absolutely be passed on to the shipper.

The new requirement pretty much only focuses on demurrage, so if you have a shipper that picks goods up from the ports in a timely manner, this is a nonissue. For shippers that treat a port like their own personal warehouse/storage lot, well, it’s going to get even more expensive for them.

FreightWaves’ John Gallager writes: “Starting May 26, container ship carriers and marine terminal operators will be required to issue detention and demurrage invoices within 30 calendar days from when charges were last incurred. Shippers and other billed parties will have at least 30 calendar days to request that charges be refunded. Carriers and terminal operators must try to resolve the matter within 30 calendar days unless the parties agree to a longer time frame.”

Some additional data requirements are also listed in the article. If they are not included in the detention or demurrage invoice, it eliminates any obligation to pay. Between 2020 and 2022, nine of the largest carriers serving the U.S. container trades charged approximately $8.9 billion in demurrage and detention.

Short story long, shippers, just pick up your containers in a reasonable time.

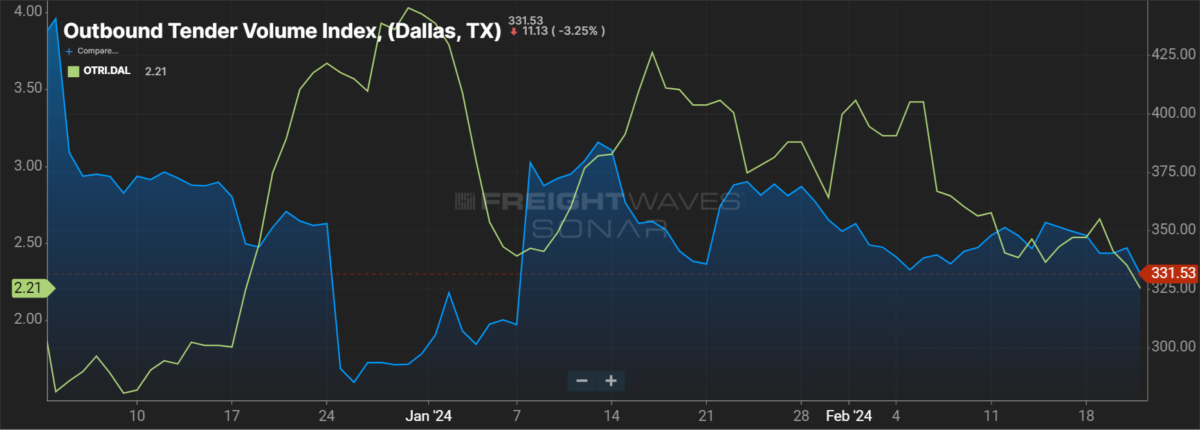

Market Check. Capacity is more than readily available in Dallas. Outbound tender rejections have dropped 17 basis points in the past week to settle at 2.21% rejections. Outbound tender volumes, on the other hand, haven’t rebounded since mid-January. Volumes are down 6.23% w/w and don’t show much chance of rebounding in the near future. While the drop in rejections isn’t significant, an OTRI of 2.21% is indicative of plenty of capacity in the market and of carriers having little trouble covering freight, much to the relief of shippers.

Who’s with whom? Keeping the M&A trend strong in 2024 is none other than RK Logistics Group Holdings. The Silicon Valley-based group expanded its network with the acquisition of New York-based On Time Trucking. On Time Trucking has more than four decades of experience, especially in New York City and the surrounding areas, which is a massive perk as some carriers refuse to go to the Big Apple for a host of reasons.

A Trucker News article quotes Joe Maclean, chairman and chief executive officer at RK Logistics: “On Time Trucking is one of the Tri-State’s most successful trucking and logistics firms, with an excellent reputation for reliable, cost-effective service throughout the five boroughs. This is a highly strategic acquisition for RK that allows us to offer lithium-ion battery and material storage services to support our energy transition customers on the East Coast.”

The more you know

Borderlands: Shifting supply chains boost trade in California-Baja mega-region

FedEx warns of higher costs under trucker rest break waivers

US Customs Ruling of Importance to Logistics and Transportation Service Providers

573 layoffs hit logistics firms in California, Illinois and Michigan