Welcome to Check Call

The last year and a half has brought “unprecedented times” more times than anyone should have to hear — a global pandemic, staffing crisis, driver shortages, uncharacteristically insane weather and laughable capacity levels. What a better time to launch a freight broker and 3PL newsletter? Our goal is to take the chaos of “unprecedented times” and use it to your advantage. My name is Mary O’Connell, I am a former operations hero, broker/dispatcher, and LTL pricing guru that has worked at multiple 3PLs and we are going to make lemonade with these lemons.

Last week was National Truck Driver Appreciation Week and what a difference from last year’s celebrations. Last year’s appreciation week was not the usual blowout affair that we have seen in the past. We were deep in the middle of a global pandemic and the in-person celebrations we’ve seen in the past were too great of a risk. It appears everyone made up for it this year.

2021 brought with it a renewed sense of hope, change and a return to normal, and celebrations this year have been louder and more boisterous than last year. This year’s National Truck Driver Appreciation Week was no different as companies and individuals made sure drivers knew they were an important part of the industry’s continued success. The celebrations included cookouts, meetups, gift baskets, swag bags, gas cards, Starbucks coffee, social media campaigns — you name it, people went out of their way to “thank a driver.”

Personally, I think Truck Driver Appreciation Week should be a multiweek occurrence throughout the year. Over the last year as everyone was urged to “shelter in place,” our drivers were out there making sure the world kept running. They delivered PPE, groceries, lifesaving medical supplies, vaccines and more. We would not be where we are today without them. Many companies — brokerages and asset-based carriers alike — are realizing just how important driver retention is and they are getting creative with their approaches.

Some companies have created a driver appreciation program with medals, plaques and other forms of recognition. Others have taken it a step further and asked drivers what they would like to see from a carrier and used their wishes to start building programs tailored to their needs. Freight volumes aren’t decreasing anytime soon, and heading into the holiday season it’s going to come down to those carrier relationships you cultivate and what you can offer drivers outside of a load.

Quick Hits

Hurricane Ida was the second-most-intense hurricane to hit Louisiana since Hurricane Katrina in 2005. According to the National Weather Service’s naming convention, the name Ida will officially be retired due to the level of destruction caused. Ida leveled parts of Louisiana, leaving people without power to this day. The storm’s destruction didn’t stop there. Ida raged east to Alabama up to New York City. Who knew the subway stations in the Big Apple could flood and the streets of Queens would rival the canals of Venice, Italy?

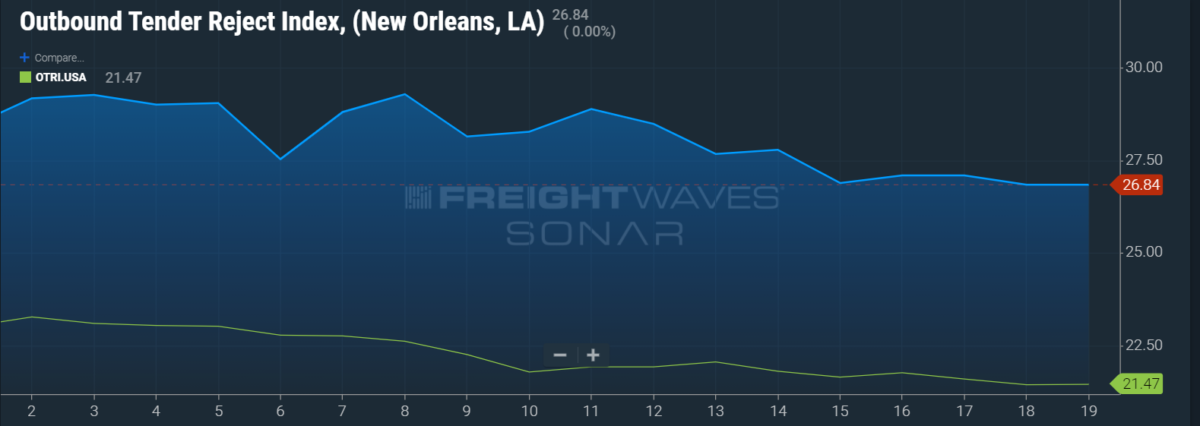

While Ida may have made landfall before Labor Day weekend, the recovery efforts will continue for months to come, especially given that Hurricane Nicholas recently hit southeastern Texas with storm surges that affected parts of Houston and Louisiana still trying to recover from Ida. While most outbound freight has started to pick up as businesses resume daily operations and carriers are more comfortable heading into that market without getting stranded, the outbound tender rejection rate is still higher than the national average.

There aren’t enough trucks to cover the freight in New Orleans. Whether that shortage is the same as the national average or more closely tied to the hurricanes and hesitancy to send equipment into the market, we may not know.

Fall brings our favorite time of year: sweater weather and, most importantly, harvest season. The small owner-operators who farm and also happen to drive a truck that normally can be relied on through the winter and parts of the summer (aside from planting season) are gone for the next month.

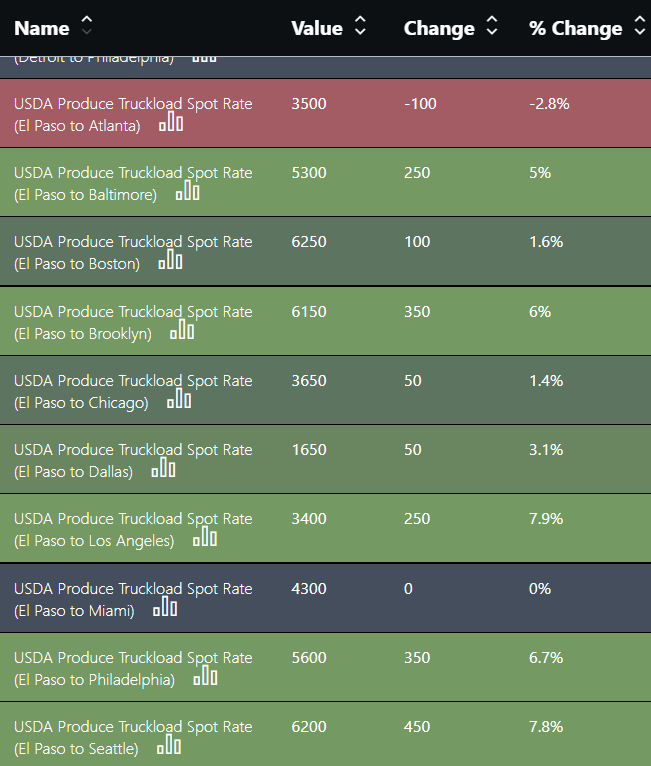

As most of us know, harvest season starts in the South and then progresses north and every year we can watch the spot market follow suit. While this year we already have tight capacity levels, we can still see the changes to the spot market as a result of the produce season. Texas and Florida typically start the season off strong, which we are currently seeing with the USDA produce truckload spot rates. Rates coming out of Texas are increasing week to week.

The good news though is that as the rates start to decline, you can start to assume that the harvest season for that region has come to an end. Based on the USDA produce spot market rates, there will continue to be a surge as harvest season is just getting underway. I would keep a close eye on the spot market by region to predict when the post-harvest dip will come.

Market Check

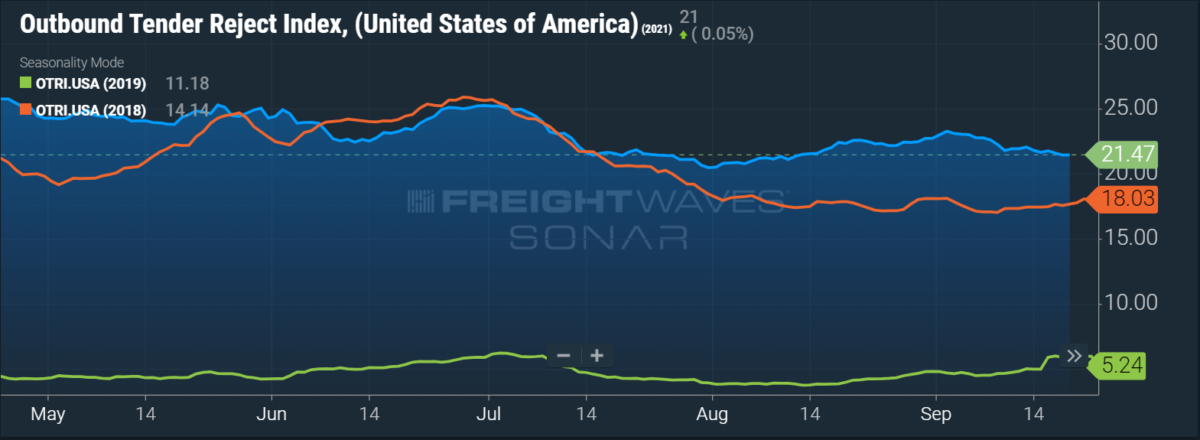

The current outbound tender rejection for the country is showing similar data to that of 2018, paralleling the data from Hurricane Florence that caused catastrophic flooding in the Carolinas as a Category 1 hurricane. We can expect to see 2021 follow similar trends of 2018 (orange line below). I would expect to see tender rejections to increase as we see the next tropical storm make landfall, which could be in a few days or a week.

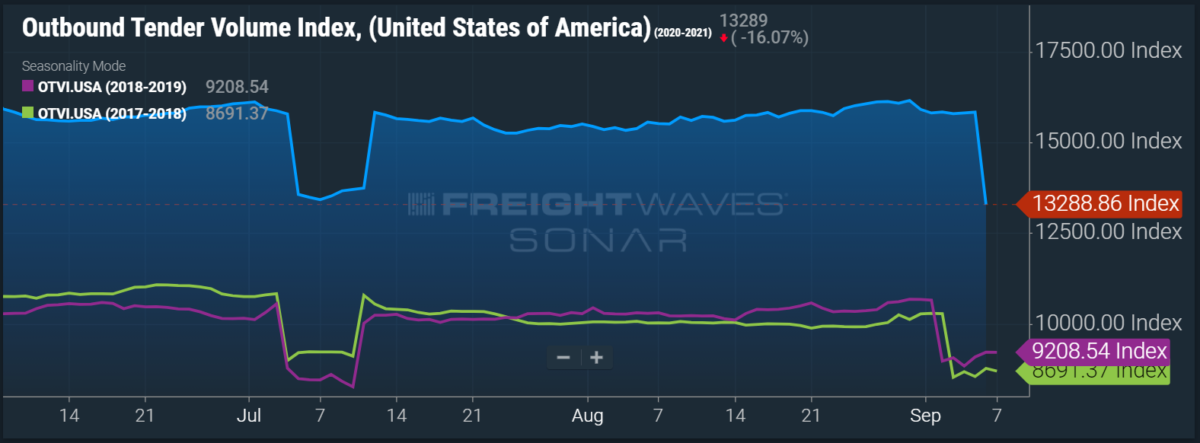

A few weeks ago the FMCSA elected to extend its COVID hours-of-service waiver through the end of November. While that is great news for critical infrastructure deliveries, it proves problematic for an already-tight market heading into the holiday season. The most recent outbound tender volume shows that current volumes are consistently above what they have been the last two years.

Throughout 2021 we have consistently had radically higher tender volumes than previous years and we can expect that trend to continue as we go into the holiday season. This holiday season is expected to see historic high volumes and historically tight capacity. It can be assumed that once we round out our hurricane relief efforts we will continue to see rates climb steadily throughout the end of the year.

While some customers are approving insanely high expedited truck load prices, not everyone has the luxury to spend $10,000 in one morning on expedited loads alone. It’s time to start having those conversations with shippers about managing their expectations going into the final quarter of the year.

Who’s with Who

Everest Transportation Systems caught the eye of Cambridge Capital by shattering expectations with its main offices in Evanston, Illinois, and Kiev, Ukraine. It is poised to be a one-of-a-kind group, truly testing global 24/7 customer service.

FreightVana is a new brokerage composed of former Knight-Swift veterans who are saying they will be doing things differently, from cultivating unique relationships with shippers and carriers to not hiding anything and having full transparency and trust across the board. They also have funny videos posted to their LinkedIn profiles that will hit a little close to home for anyone who has ever had to look for a truck.

Woman-led Transfix has announced its plans to become a publicly traded company in a transaction that provides $405 million in gross cash proceeds to accelerate growth initiatives. The deal is taking place via a definitive business combination agreement with G Squared Ascend I Inc., a growth-stage venture capital fund manager focused on the technology sector.

Further Readings

Hurricane Ida blowing wobbly market further off kilter

Flood Threat keeps trucking across south

Cambridge Capital makes majority investment in Everest Transportation