Welcome to Check Call, our corner of the internet for all things 3PL, freight broker and supply chain. Check Call the podcast comes out every Tuesday at 12:30 p.m. EST. Catch up on previous episodes here. If this was forwarded to you, sign up for Check Call the newsletter here.

Well well well, look at how the turntables have turned. It’s coming near the end of the year, which means it’s time to look at predictions I made last year and roast myself accordingly.

Last year my hot predictions for 2023 were: “This year sustainability will continue to be at the top of shippers’ requirements. The days of ESG programs are here and those who are caught with nothing will not fare well. The market will more closely reflect that of 2018 and 2019. 2020 and 2021 will be outlier years, and after this market correction it will be more business as usual. Lastly, labor problems will remain, especially the longshoremen contract for the West Coast. That might rival the threatened rail strike in terms of disruptions to the national supply chain.”

Needless to say, this wasn’t 100% accurate.

The market was more similar to freight markets of 2018 and 2019 but also left a lot to be desired in terms of rates and capacity, whereas 2018 and 2019 weren’t as rough in the rate department. Especially when it comes to the number of bankruptcies and struggles in the industry, 2023 for sure was worse than 2018.

Labor problems are half-right. The longshoremen secured a contract, with minimal long-term impacts, but the United Auto Workers made the Detroit Three car manufacturers feel the pain from failed negotiations before securing a contract. That’s without getting into the issues with Yellow and the Teamsters and UPS and their union. It was a big year for unions and labor disputes. Right on the money there.

A prediction that was more than a little off the mark was on sustainability and environmental, social and governance programs. As budgets became tighter and companies looked to curb extraneous spending, ESG programs that weren’t already established weren’t something everyone was ready to jump on board with.

Personally, I am looking forward to a rapid growth of ESG programs in 2024, but as long as the market remains tight, it will take a lot of low-cost barriers of entry to make significant headway in this area.

As for 2024 predictions? We’ll make those next week after the holiday.

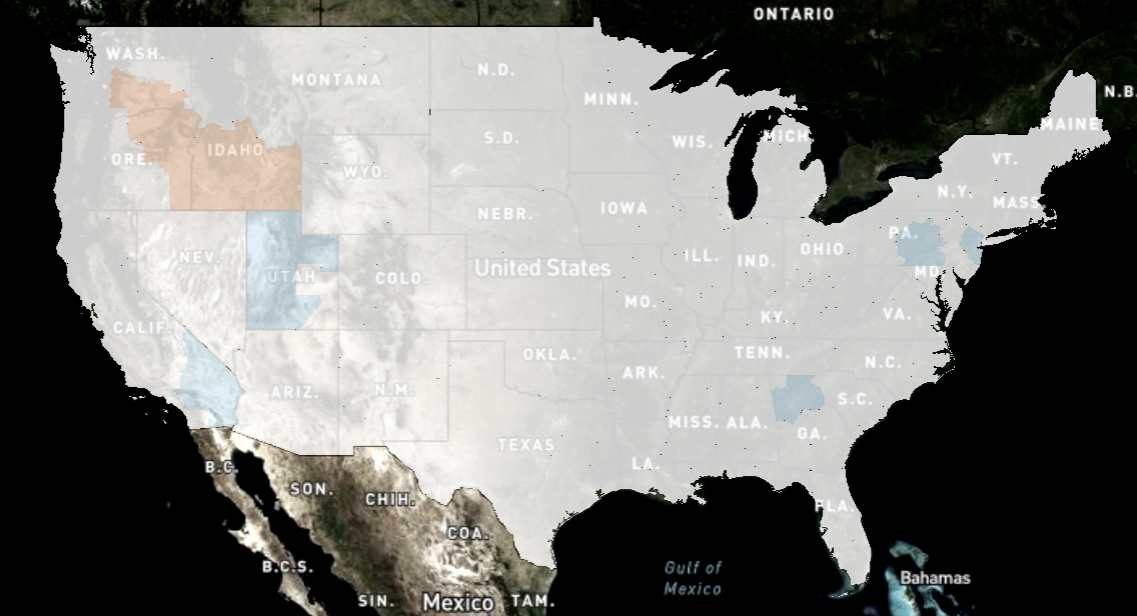

Market Check. The Weighted Rejection Index (WRI) is the product of Outbound Tender Market Share (OTMS) and Outbound Tender Rejection Index Weekly Change (OTRIW) for an individual market. This helps prioritize tender rejection rates by market size. In redder markets, capacity is loosening, whereas it is tightening in blue markets. Not exactly a hotbed of freight volume, Salt Lake City is seeing some capacity tightening week over week — a trend that will start to develop over the next week as various markets prepare for drivers taking a break for the holidays. While right now there is plenty of excess capacity for markets, it’s something to watch out for in some of the larger markets as it could impact spot rates.

Who’s with whom? Closing out the year the way it started, with labor disputes, seems like the only appropriate way to end 2023. Everyone and their union seemed to have labor issues this year, and DHL Express workers are the latest to join the trend. DHL Express workers represented by the Teamsters union have walked off the job at several U.S. locations in solidarity with ramp workers who went on strike a week ago at Cincinnati/Northern Kentucky International Airport (CVG).

What started as one location has naturally expanded to more as members of the Local 100 in Boston, Detroit, Miami, Los Angeles and San Francisco have refused to cross picket lines established by CVG workers.

This is a slightly surprising move since workers just joined the Local 100 in April. Among the reasons workers are striking are safety concerns and alleged union-busting activities.

DHL has developed contingency plans to accommodate the workers on strike and still ensure that customers’ freight still gets where it needs to go — especially as DHL Express is the expedited arm of the business so packages cannot be late.

The more you know

It’s beginning to look a lot like … 2021?

Borderlands: Mexico averaged 57 thefts a day from cargo trucks in Q3

New York becomes next state requiring 2-person freight train crews

Convoy autopsy continues: Panel sees capacity issues, lack of discipline

Miss anything from the Domestic Supply Chain Summit last week? Catch up here!

See you on the internet.

Mary

Join the community in freight and subscribe for more at freightwaves.com/subscribe.