It’s been a little over a week under a new presidential administration, and with it come changing rules, regulations and just about everything else at breakneck speed. Focusing on supply chain impacts proves to be a bit of a wait-and-see exercise.

Along the campaign trail, there were promises of imposing tariffs on Mexico, Canada and China. Most of those promises have yet to come to fruition. That’s left a majority of those in the global supply chain wondering what is in store for the future and how to plan around potential hurdles.

As of right now, there are no new tariffs on goods coming into the U.S. The normal tariffs are still in play, and the International Trade Administration can help sort out what the current tariffs for goods are.

The future? Well, that is where things get a little messy. There are threats of tariffs, according to CNN: “25% tariffs on all imports from Mexico and Canada, anywhere from 10% to 60% across-the-board tariffs on China and 10% or 20% tariffs on everything else that comes into the United States.”

The when of it all is still very much up in the air.

There is some clarity as to the goods that could be affected by a potential tariff first. As quoted in a CNN article, “We are going to look at pharmaceuticals, drugs. We are going to look at chips, semiconductors, and we are going to look at steel and some other industries and you are going to see things happening,” President Donald Trump told House Republicans.

A consensus has emerged among supply chain professionals on how to prepare for whatever a tariff rate might be whenever it takes place. Global supply chains can’t keep waiting in limbo, and a Kuehne + Nagel webinar, “Navigating the Unprecedented Global Trade Disruption,” drew 1,500 people to get a picture of the future.

An article by FreightWaves’ Noi Mahoney noted, “While [Greg] Tompsett [vice president of customs brokerage USA at Kuehne + Nagel] believes the threats could be a bargaining tactic, he said if they are implemented on Saturday, shippers will need to immediately take stock of what goods they have in the supply chain.

“What is already out on the water,” Tompsett said. “What purchase orders have already been booked? What are things that we can’t really change or shift, and what temporary options do we have to buy us a little time? Can we move something in bond – that’s where it hasn’t technically been imported yet, but it gets in and we set it off at a bonded warehouse, and we can keep it at bay for a little bit – and what’s that cost? Can we defer or hold off importing it? Do we have the ability to move it in a foreign trade zone – those are things we’ll be looking at.”

It’s now a matter of how well global shippers can plan and adapt to ever-changing components of their supply chains.

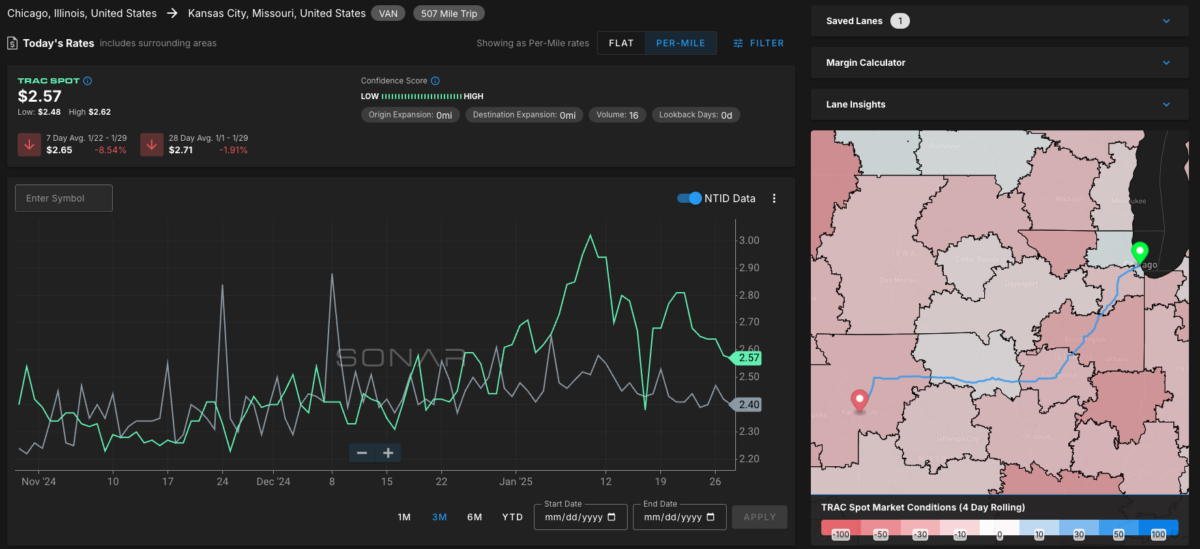

TRAC Tuesday. This week’s lane is going from Chicago to Kansas City, Missouri – a solid 507 miles of Midwestern roads and endless cornfields. The per-mile rate for this lane is $2.57, which is 17 cents above the National Truckload Index of $2.40. Chicago is experiencing significant market tightening as outbound tender rejections have risen to 8.45%, a 1.39% increase week over week. Kansas City on the other hand has some tightening but has consistently been seeing an OTRI above 10% since mid-December. Current outbound tender rejections are at 12.84%, indicating an inflated spot market.

Spot rates for this lane are maintaining their higher-than-average rate and will continue to do so as long as the OTRi in KC stays above 10% and Chicago continues to experience extreme tightening. Loads originating in either location will likely be trickier to cover than most. Let shippers know that outbound tender lead times will need to be increased.

Who’s with whom. The one downside of a global supply chain is that when there is a massive cultural holiday in one region, parts of the world essentially shut down. In the same way the U.S. closes up shop for the Fourth of July, Thanksgiving and Christmas, Asia is having that moment right now with the Lunar New Year. This is the Year of the Snake and according to Chinese mythology, “Snakes are also known as ‘little dragons,’ and the skin they shed is known as ‘the dragon’s coat,’ symbolizing good luck, rebirth and regeneration. The snake also symbolizes the pursuit of love and happiness.”

I’m not sure how love and happiness will tie into global supply chains. As major operations in China, Vietnam, Korea and other Asian countries are shut down in celebration of the holiday, there is a lack of happiness in other countries waiting on Asian-produced goods.

Most shippers affected by the disruption should have already made plans. Whether that involved pulling freight forward or alternating a production schedule, it should be squared away by now. If not, well that shipper is about to have a bad few weeks.

Imports on the West Coast ports are poised to see a decline in volume, which means those carriers might be available and looking for surplus freight. The Asian ports are either closed or working in an extremely limited capacity for the next two to three weeks as people travel for the holiday.

The disruption should be fully resolved by Feb. 12 as that is the official end of the new year period and everyone is to return to work. That said, it can take longer for factories, ports and other businesses to return to business as usual.

The more you know

Western Express prevails at federal appeals level in ‘wall of water’ case ATA saw as important

Logistics workers charged with importing $200M in fake goods via LA, Long Beach ports

US cross-border freight stalled in November

Senate debates ways to gain leverage over Panama Canal

Southern California softness cited for 2024 drop in logistics real estate rents