The Future of Freight Festival in Chattanooga, Tennessee, is the event of the fall. Subscribers to Check Call have a special discount code for F3 registration. This is going to be one of the best deals on F3 tickets. Use the code CheckCallF324 or go to this link, and the discount will be applied. There is no better party than a Chattanooga party. This is not one to miss.

Labor Day weekend has come and gone, taking with it the hope that it would be the event of the year to set the trucking market back on track. The next big possible spark of life in the trucking market is retail peak season in Q4. It’s about to be the holiday season, and a fair number of possible hiccups are already staring down holiday season supply chains.

The first is a potential strike by the International Longshoremen’s Association (ILA) and the United States Maritime Alliance (USMX). The current contract between the two parties ends at the end of September, and they are struggling to come together on a new agreement. Spoiler alert: The sticking point is wage increases.

The ILA represents roughly 70,000 dockworkers in the U.S and Canada, while the USMX represents employers at 36 coastal ports including the Ports of Savannah, Georgia; Houston; and New York and New Jersey. For once, Los Angeles and Long Beach aren’t part of the mess.

For those looking to solve potential port issues by utilizing airplanes and air cargo … well, that might not be as strong an option.

The second issue looking to affect peak season is some reduced capacity for air cargo in the coming months. Freight forwarders have started to receive warnings of an air cargo capacity crunch out of certain Asian markets during peak season. Routes from China to the U.S. are anticipated to have reduced availability.

The rise of this complication comes from e-commerce shippers signing deals directly with commercial airlines, which is putting extra pressure on capacity. Dimerco, a global freight forwarder, said in an Air Cargo News Article, “Another product category that will contribute to the capacity demand is the consumer electronics market, which will begin its peak season in September.

“As more production of finished goods has relocated from China to Southeast Asia since 2022, additional capacity is required to transport these products to the US and Europe. This has placed significant pressure on freighter services in key transit hubs like Taiwan, Korea, Japan, and Hong Kong, impacting outbound capacity from these locations as well.”

As many shippers look to bring volumes forward ahead of peak season, capacity could be constrained even more and air cargo rates will become inflated even more. The two events combined could be the flip the freight market needs, or it might be another empty promise.

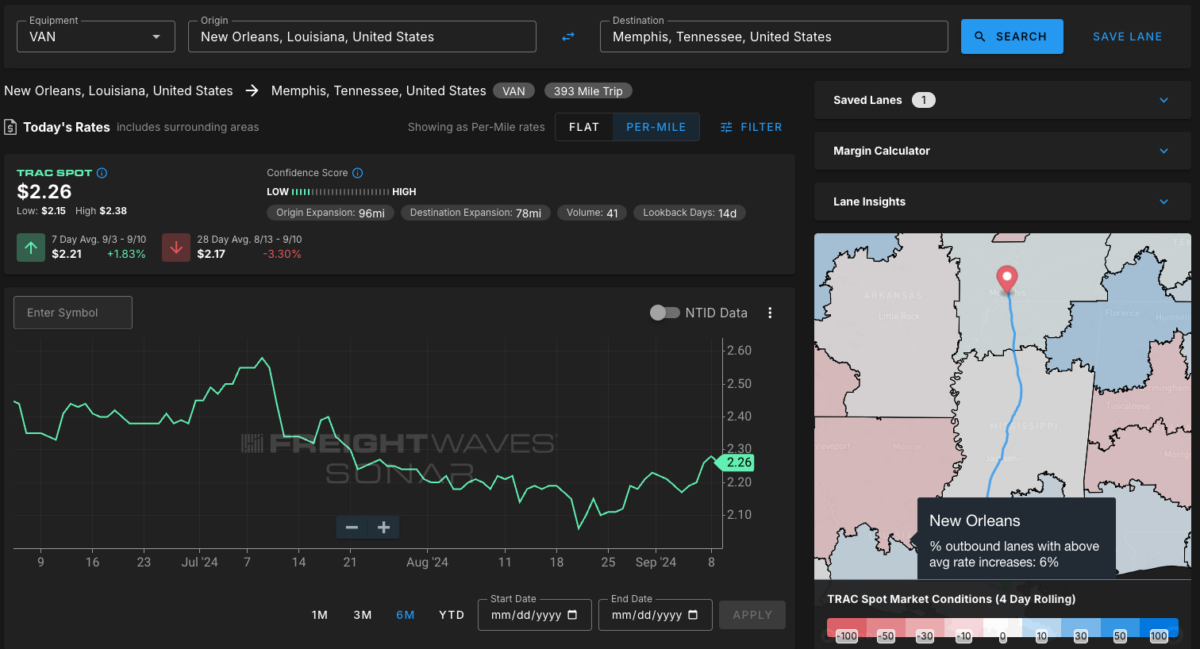

TRAC Tuesday. This lane from New Orleans to Memphis, Tennessee, is remaining stable right now but could see some increase in the coming days as the National Hurricane Center issued a hurricane watch from High Island, Texas, to Cameron and from Grand Isle to the mouth of the Pearl River, including Lake Pontchartrain and Lake Maurepas. The storm is anticipated to hit Louisiana and the upper Texas coastline Wednesday.

Currently, outbound tender rejections in New Orleans have fallen from 7.78% on Sept. 3 to 6.36%, a drop of 32 basis points week over week. Taking the opposite approach are outbound tender volumes. They have increased 14.61% in the same period. Depending on the severity of the storm and the rainfall numbers, Louisiana and eastern Texas could see a spike in rates to round out the week.

Who’s with whom? Aifleet has a cool $16.6 million after closing on its Series B round of funding led by Tom Williams, general partner at Heron Rock. Other notable participants for this round of funding were Volvo Group Venture Capital, Obvious Ventures, Ibex Investors, Compound, Winthrop Square and Cooley.

In a statement quoted in an article by FreightWaves’ Noi Mahoney, Williams said, “AiFleet uses their technology to pay drivers more, send them home more often, and reduce emissions. With this approach Aifleet is positioned to become America’s largest and most profitable truckload carrier.”

“As truck utilization has trended downward since 2018, Aifleet has developed technology to mitigate the problem and the strain created by the trucker shortage, while bringing real humanity back to the driver experience,” co-founder and CEO Marc El Khoury said in a statement.

The more you know

How to report cargo theft to law enforcement: Essential tips for ensuring effective communication

Borderlands Mexico: Wiliot chatbot would like a word about food supply chain safety

NASA’s gateway deep space logistics team shares insights with SSC

Cargo shipments face delays if Air Canada pilots go on strike